Track, Manage and Report on Third Party Risks

The Predict360 TPRM Lite application enables financial organizations to track, manage, and report risks associated with third parties under one platform. The solution includes vendor lifecycle management and keeps track of issues, performance, certifications, risks, metrics, and much more. Predict360 TPRM Lite provides a centralized data repository that collects information and documents about third parties using configurable checklists from onboarding to security assessments and due diligence to periodic supplier performance evaluations. Key capabilities include:

- Automates workflow processes to collect information from third parties

- Enables employees to add new third parties and complete associated onboarding activities

- Drives the workflow for review and approval of third-party information

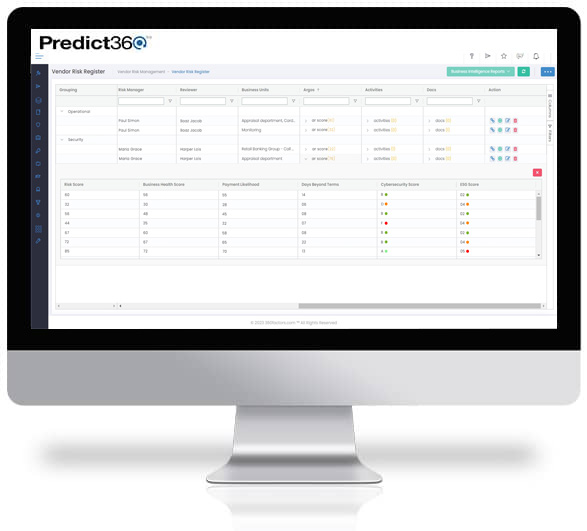

- Enables the categorization of the type and level of risk for each vendor or third-party

- Automates ongoing controls and assessments to measure and manage third-party performance and compliance periodically

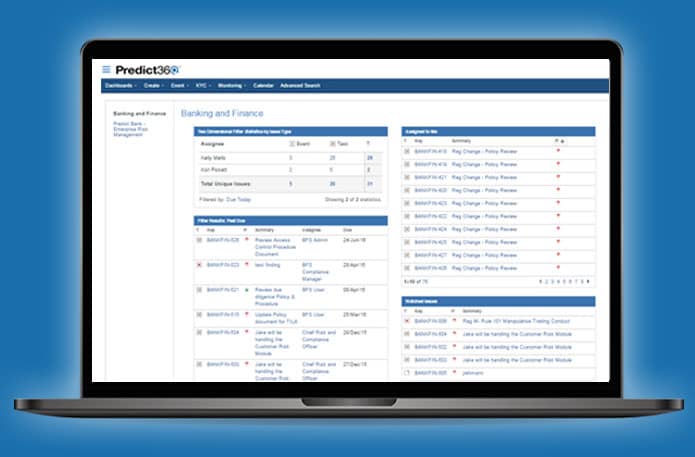

- Enables employees to create, assign, track, and manage any action item or task related to vendors or third parties

- Harnesses advanced business intelligence insights with Predict360’s embedded Tableau and Power BI reporting engines.

- Available as an integrated module of the Predict360 risk and compliance intelligence solution platform or as a standalone system

Advanced Third Party Risk Intelligence Powered by AI

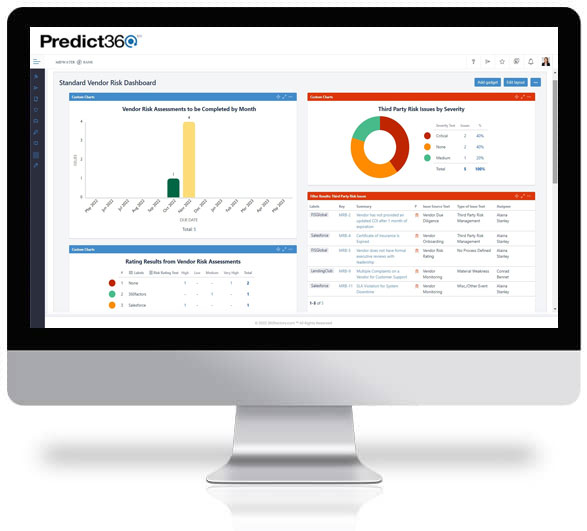

Predict360 TPRM Lite’s advanced third-party reporting and dashboard capabilities provide visibility into the risk and status of all vendors, enabling organizations to monitor vendors closely and quickly resolve vendor risk-related issues.

- Track the performance of all third parties in one easy-to-use system

- Store information on all third-party-related issues and problems

- Generate vendor reports in PDF or MS Word that summarize vendor information, assessment results, risk ratings, etc.

- Easily audit performance by viewing all historical problems and issues in just a few clicks

- Calculate vendor scores based on the completion of multiple types of assessments

- Complete third party life cycle management – from onboarding to service delivery

- Measure risk based on Financial Health, Company Identity, Sanctions Status, Cyber Security risk and even ESG

- Make OFAC checks, and track CFPB & BBB complaints

- Detect ongoing issues through trends and patterns to determine vendor risks

- Create and assign one-time or recurring tasks that can be managed by vendors or third-parties

- Automate SIG questionnaire sending to vendors for periodic COI, SOC, and other due diligence reviews

Vendor Surveillance

Argos Risk’s optional AR Surveillance offers access to a continuous stream of data, which aids in addressing the following common questions:

- Operational Risk: Does the vendor possess the stability required to be an integral part of your mission-critical operations?

- Financial Risk: Does the vendor possess the financial resources necessary to fulfill the terms of your contractual agreement?

- Legal Exposure: Is the vendor exposed to legal actions that could potentially impact your business relationship?

- Cybersecurity Risk: Is the vendor maintaining a robust and secure online presence?

- Reputational Risk: Is the vendor’s reputation in alignment with your organization’s values and goals?

- Sanctions Risk: Is it legally permissible for your organization to engage in business with this entity?

- Diversity Inclusion: Does the vendor meet the criteria for participation in your organization’s diversity and inclusion program?

AR Surveillance provides an extensive array of data and information, ongoing monitoring, risk-based scoring, and one of the industry’s most user-friendly interfaces. It is the dominant way to analyze, assess, and monitor the overall viability and health of your commercial third-party relationships and empowers your vendor management program to leverage real-time risk intelligence for making informed decisions.

Third-Party Risk Management Challenges

Manual programs cannot keep pace with an evolving third-party risk landscape and associated regulatory obligations. Using disparate software tools – such as email, spreadsheets, shared drives, ticketing systems, etc. – often creates barriers to effective vendor risk management.

The top challenges when using a manual approach to manage third-party risks are:

- The role of third parties is critical, but financial organizations often have limited visibility into performance

- Lack of document management can result in accidental non-compliance

- Regulators are increasing requirements for the management of third-party compliance

- Ensuring that the products and services provided by third-party service providers are safe and comply with applicable laws, regulations, and standards is difficult

- Collecting all the information in spreadsheets and documents is an inefficient process

- Third-party data is not available for trend analysis

Predict360 TPRM Lite Automates the Third-Party Risk Management Lifecycle

The Predict360 TPRM Lite application enables risk and compliance departments to manage the entire third-party risk management lifecycle on a single platform. The features and workflows built within Predict360 help with onboarding third parties, monitoring performance and qualifications, and terminating services while fulfilling all compliance requirements and mitigating the associated risks.

Predict360 TPRM Lite is a streamlined solution available as an integrated module of the Predict360 risk and compliance intelligence platform or as a standalone system. However, when Predict360 TPRM Lite is integrated with the Predict360 Risk and Compliance Intelligence suite, it can roll up all the third-party risk information within an enterprise risk management framework.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist