Third Party Fintech Governance to Enhance Your Organization’s Security and Performance

Fintech services and businesses are delivering innovating solutions to customers, often partnering with banks to deliver financial services in a secure and compliant manner. The Predict360 Third Party Governance platform enables banks to ensure compliance and manage risks when working with third parties to deliver financial services and expertise.

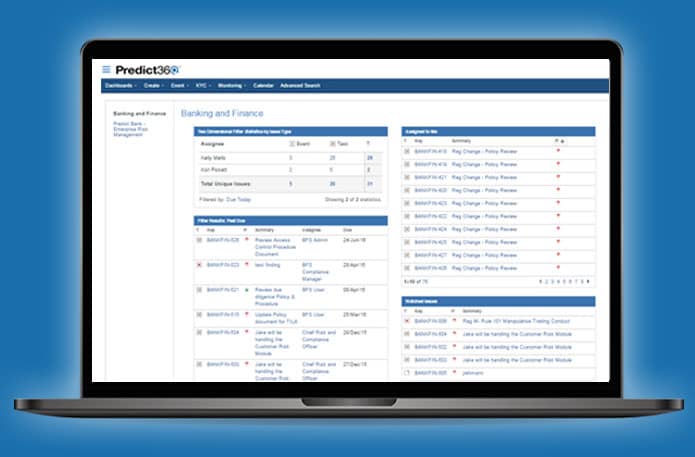

Predict360’s Third Party Governance platform enables financial technology firms and the banks that serve them to control and monitor all of their third-party relationships on a single platform. For streamlined communication with Third Party Fintech partners to register, track, escalate, and manage complaints, ad reviews, change requests, and monitoring activities that the bank is ultimately responsible for through the relationship.

Request a Custom Demo

Benefits

- Ensure that the products and services provided by the third-party vendors comply with applicable laws, regulations, and standards

- Ensure third party complaints management, detect problematic trends in Fintech services, and monitor performance in real-time

- Automate workflow processes to collect information from third parties and/or Fintech partners

- Drive the workflow for review and approval of this information such as ad reviews or change requests

- Categorize the type and level of risk for each vendor or third-party

- Create, assign, track and manage any action item or task related to a vendor or a third party including managing the ad review process and monitoring of social media, marketing, and call centers

Challenges in Working with Digital-Born Third Parties

The use of disparate software tools – such as email, spreadsheets, shared drives, CRM and ticketing systems, etc. – often create barriers to effective issues and complaints program management:

- The existing risk and compliance management framework in most financial organizations was not designed to work with Fintech services and delivery channels.

- Third parties are often unaware of all the legal and regulatory requirements that need to be fulfilled and need to be supported to ensure compliance.

- Organizing all of the third-party risk and compliance data in spreadsheets and documents is a time-consuming operation.

- Modern Fintech operations move at a faster pace than many traditional banking operations, which reduces the time available to ensure compliance and manage risks.

- The application provides a scalable system to document and collaborate with Fintech Partners supporting each step in the maturity of collaboration between organizations: from simple compliance activity registration through a web-form to bi-directional collaboration in a dedicated compliance management system.

Key Features

- External webforms for easy and intuitive communication from each Fintech to the bank

- A configurable workflow engine that supports unique workflow processes for different types of Third Party/Fintech Partners with easy-to-use data collection forms and automated alerts.

- Automatic notifications and due dates can be distributed via email to related parties and owners.

- A calendar provides visibility to all compliance issues being managed and associated due dates.

- Reporting platform to drive insight across fintech partners and identify or diagnose problem areas across Fintech product providers

- Dashboards and reports provide complete visibility in real-time to the status of all compliance-related issues to compliance owners, managers, senior executives, and boards members.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist