Fintech Risk + Compliance Starter Kit

Accelerate regulatory readiness with fair and responsible risk and compliance management software, risks, controls, and expertise

Modern financial services firms excel at delivering innovative products and services but may lack the risk and compliance integration required for simultaneously managing customer issues, bank partners, and regulators with agility. These key stakeholders’ expectations will increase as consumer protection, fair and responsible banking, financial crimes, and third-party risk management obligations rapidly evolve.

Jump-start your fair and responsible stakeholder readiness with a foundational toolset that equips your team with the technology and know-how to manage risk and compliance confidently.

- Expedite Banking Partnerships: go to market faster with existing and new banking partners by leveraging your compliance readiness.

- Fast-Track Fair and Responsible Regulatory Compliance: empower your team with a Fintech-specific, configurable toolkit that provides the foundation for proactively managing risks and controls, marketing, and complaints.

- Adopt Quickly: deploy in days, not weeks or months, with fair and responsible workflows, risks, controls, forms, and libraries exclusive to the solution.

- Comply with Confidence: leverage industry leaders with deep experience in FI regulatory risk, compliance, and AI-powered technologies.

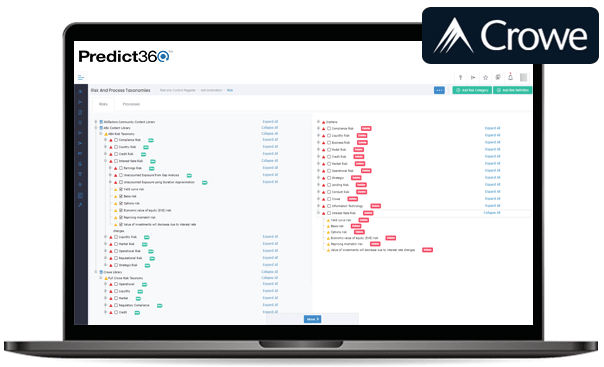

Predict360 Risk Management Solution with Crowe Risk & Control Library for Banks

Predict360’s Risk Management and Assessments solution enables banks and financial organizations to manage risks using proven enterprise risk management (ERM) techniques such as risk and control self-assessments (RCSA) to capture inherent and residual risk ratings, identify controls as well as document additional details including risk owners, risk type, management comments, monetary impact and more. Manage your financial institution’s risks more quickly and effectively with a complete solution from 360factors and Crowe that offers the following Predict360 functionality and libraries:

Predict360 Risk Management and Assessments Software Application

- Risk Library (Taxonomy / Catalog Management)

- Risk Register (Inventory)

- Risk and Control Self-Assessment (RCSA) and Risk Reviews

- Built-In Task Management to make RCSAs actionable

- Risk Reports and Dashboards

- Deployed to your organization within 30 days

Crowe Integrated Risk and Control Library and Professional Services

- A risk and library for financial services institutions including a comprehensive catalogue of risks, typical controls, and associated design and operating effectiveness testing scripts.

- Risk and compliance advisory and consulting professional services for financial institutions across areas of risk and compliance, including RCSA, Credit Risk Management, Corporate Governance, Internal Audit, Enterprise Risk Management, Cybersecurity and IT audit and AML Compliance

Intelligence and Experience, Combined

The Crowe financial services risk, control and testing scripts library includes a comprehensive catalogue of risks, attributable controls and associated testing and assessment scripts. The library, coupled with 360factors’ risk and compliance intelligence platform, is adaptable to each client’s specific needs, helps enable growth strategies and meet business and regulatory expectations, and ensures maturity and sustainability of banking risk management programs.

360factors can provide the extensive Crowe library of enterprise risks and standards aligned to regulatory guidance, typical controls for each risk and testing steps for each control for a variety of compliance and banking risk categories pre-loaded into Predict360.

360factors’ Risk and Compliance software platform and software applications, Predict360, enables executives, managers and staff to optimize day-to-day risk and compliance responsibilities while providing stakeholders real-time visibility into the risk and compliance profile of all business lines, locations and assets. The artificial intelligence (AI)-powered platform vertically integrates risks and controls, Key Risk Indicators, regulations and requirements, compliance and regulatory change management, policies and procedures, audit and examinations, and training in a unified, cloud-based system. Predict360’s SaaS architecture and modern technologies deliver predictive analytics and data insights for predicting risk and streamlined compliance.

As both Crowe and 360factors are American Bankers Association (ABA) Endorsed Solutions Providers, the joint collaboration benefits banks by bringing together industry-recognized best-in-class solutions.

Learn more about Crowe’s approach for banks and financial services organizations.