Predictive Risk Assessments and Enhanced Risk Insights

Predict360 Risk Insights identifies existing risks operating outside of tolerance and predicts emerging risks using Artificial Intelligence (AI) to augment internal and external risk data. These insights help drive executive decision-making and enable organizations to increase profitability, accelerate innovation, and improve productivity. Key features include:

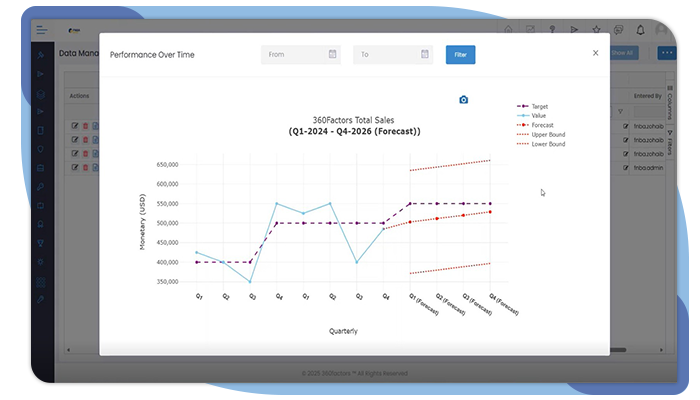

- Dashboard with Power BI and Tableau BI visualizations and reports that identify risks operating outside of tolerance and predict emerging risks

- Risk taxonomy/library to map the customer’s existing risk register

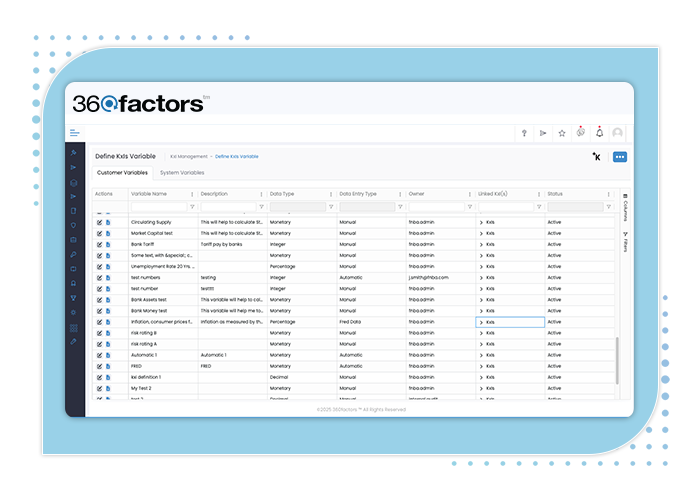

- A Powerful Key Risk Indicator engine (referred to as KxI for KPIs and KRIs) that collects, monitors, and calculates KRIs dynamically based on defined variables

- Ability to define KRI Variables and create Calculated KRIs using a flexible Formula Editor, with support for manual input, API, or SFTP imports for real-time KRI calculations

- Data feed of external regulatory intelligence data and other market indicators, including FRED and FFIEC integrations that link KxIs with market and peer performance data

- Trending/velocity analysis of external and internal data with the ability to dive into the details

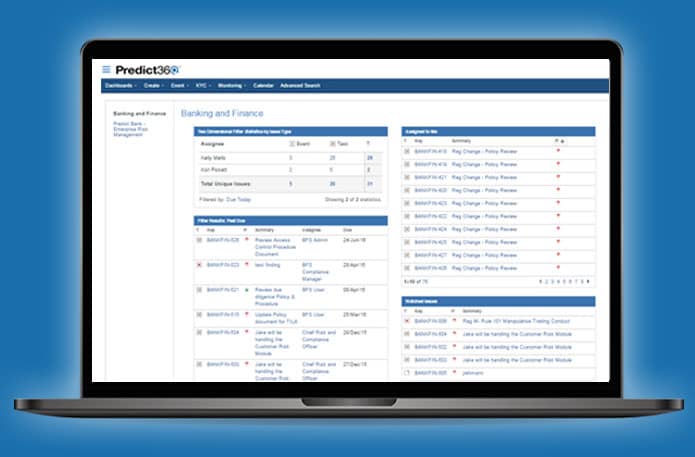

- Record issues using the Risk Insights Issue Management feature

- Explore KxI data and trends, create on-the-fly charts and reports that flow into Power BI, and evaluate peers with Kaia, our generative AI companion

Risk Prediction and Predictive Risk Analysis with Predict360 Risk Insights

A proactive approach enables organizations to increase efficiency, decrease resolution times, collaborate more effectively, and gain insight into issues and trends.

- Implement an out-of-the-box risk reporting solution using AI technology to generate powerful predictive risk analysis and insights with an easy-to-use interface

- Create KRIs/KPIs that can be updated manually or from data integrations

- Use the Formula Editor to automatically calculate KRIs based on real-time variables, improving precision in predictive risk analysis

- Leverage the power of collecting internal and external data/KRIs/KPIs (such as Federal Reserve Economic Database (FRED) and Peer Metrics (FFIEC Call Reports and Uniform Bank Performance Reports (UBPRs)) and apply them to your risk analysis

- Collect external data feeds such as regulatory intelligence data and calculate velocity changes and trends based on that data for predicting risks

- Set KxI triggers for risk threshold levels to monitor risk in real-time across the organization using built-in KRIs and KPIs

- View detailed Risk Insights and filter by Risk Categories and hierarchies

- Set up real-time insights for predicting emerging risks and identifying existing risks that are not operating within your expected tolerance levels

- Reduce the effort to create risk reports and actionable intelligence through Predict360 Risk Insights

- Create fully customizable Key Risk/Performance Indicators with a weightage based on risk taxonomies, including the ability to calculate KRIs dynamically through variable-based formulas

Identifying Key Risk Indicators (KRIs) and Predicting Emerging Risks

While managing risks and implementing controls to mitigate those risks are core functions for any financial organization, predictive risk modeling or identifying where risks are not operating within tolerance is often difficult to accomplish. Common challenges include:

- Key Risk & Performance Indicators (KRIs/KPIs) can help predict risks that are operating out of tolerance, but risk managers often have difficulty obtaining this data from the business lines

- While internal data and KRIs can indicate problem areas, linking those KRIs to the associated risks and identifying the risks operating outside of tolerance in real time is hard to accomplish

- External data, trends, and news can indicate emerging areas of risk within the industry but often are only evaluated by the financial organization during annual risk assessments or as part of a regulatory examination

- Information is scattered across the organization in different files and reports. It requires significant manual effort and causes major delays in creating a dashboard/report that shows risks, their associated KRIs & and KPIs, and identifies which risks are outside of the tolerance level

- The platform enhances user experience by presenting unique and relevant data for different task types, streamlining the monitoring and management of KRI data updates and task assignments

Benefits of Predictive Risk Intelligence & KRI Management

Financial organizations often manage risks assuming controls are operating properly and that risks are operating at a residual risk level set once a year during their risk assessment process. Identifying the current risk level and even predicting where risk intelligence levels may be if actions are not taken is much more challenging. Predict360 Risk Insights addresses this challenge by enabling risk managers to:

- Efficiently update associated risks and enable management and boards of directors to optimize their business operations and profitability

- Utilize out-of-the-box KRIs based on industry-specific external data (such as FRED (Federal Reserve Economic Data)) to automatically identify and flag risks within your organization that may not be consistent with those changes

- Capture internal KRIs/KPIs in an automated fashion and automatically identify and highlight where risks may be operating outside of tolerance in real-time

- Refined task tracking allows users to focus on active tasks, reduce clutter, and enhance workload analysis for KRI updates

- Generate accurate and up-to-date risk reports with current risk levels quickly and easily, instead of providing static reports with outdated data to the board of directors and management executives that take days to create each quarter

- Build flexible and dynamic KRIs linked to real-time data variables, enabling more accurate and proactive risk detection

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist