The Challenge: Customer Retention in an Increasingly Competitive Landscape

Community banks and credit unions face mounting competition from FinTechs, neobanks, and digital-only platforms. Despite having access to vast amounts of customer data, many financial institutions struggle to leverage it effectively for predictive insights, leading to:

- Ineffective Marketing Campaigns – Generic targeting results in wasted budgets and risks damaging your brand reputation.

- Limited Share of Wallet – Traditional banks and credit unions often capture only a fraction of their customers’ financial business.

- Customer Churn – Without predictive analytics, financial institutions miss critical opportunities to proactively address customer dissatisfaction.

The Lumify360 Solution: AI-Driven Insights for Customer Retention

Lumify360 equips banks and credit unions with cutting-edge analytics to transform customer data into actionable insights, boosting profitability and retention. Key features include:

- Seamless Data Integration – Connects with over 200 data sources, including your existing data warehouse, core, and API-enabled systems.

- Custom Analytics Frameworks – Prebuilt data schemas, predictive analytics, and dashboards designed for customer segmentation and churn prediction.

- Embedded Reporting – A built-in Power BI engine with pre-configured reports.

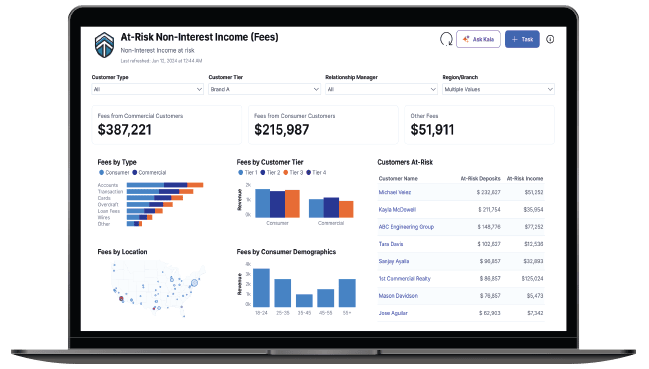

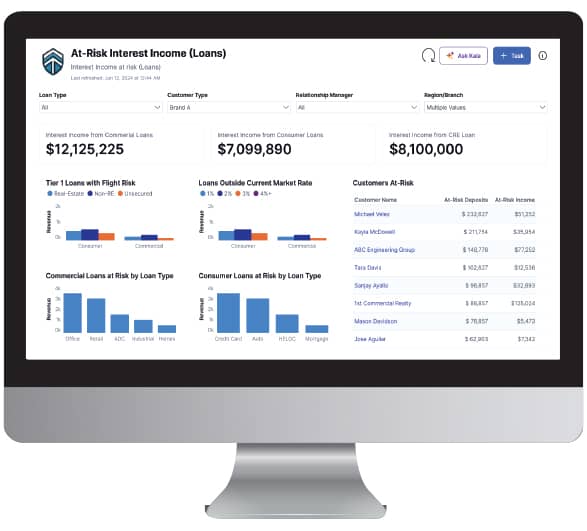

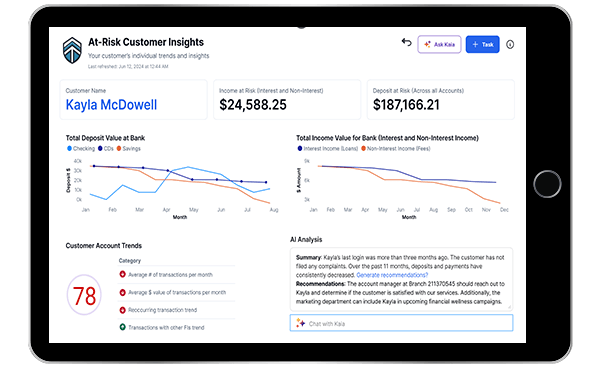

- AI-Driven Insights – Combine your data with AI-powered analysis to reveal predictive insights. Empower your business users to dive deeper into the data with Kaia, our secure chat agent, that answers questions, prepares ad-hoc charts and graphs, and performs trend analysis on underlying data.

- Issue Management Workflow – Helps teams collaborate on actionable outcomes, with CRM integration coming soon.

How Lumify360 Helps Financial Organizations Reduce Churn & Increase Profitability

Customer retention is more than just tracking account activity—it’s about predicting behaviors and taking proactive steps to keep customers engaged. Lumify360 empowers banks and credit unions with AI-driven insights, helping them identify risks and opportunities before they impact revenue. Here’s how:

- Identify at-risk customers before they leave.

- Optimize cross-sell and upsell opportunities to maximize customer lifetime value.

- Improve marketing ROI with advanced customer segmentation and personalization.

- Leverage AI to uncover hidden trends in customer behavior and transaction patterns.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist