IT Risk Assessment Software for Banks, Credit Unions, and Financial Services

Predict360’s IT Risk Assessments application delivers risk stakeholders:

- Streamlined workflows for documenting and analyzing IT risks

- A consolidated risk and control taxonomy across business areas, including business units, products, processes, and vendors

- Assessment scheduling for one-time and reoccurring risk assessments

- Action plans and tasks for related assessment activities

- Optional access to industry-standard risk and control content within Predict360, along with the ability to upload your organization’s risk taxonomy.

Unlock Comprehensive IT Risk Assessments with Predict360

Predict360’s IT Risk Assessment software modernizes the way financial organizations manage IT risks. Built on industry-based enterprise risk management techniques, our software is designed with a particular focus on financial entities, offering robust features that resonate with the intricate demands of the banking and finance sectors. You can rely on:

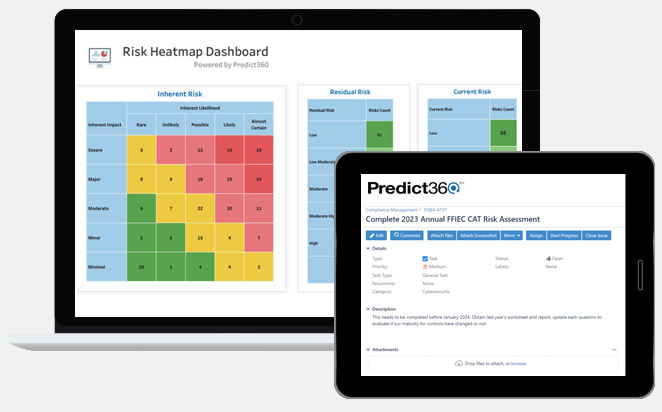

- Real-time insight into IT Risk Assessment progress and risk ratings

- Standardization of risk and control taxonomies to streamline risk comparison and evaluation

- Enterprise-level reports based on data from different business units, product lines, processes, and more

- Executive visibility into risks and activities with drill-down details

Advanced IT Risk Assessment Software

Replacing manual IT risk assessments with advanced technologies delivers many advantages. Predict360 customers achieve:

- Scalability: As organizations grow and their IT environments become more complex, manual risk assessments can become overwhelming. Predcit360 enhances scalability and handles increased data and more complex risk scenarios.

- Accuracy and Consistency: Manual assessments are susceptible to human error. Predict360 provides more consistent and accurate results by reducing the chances of oversight or miscalculations.

- Comprehensive Reporting: Predict360 features activity-based dashboards and embedded Tableau and Power BI for advanced business intelligence reporting.

- Risk and Control Content: Predict360 offers optional risk libraries that can be added to your risk and control taxonomy.

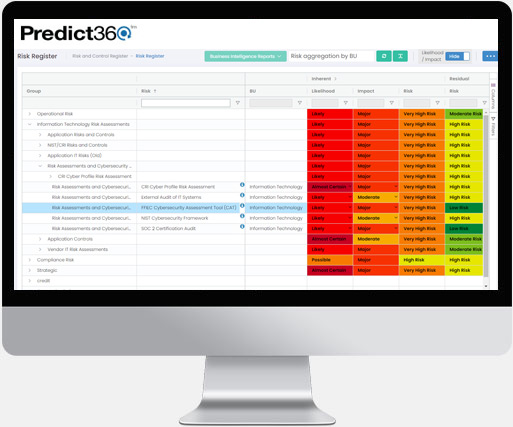

IT Risk Assessment Software from Predict360

Perform risk and control self-assessments and analyze them within your enterprise risk management framework.

- ERM Framework: Capture inherent and residual risk ratings, controls, and essential details. Assign risk owners, specify risk types, add management comments, and more.

- Regulatory Integration: No more silos! Link individual risks directly to corresponding regulations or business obligations. Stay ahead with compliance while managing risks efficiently.

- Real-Time Risk Insights: Gain live feedback on your RCSA progress. Know where you stand at any given moment with our intuitive risk management reporting.

- Enterprise-Ready Reports: Consolidate data from various business units into a singular, enterprise-level RCSA report. Simplify risk management without compromising on detail.

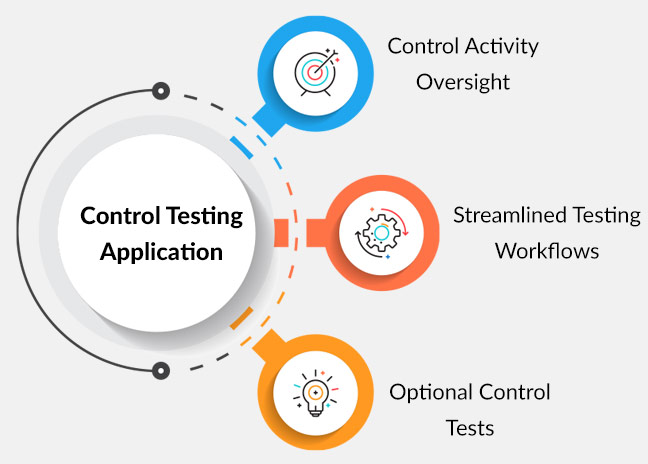

Control Testing Application

Dive deeper into risk management with Predict360’s Control Testing application. This add-on extends the capabilities of our Risk Management and Assessment tool, offering:

- Control Activity Oversight: Create or link tasks such as control tests, action plans for control enhancement, and oversight of issues stemming from process discrepancies or control test issues.

- Streamlined Testing Workflows: Incorporate both Design Assessment Procedures (DAP) and Operating Effective Procedures (OEP) seamlessly into your control examination processes.

- Optional Control Tests: Benefit from industry-recommended assessments and questionnaires, integrated into Predict360, and easily link them to the relevant controls.

Learn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.