Challenges with Legacy Practices

Legacy risk and compliance management practices create many challenges for MSBs. The most obvious challenge is the lack of efficiency in operations, but there are also many other challenges that limit the profitability and growth of the business. Instead of limiting the services they deliver to keep the workloads low enough to be sustainable, MSBs need solutions that help them overcome obstacles such as:

- Gone are the years of simplicity in money services business operations. Keeping the complexity and change in sync is a significant challenge for boards, executives, as well as risk management professionals throughout the business. MSBs have to invest in modernizing and implement an integrated governance, risk, information, compliance and audit systems with bleeding edge artificial technology and architecture to improve operational throughput and minimize non-interest expenses. In order to stay competitive, provide exceptional service and increase quality, MSBs have to balance their focus from growing their portfolio to investing in integrated governance, risk, information, compliance and audit management systems.

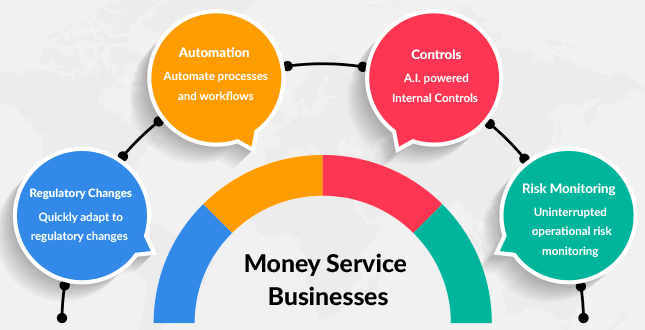

We Offer the Following Solutions To Money Services Business (MSBs):

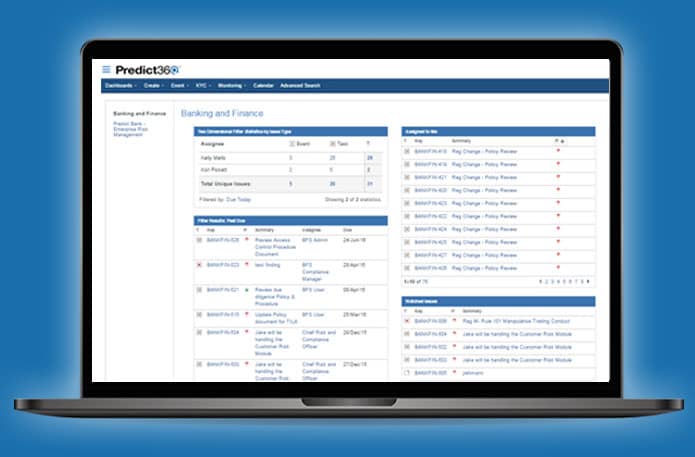

- Money Services Business (MSB) Action Plan Automation Through Policy & Procedure Management System Using Artificial Intelligence

- Automate Efficacy of Internal Controls Through Artificial Intelligence

- Integrate Operational Risk Data with Financial Risk Data to Get Better Risk Monitoring

- Money Services Businesses (MSBs) Regulatory Change Management Automation

- Money Services Businesses (MSB) GRC BI Platform

The Solution

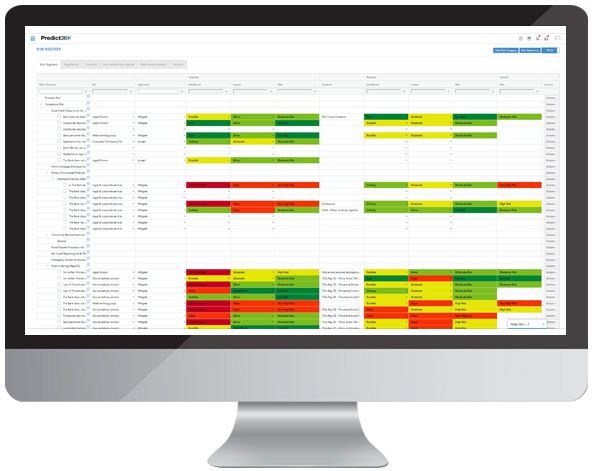

Considering how advanced technology is with artificial intelligence, advance data informatics, and pattern detection, MSBs can easily implement an integrated Risk and Compliance Management system based on artificial intelligence which is a big data approach to Risk and Compliance Management system. It can automate several risk and compliance process flows such as:

- Automate the regulatory change management with alerts and tasks

- Enable mapping of regulations and standards to internal and financial controls

- Map risk to company & department goals.

- Take in external data feeds from other internal systems such as financial risk systems and create concept maps between financial risk data to operational risk data which gives you a view of where all the risks intersect, compounds and interrelates and provide enterprise risk view through a single platform.

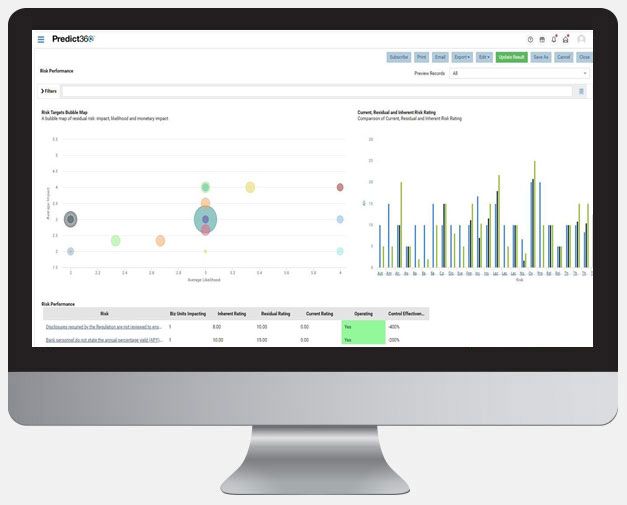

- Automate efficacy and effectiveness of internal controls which is tedious and manual process requiring an army of people.

Value

- MSBs that will switch from disjointed legacy application to advanced technologies by investing in integrated risk and compliance management system will undoubtedly gain efficiencies and reduce costs by minimum of 20%.

- A sophisticated integrated E-GRC system will provide insight into predictive analytics and context around risk management, business strategy, objectives and performance which will enable the MSBs to make intelligent decisions about acquiring and retaining the best customers as well as safeguard reputation and financial health of your company.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist