A Complete Compliance & Risk Management Solution for AI in Financial Services

Today’s customers demand better and faster financial services that match the speed and convenience of operations. Predict360’s Risk and Compliance Intelligence suite achieves this goal through enhanced AI in finance, enabling financial services companies to improve risk and compliance management through automation and streamlined workflows while identifying, mitigating, and optimizing risks more effectively.

- Automates repetitive tasks such as data collection, analysis, and reporting.

- Streamline workflows across different departments and functions within your financial institution.

- Ensure real-time monitoring of regulatory changes, compliance status, and risk indicators, receiving alerts and notifications for potential issues or violations to address them promptly.

- Identify and assess various types of risks more accurately. Prioritize risks based on severity and likelihood, facilitating better decision-making and resource allocation.

Delivering Excellence for Risk and Compliance Management through AI in Financial Services

Predict360 enables financial services businesses to manage risk and compliance with confidence, including:

- Delivering financial services while ensuring compliance requirements are being met.

- Achieving real-time risk visibility and predictions for emerging risks that need to be assessed and mitigated.

- Improving reporting and decision-making through powerful, exportable BI reports with embedded PowerBI.

- Maintaining a single, centralized repository of documents for teams to collaborate effectively, make updates in real-time, and share important information seamlessly, reducing the risk of version control issues, inconsistencies, and miscommunications.

Financial Services Risk Management with Predict360

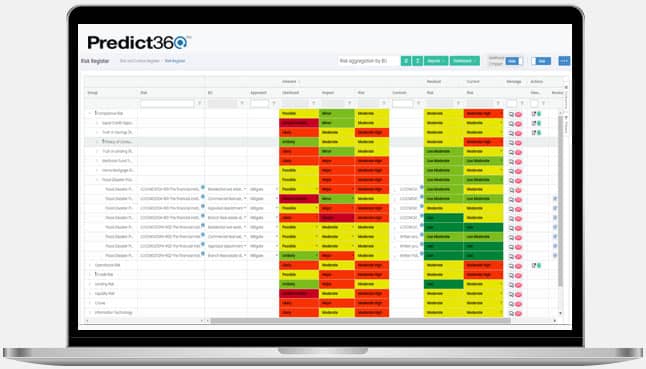

Predict360 augments risk management teams working in financial institutions and enables them to get better risk insights, set effective controls, mitigate more risks, and generate richer reports. Different applications within the platform deliver functionality that helps manage risks in financial services.

Predict360 offers risk managers the benefits of AI in financial services risk management in addition to constant visibility into enterprise risk via executive dashboards. All risk metrics are updated in real-time to reflect new and emerging risks. Predict360 offers the following focused applications for financial services.

- Risk Control Self Assessments (RCSA)

- Issues and Incident Management

- Vendor Risk Management

- Internal Audit and Findings Management

- IT Risk Assessments

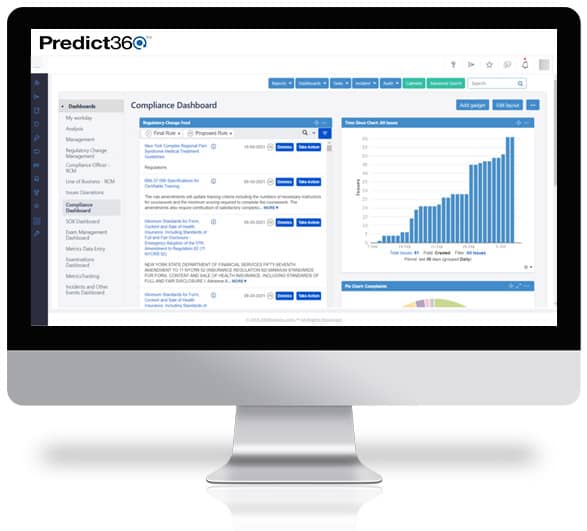

Financial Services Compliance Management with Predict360

The Predict360 compliance management platform helps financial services at every step of the compliance management process. It provides a comprehensive framework for managing and monitoring compliance obligations across various regulatory domains, such as consumer lending, data privacy, equal credit opportunity, and fair lending regulations.

Predict360 Risk and Compliance software is at the forefront of integrating AI in finance, ensuring consistency and transparency in compliance practices and facilitating easier audits and regulatory inspections. The platform offers the following focused solutions for financial services.

- Compliance Monitoring and Testing

- Regulatory Change Management

- Complaints Management

- Policy and Procedure Management

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist