The Challenge: Financial Organizations are Missing Customer Opportunities

Midsize and community banks and credit unions operate in an increasingly competitive market, facing pressure from FinTechs, neobanks, and digital-first challengers. Despite holding vast amounts of customer financial data, many financial organizations fail to leverage it effectively for customer segmentation, cross-selling, and upselling. As a result:

- Only 3% of banks capture over 80% of their customers’ share of wallet – leaving the majority of banks with just a fraction of their customers’ financial business.

- Most banks engage with only 10-20% of a customer’s wallet – while top-performing banks reach up to 60%.

- Challenger banks are rapidly gaining market share – Chime, Synchrony, and SoFi now account for 1 in 10 new primary bank accounts in the last two years.

The Lumify360 Solution: AI-Powered Share of Wallet Expansion

Lumify360 equips banks and credit unions with cutting-edge analytics to transform customer data into actionable insights, boosting profitability and retention. Key features include:

- Seamless Data Integration – Connects with over 200 data sources, including your existing data warehouse, core, and API-enabled systems.

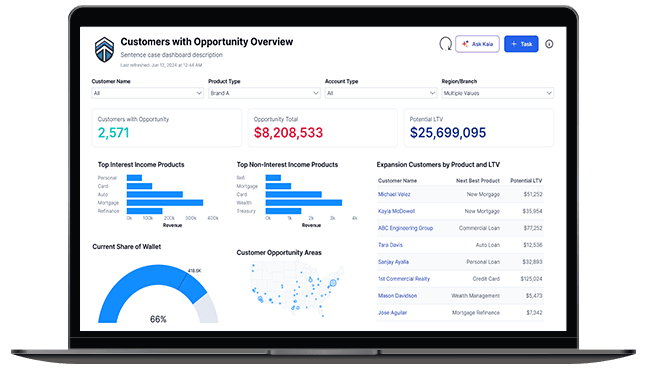

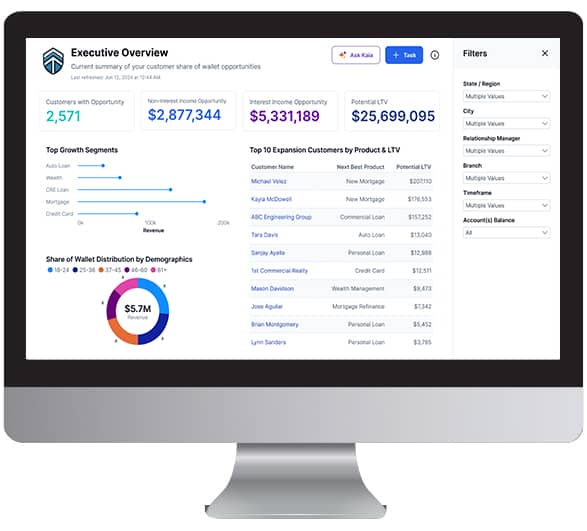

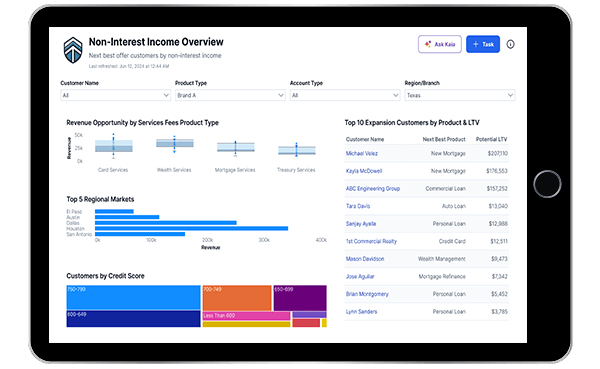

- Custom Analytics Frameworks – Prebuilt schemas and dashboards designed to identify cross-sell and upsell opportunities.

- Embedded Reporting – A built-in Power BI engine with pre-configured reports.

- AI-Driven Insights – Combine your data with AI-powered analysis to reveal predictive insights. Empower your business users to dive deeper into the data with Kaia, our secure chat agent, that answers questions, prepares ad-hoc charts and graphs, and performs trend analysis on underlying data.

- Issue Management Workflow – Helps teams collaborate on actionable outcomes, with CRM integration coming soon.

How Lumify360 Helps Financial Organizations Increase Share of Wallet

Your customers are already banking elsewhere—how can you capture more of their financial business? Lumify360 provides the predictive intelligence needed to strengthen relationships and increase profitability:

- Identify top customer accounts – Use AI-driven analytics to suggest the next best action for relationship managers.

- Segment by revenue potential – Analyze interest and non-interest income opportunities to optimize your product offerings.

- Improve marketing ROI – Personalize campaigns with advanced customer segmentation and behavioral insights.

- Leverage AI for deep insights – Uncover transaction patterns and trends to predict financial product needs.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist