Meet Kaia, Predict360’s AI Companion

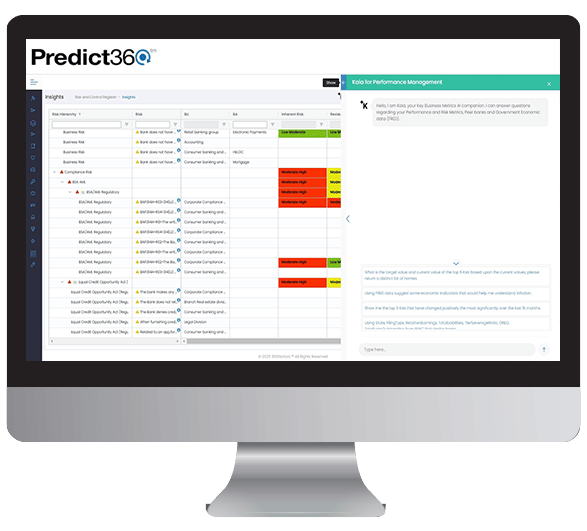

Kaia is an integrated AI companion built and hosted by 360factors that empowers users to explore risk and compliance data using natural language. Kaia has been specifically trained on financial industry-specific regulations, risks, KRIs, and KPIs to ensure that the optimum results are returned to you based on this domain-specific context and knowledge.

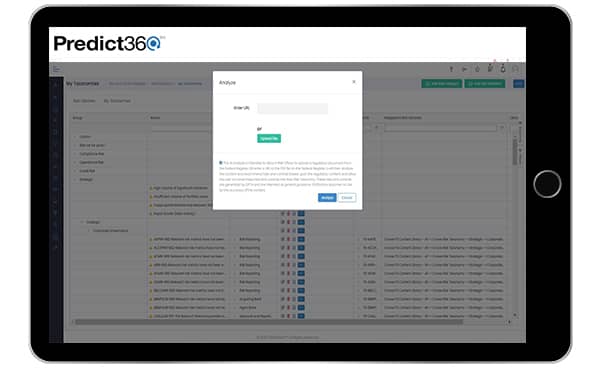

- Risk Management: Kaia analyzes customer-submitted regulatory documents, such as proposed or final rules, and suggests related risks and controls that are applicable to that particular regulation. Customers can then move into their Risk Taxonomies and edit as needed, saving hours per document.

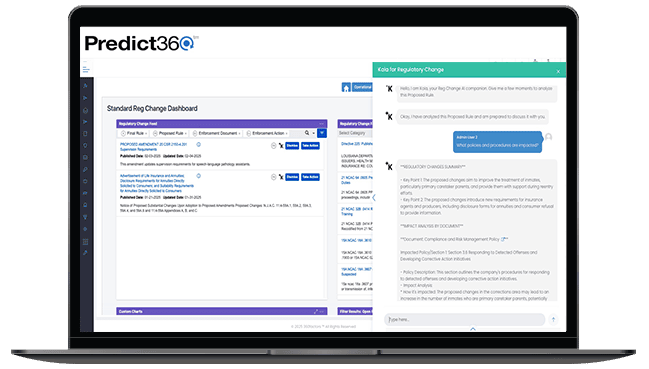

- Regulatory Change Management: Kaia analyzes Regulatory Change feed items and provides detailed and contextually specific answers per feed item, including identifying related policy and procedure documents that may be impacted. Customers can choose from suggested prompts or chat in free form.

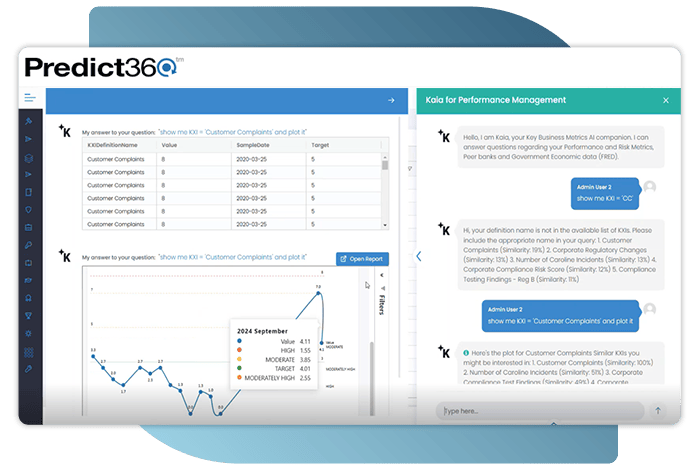

- Risk & Performance Insights: Kaia provides contextually relevant answers to KxI-related queries. It leverages your customer KxI data, FRED Series data, and FFIEC data to assist users data exploration and chart creation.

- Private & Safe: Kaia keeps your confidential data secure. It is never sent to external AI engines, and training data is stored on a per-customer basis.

Kaia for Risk Management and Assessments

Kaia enhances risk identification and saves hours of document review time by leveraging regulatory expertise, AI-driven insights, and best practices for banks and financial institutions.

- Kaia reviews and analyzes regulations or laws either as an uploaded document or by providing a URL link to the Federal Register or other sources.

- It then analyzes the provided document and suggests applicable risks and controls to users based on the document.

- These risks and controls can be imported into users’ Risk Taxonomies and edited or customized.

Kaia for Regulatory Change Management

Predict360 RCM ensures organizations stay ahead of new regulations by providing real-time analysis and interactive insights.

- Kaia can analyze newly released regulatory documents (e.g., proposed rules, notices etc.) and provide insights that general-purpose AI tools may miss.

- Users can chat with Kaia to ask questions about new regulations, such as applicability, penalties for non-compliance, and more.

- Additionally, Kaia can review policies and procedures in Predict360’s Document Management System and suggests which ones may be impacted by each regulatory change.

Kaia for Risk and Performance Insights

Kaia empowers organizations to explore their own KxI data alongside peer and market data.

- Kaia streamlines the user experience by providing intelligent, contextually relevant answers to KxI-related queries.

- Users can request custom visuals, and Kaia will generate summaries, charts, and trend analyses.

- Kaia is trained on large banking data sets, including FRED and FFIEC. Explore critical metrics, compare your bank with peers, and create on-the-fly charts with ease.

How Kaia Benefits Your Organization

By leveraging Kaia, organizations can streamline regulatory compliance efforts, reduce manual workload in risk and compliance management, and improve decision-making.

- Kaia identifies emerging risks and trends, ensuring proactive risk management.

- Kaia streamlines risk and control assessments, reporting, and analysis, freeing up risk and compliance teams for higher-value strategic tasks.

- Kaia identifies which policies and procedures need updates due to regulatory changes, reducing compliance gaps.

- By incorporating AI-powered risk insights, controls, and compliance updates, Kaia ensures a more efficient and up-to-date risk identification process.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist