Starting or updating your Fair Lending risk and compliance journey?

Discover how Predict360’s fair lending software and partner content can streamline regulatory risk and compliance. Let’s embark!

1Identify and Analyze Impact

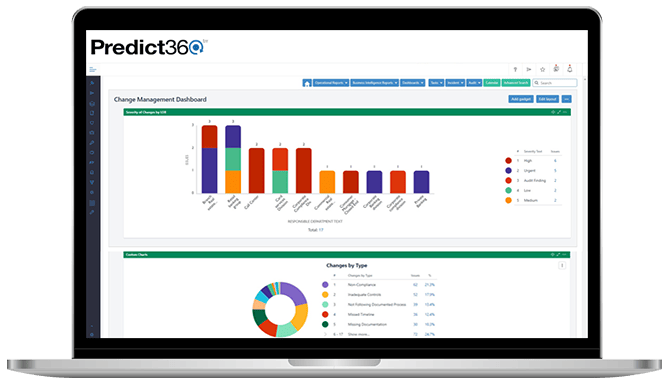

Whether there is a new regulation or an update to an existing Fair Lending regulation, it’s critical to understand the regulatory requirements, if and how the requirements impact your financial organization from a risk and compliance perspective, and then track and manage operational changes. Learn how banks, credit unions, fintechs, insurance companies, and other financial institutions manage regulatory changes and action plans seamlessly with the following fair lending risk management software solution components:

- Predict360 Regulatory Change Management

- Optional Content Plugins

- Reg-Room

- Compliance.ai

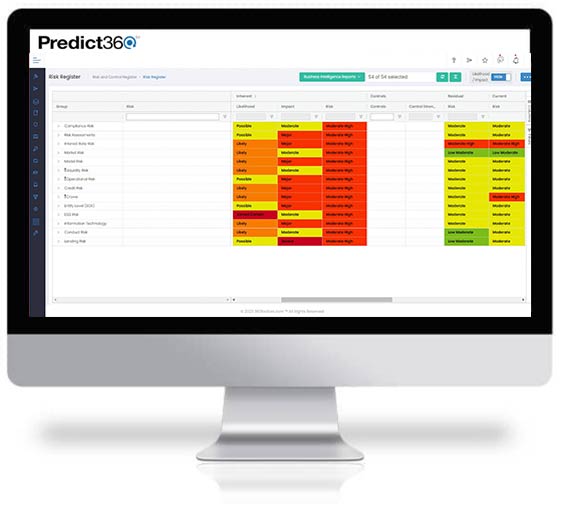

2Quantify Applicable Risks and Controls

After identifying a new regulation or regulatory change, evaluating its impact, and commencing the implementation process, it’s time to evaluate risks. You may ask, “What new compliance risks are introduced by these requirements, and how do they map to my overall Fair Lending risk management framework?” To streamline gap analysis, you can compare your risk library with industry standard libraries from Crowe, the ABA, and 360factors to identify gaps and map them to your taxonomy by product, process, or business area. Standardizing how risks and controls are evaluated and quantified enables you to achieve a powerful enterprise view of your organization’s risks. Solution components:

- Predict360 Risk & Control Self-Assessment

- Optional plugins, in addition to your risk library

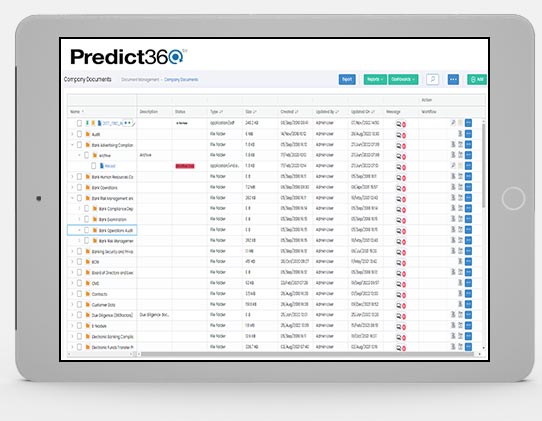

3Connect Policies and Procedures

Risk and control assessments empower your team to identify and map related policies and procedures and assess those that may require creation or updates. In addition to policy and procedure documents, Predict360 fair lending compliance software also enables your team to map controls, testing scripts, regulations, training documents, and other artifacts to risks – as well as activity and task management workflows to manage updates for each artifact. Learn more about:

4Conduct Testing and Monitor Issues & Complaints

Are you aware of emerging issues in between your regularly scheduled Fair Lending risk assessments? Control testing helps your team manage control performance and effectiveness. Additionally, if you are regularly monitoring Fair Lending complaints, you can identify any emerging risks that may arise from internal operations and third-party partners – before they become issues.

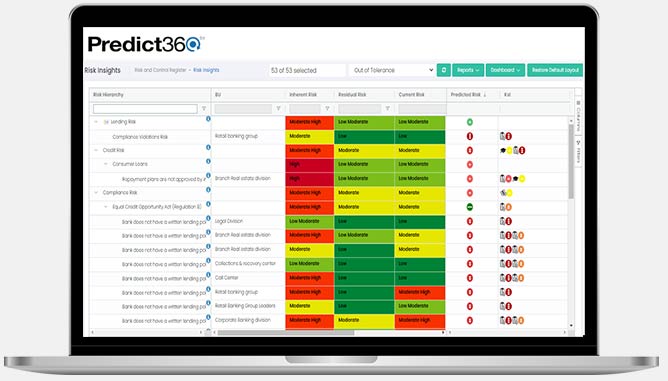

5Predict Emerging Risks

Predict360 Risk Insights identifies existing risks operating outside of KRI tolerance levels and predicts emerging risks using Artificial Intelligence. By mapping optional external data to risks, like enforcement actions and trends, your team is empowered to have a forward-looking view of where risks may emerge and mitigate them proactively.

- Predict360 Risk Insights

- Optional Reg-Room enforcement actions

- Optional Compliance.ai enforcement actions

No matter where you are in your Fair Lending risk and compliance management journey, our team and partners are here to empower your team with solutions built by banking and financial industry experts for financial organizations. Schedule a demo today!

Additional Resources for Your Fair Lending Journey

Regulatory Agency Resources

- CFPB Compliance Resources

- CFPB Regulatory Agenda

- Small Business Lending Under ECOA (Section 1071, March 31, 2023)

- FDIC Consumer Compliance Examination Manual (March 2021)

Partner Resources

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist