Advanced Compliance Monitoring and Testing for Banks & Financial Organizations

A successful compliance monitoring and testing program provides early insight into potential compliance challenges, enabling financial institutions to more quickly and easily resolve issues before they become serious. Today’s banking and financial services regulators, customers, executive leadership, and functional areas depend on Compliance to preserve and promote the integrity of the organization – and deliver results. These stakeholders expect more:

- Greater data accuracy and reporting

- Real-time reports for management and board committees

- Lower costs and better resource optimization

- Avoidance of enforcement action(s)

- Real-time insight into emerging issues

Automate Compliance Monitoring and Testing to Ensure Accountability

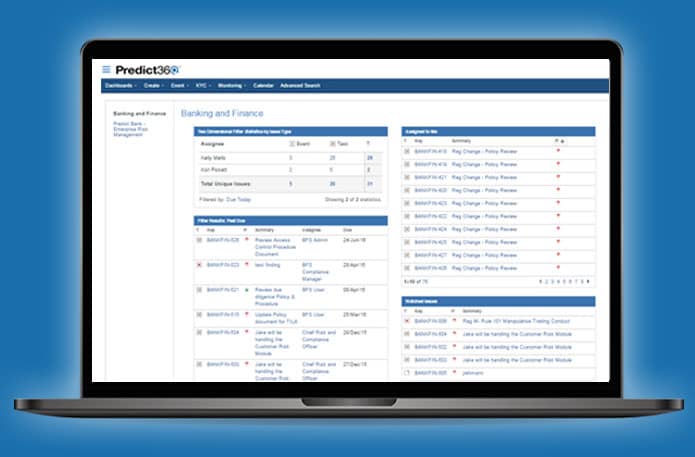

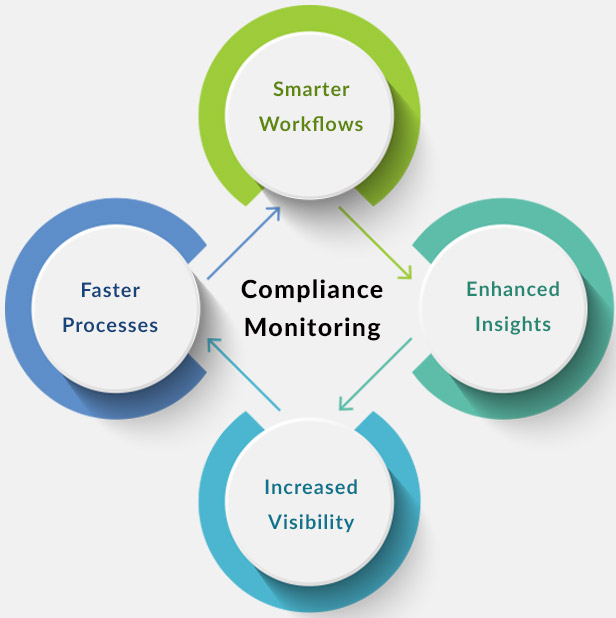

Workflow-based solutions increase productivity by automating compliance monitoring and testing activities and ensure accountability throughout the process. Workflows also shorten testing times because, by having greater visibility of centralized data and tasks, management can avoid duplicating tests across business units and/or first lines.

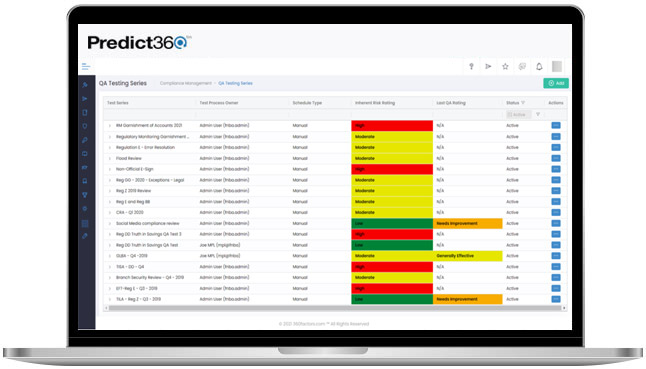

- Automate test series scheduling, execution, and closing memo creation and notification

- Map to regulations, attach work papers, assign questionnaires to tests, and assign and enforce milestones for completion

- Build a continuous flow of communication by providing a single collaborative space across business lines and compliance teams

- Drive accountability and manage expectations with real-time access to help close out action items in timely manner

The Challenges of Legacy Methods of Compliance Monitoring

As critical as Compliance Monitoring and Testing is for accountability, legacy technology solutions have lagged. Manual methods, such as spreadsheets, emails and shared documents, have resulted in seemingly endless cycles of inefficiency along with:

- Lengthy and costly testing times

- Historic-based reporting that is limited to status updates on completed activities

- Reporting errors

- Unintentional testing overlap

- Subjective versus objective assessments

- Enforcement actions

Deliver Business Intelligence and Insight with the Predict360 Compliance Platform

As an integrated risk and compliance intelligence platform powered by AI, Predict360 automates many tasks and workflows while improving quality and value of compliance and risk activity execution through a single platform.

- Create risk and regulatory relationships between organizational activities to provide visibility into where risks intersect

- Harness modern capabilities of machine learning, natural language processing and Artificial Intelligence (AI) to bring in risk data from external sources and analyze against internal data

- Achieve insight into areas the organization is currently unaware of to proactively adjust courses of action as needed.

- Provide management real-time visibility into overall progress across compliance programs

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist