Improve Compliance While Reducing Costs

Every business knows the importance of compliance but achieving desired compliance levels remains a challenge. The cost attached with compliance is so high that reaching optimum compliance levels through increasing investment and personnel is unsustainable. The Predict360 Compliance Management Suite delivers an increase in compliance levels with a decrease in cost and has been endorsed by the American Bankers Association.

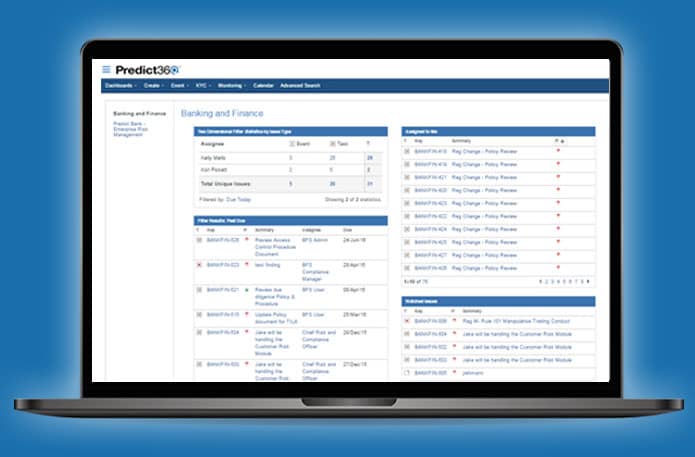

The compliance management platform helps businesses at every step of the compliance management process. It streamlines compliance monitoring, activity management, tracking, regulatory change management, document management, and much more.

Request a Custom Demo

Compliance Management Software Features

- A single compliance platform for all compliance related information, data, discussion, and documents

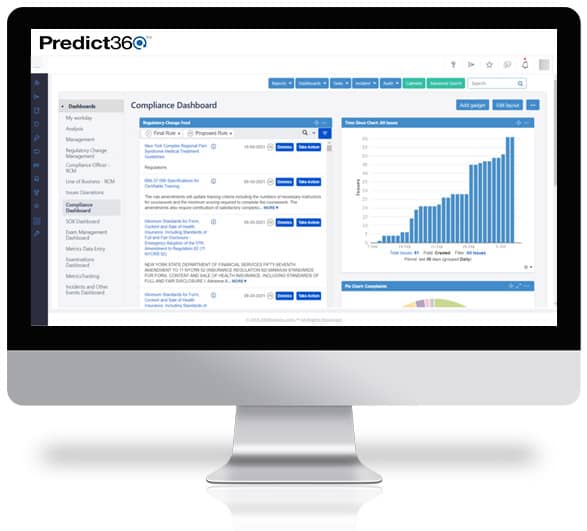

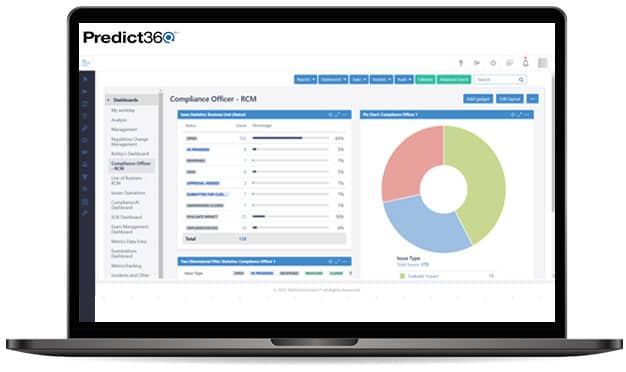

- Executive dashboards that show real-time compliance intelligence and data to enable proactive compliance management

- Streamlined compliance workflow processes for different compliance related activities and users

- Easy to implement cloud-based compliance management solution

- Integrates with other Predict360 solutions for complete GRC management under a single system

- Decreases costs of compliance by completely automating compliance monitoring, reducing workload, and increasing efficiency of catching violations

- Integrated compliance management calendar and a customizable compliance executive dashboard

Today’s Compliance Challenges

Legacy compliance practices are time-consuming and inefficient. The effort required to gather compliance data, detect vulnerabilities, and mitigate issues is compounded by decentralized data, manual data entry, and ad-hoc analysis. The slowdowns in compliance caused by manual processes result in challenges such as:

- Close coordination and integration with many related functions is difficult for businesses. Linked activities such as regulatory and standards compliance, incident management, workplace investigations, internal audit, quality management, and others need to be synced.

- The information required by the compliance team is often located across disparate systems. In addition, departmental silos further exacerbate the challenge of coordinating and acting on the known and emerging compliance issues.

- New players in the financial industry, such as Fintech solution providers, require a seamless compliance management framework that can easily integrate new processes and react to upcoming regulatory changes.

The Predict360 Compliance Management Solution Suite

The Predict360 Compliance Management Solution combines multiple compliance management tools under one platform. These tools can be used as a part of the platform or independently.

- Compliance Monitoring and Testing with Regulatory Risk Management

- Issues and Complaints Management

- Regulatory Change Management

- Regulatory Examination and Findings Management

- Policy & Procedure Document Management

- Training Management (LMS)

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist