Real-Time, Accountable Issues and Complaints Management

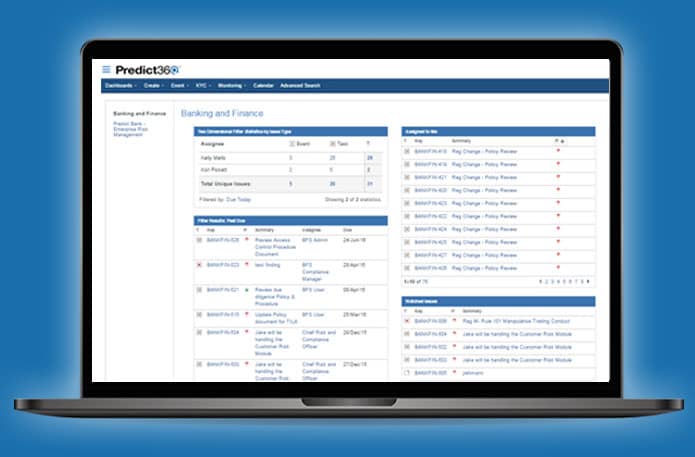

Predict360’s Issues and Complaints Management Solution provides first, second and third lines of defense the ability to more quickly and efficiently manage, track, collect evidence and collaborate on all compliance-related tasks, activities, issues and complaints in real-time. Managers are provided with a holistic and real-time view of all compliance issues and tasks across the organization by site, by business unit, and by regulation. Key features include:

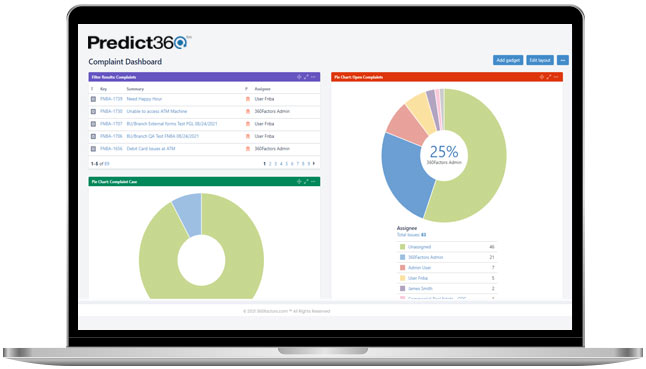

- Dynamic Dashboards with configurable views and segmentation

- Trend analysis to uncover complaints and issues insights

- Follow-up and resolution tracking for individual complaints

- Audit trails for enhanced accountability

- Progress tracking to monitor investigations and follow-up actions

- External complaint forms that auto-route to your compliance team and relevant stakeholders

- Priority ratings and automated notifications for critical information

Proactive Investigation & Resolution

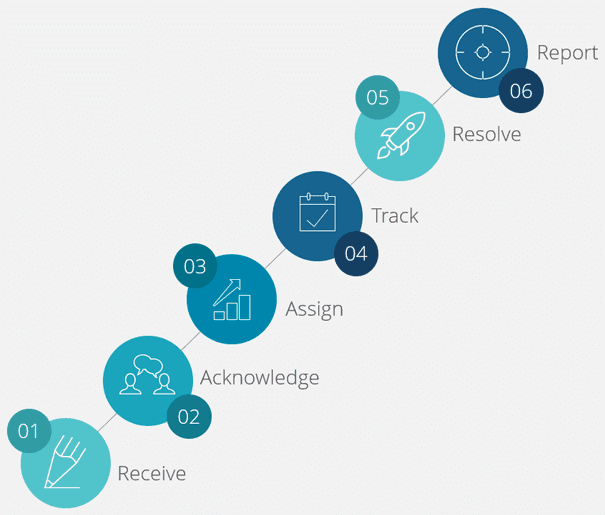

Taking a proactive approach enables organizations to increase efficiency, decrease resolution times, collaborate more effectively, and achieve insight into issues and complaints trends.

- Smart categorization enables businesses to classify complaints according to multiple criteria

- Capture the submission date, due date, assignee, resolution date, submission source, & communicate or provide the next steps in comments

- Initiate investigation workflows and/or close complaints

- Enable collaboration between the first, second, and third lines

- Filter issues and complaints with real-time operational dashboards, including those with high priority or overdue action items

- Immediately find and diagnose the status of any logged complaint or issue with Advanced Search

- Capture complaints via highly configurable internal system forms and external webforms

- Initiate, manage and close investigations. Once an investigation is initiated, editing and commenting provide updates and becomes part of the audit trail.

Obstacles to Effective Complaints Management

The use of disparate software tools – such as email, spreadsheets, shared drives, CRM and ticketing systems, etc. – often create barriers to effective issues and complaints program management:

- Lack of visibility into issue status results in missed unresolved complaints

- Complaints managed via multiple email threads creates confusion and delays across departments and between employees

- Manual complaints prioritization means that larger problems may be missed while smaller issues are being fixed

- Lack of efficient issue categorization can hide emerging problems, for example a business unit that has an atypically high number of complaints

Business Intelligence and Insights with Predict360

Predict360 doesn’t just improve the examination workflow – it also helps improve the way findings are recorded, managed, and responded to:

- Control Information can be captured in a summary control text field or as individual control items with attributes including efficacy, implementation percentage and weight to calculate the effectiveness a control has on managing a particular risk.

- Functionality linking multiple controls to a single risk and/or a single control linked to multiple risks is supported.

- Using the efficacy, implemented % and weight, a current risk rating is calculated and updated in real-time to identify controls that are operating outside tolerance levels. Those values can be updated any time that an incident occurs or control tests fail to instantly flag emerging risks to the enterprise.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist