Home/ Blog / Unlocking the Power of AI in Financial Services for Growth and Transformation

Staying ahead of technological advancement is the key to transformation and growth in the financial services sector. One of the most promising innovations in reshaping the industry is Generative AI. From enhancing customer experiences to automating recurring activities, generative AI is poised to modernize how financial institutions work. By streamlining procedures, improving productivity, and allowing customized client interactions, generative AI is introducing the latest avenues for growth and efficiency.

The capabilities of generative AI in financial services are broad. Financial enterprises harnessing AI’s power must integrate it holistically across their processes and workflows. This allows incremental productive benefits and a modern approach to banking operations that can transform the sector.

This blog will discuss key categories, costs, and key considerations for implementing generative artificial intelligence in financial services.

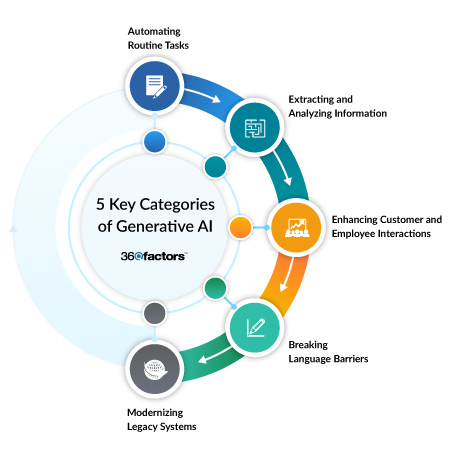

5 Key Categories of Generative AI

The rapid transformation of Generative AI in financial services has been made possible due to the innovative tools that enhance efficiency, improve customer experience, and offer operational refinements. Five major areas where generative AI is contributing immensely are discussed below:

1. Automating Routine Tasks through Content Generation

Generative AI is playing a significant role in automating time-consuming activities like drafting emails, reports, and documents. For instance, banks can utilize generative AI to produce the first draft of routine communication or marketing emails, freeing workers to concentrate on higher-value tasks. By automating such tasks, content generation aids in streamlining operations and enhances productivity across the company.

2. Extracting and Analyzing Information Efficiently

The most critical application of generative AI in financial services is to extract and analyze enormous amounts of data accurately and quickly. AI can analyze and summarize long documents, including employee benefit plans, contracts, and supplier agreements, enabling stakeholders to quickly spot critical details or errors with the least manual intervention.

3. Enhancing Customer and Employee Interactions with Chatbots

Conventional chatbots’ limitations are being improved thanks to the recent developments for generative artificial intelligence in finance, allowing smarter, more intuitive interactions. AI-based chatbots can engage in more informative and relevant conversations with employees and customers, providing a more customized and efficient service.

4. Breaking Language Barriers with AI-Powered Translators

Financial institutions with multinational operations encounter diverse linguistic barriers, and AI-powered translators are covering language gaps more successfully than ever. Generative AI in financial services can translate content more accurately and in real-time across various languages, allowing banks to offer multilingual, customized communication to employees and clients.

5. Modernizing Legacy Systems with AI Code Generators

Many financial organizations still depend on outdated legacy systems because it is challenging and costly to update them. Generative AI offers code generation capability, making it easy to modernize these systems by transforming natural language commands into code for the latest programming languages.

The Costs of Implementing Generative AI

Financial organizations should understand the economic implications of integrating AI in financial services, from initial investments to continuous operational expenditures, to assess the viability of switching to generative AI.

Initial Setup and Integration Costs

The initial costs, including the first-time implementation of generative AI, can be huge. The development of Gen AI tools involves substantial investment in creating training models, conducting rigorous testing procedures, and integrating them with existing systems. This process requires extensive computing power, specialized skilled employees, and much data. Financial enterprises may also need to develop centers of excellence or dedicated AI workers to supervise the integration process and ensure it aligns with business objectives and regulatory needs.

Ongoing Operational Costs and Environmental Impact

After the development, the cost of operating generative AI systems is also substantial. AI requires ongoing computer power to process large data volumes, and sustaining the efficiency of AI in financial services models across departments incur noticeable operational expenses. The decreasing cost of deploying LLM models and enhanced AI efficiency have reduced some of these issues. Still, the overall costs remain high, particularly for organizations that depend on multiple AI models.

Transforming Financial Processes with AI for Maximum Impact

Financial institutions must go beyond isolated use cases to fully realize the transformative potential of generative AI in finance.

Holistic AI Integration for Comprehensive Transformation

Rather than focusing on siloed AI implementations in specific tasks or departments, financial institutions should aim for holistic AI integration that spans the entire organization. This approach enables AI in financial services to be embedded across various business functions, creating a seamless flow of information and decision-making processes. Banks can drive comprehensive transformation beyond incremental improvements by leveraging AI throughout workflows—whether in compliance, risk management, customer service, or financial forecasting.

Parallel AI-Driven Processes for Enhanced Efficiency

One of the most significant advantages of generative AI is its ability to handle multiple tasks simultaneously. By applying AI to several process steps in parallel, banks can significantly reduce the time it takes to complete critical functions, enhancing efficiency. This parallel processing capability allows financial institutions to operate more dynamically, completing tasks that would traditionally occur in sequence at much faster rates.

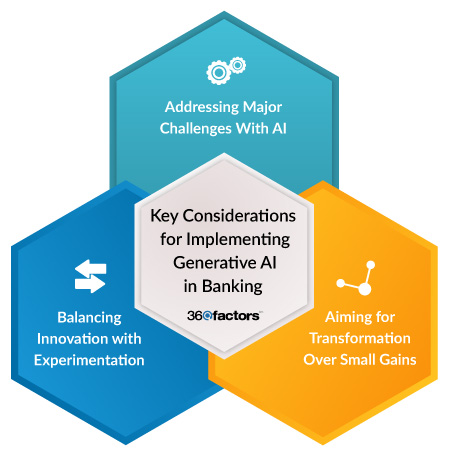

Key Considerations for Implementing Generative AI in Banking

Financial institutions must consider various risk factors to maximize the benefits of AI in financial services:

Addressing Major Business Challenges with AI

Financial organizations should concentrate on overcoming significant business challenges when executing generative AI for innovation. Generative AI can address critical functions, such as enhancing risk management, accelerating product design, or optimizing customer experience. By identifying the most significant problems and applying artificial intelligence in finance where it can deliver the best results, banks ensure that the technology becomes an important tool for essential business challenges.

Aiming for Comprehensive Transformation Over Small Gains

It may be appealing to start with small implementations here and there to manage specific tasks, and financial organizations should aim for comprehensive transformation over time. AI in financial services attains the best productivity benefits and efficiency across various procedures by prioritizing wider, organization-wide integration.

Siloed AI projects may get limited gains, such as a 5% productivity enhancement in one department. However, incorporating AI across the workflow, including compliance, risk evaluation, and customer service, leads to far better outcomes.

Balancing Innovation with Responsible Experimentation

Financial organizations experimenting with generative AI should balance innovation with responsible testing. Conventional wisdom suggests that rapid technological transformation requires financial organizations to move quickly to stay ahead. Still, ensuring that AI in financial services is implemented with appropriate governance and risk management frameworks is essential.

Critical concerns like lack of output explainability, bias in AI models, and cybersecurity risks must be tackled proactively. For instance, if AI is trained on biased data, it will produce biased results. Financial organizations must ensure ongoing tracking for such risks so that the technology is implemented ethically and responsibly.

Embracing AI Risk Management Software for Long-Term Growth in Financial Services

Financial organizations must progressively adopt generative AI in financial services to succeed. They must also ensure that any AI-based software is implemented with a holistic risk management framework. With AI-based risk management software as part of their modernization approach, businesses can manage risks and maintain long-term growth more effectively.

Predict360 Enterprise Risk Management Software offers financial institutions the tools they need to identify, monitor, and manage real-time risks, including the risks of AI deployment. This cloud-based solution provides a comprehensive, single-dashboard view of all enterprise risks, giving banks the confidence to deploy AI solutions with transparency and control.

It offers a real-time view of risks, ensuring that new and emerging threats are immediately visible to authorized stakeholders. This level of transparency is critical when managing the dynamic risks associated with AI in financial services deployment across multiple business functions. The software ensures that internal and external risks are recognized early and appropriate control measures are implemented.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.