Home/ Blog / 6 Top Strategies for Successful Execution of AI in Risk and Compliance

Financial organizations are going through significant challenges related to risk management and complex regulatory adherence in the current competitive business landscape. With the growing volume of regulations along with the increasing sophistication of cyber fraud and threats, convention risk management and compliance management are insufficient. Businesses must adopt innovative tools and technologies to overcome these challenges.

Artificial intelligence in finance has emerged as a transformative force in the risk and compliance landscape, offering supreme capabilities to automate, analyze, and augment decision-making processes. By leveraging AI, organizations can enhance their ability to detect potential risks, streamline compliance efforts, and ensure operational resilience. Beyond efficiency, AI enables companies to make proactive, data-driven decisions critical for navigating today’s dynamic regulatory environment.

However, successfully implementing AI in risk and compliance requires more than just technological adoption. It demands a strategic approach rooted in AI governance, model transparency, and ethical considerations. Ensuring that AI systems are accurate, unbiased, and aligned with organizational values is vital for achieving sustainable results.

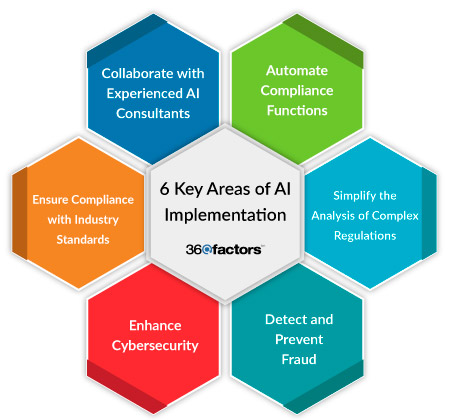

This blog explores six key strategies that businesses can adopt to maximize the benefits of AI in risk and compliance. By understanding and applying these approaches, organizations can position themselves for long-term success in a rapidly changing world.

6 Key Approaches of AI Implementation

1. Automate Regular Compliance Functions for Knowledge Workers

Compliance programs often require significant manual effort, from tracking regulatory changes to generating reports and conducting audits. AI in risk and compliance can transform these labor-intensive processes by automating routine tasks, allowing knowledge workers to focus on higher-value activities. For example, AI-powered systems can monitor regulatory updates in real-time, categorize obligations, and generate actionable insights for compliance officers.

By automating these functions, organizations save time and reduce the risk of human error. This is particularly important in industries where regulatory requirements evolve rapidly, such as banking and finance. Moreover, AI-driven solutions provide scalability, enabling businesses to efficiently manage compliance efforts across multiple jurisdictions.

2. Simplify the Analysis of Intricate Regulatory Documents

Navigating complex regulatory frameworks is a time-consuming task for compliance management teams. AI can significantly ease this burden by analyzing large volumes of regulatory documents and extracting relevant information. Through natural language processing (NLP) models, AI in risk and compliance systems can identify key obligations, deadlines, and reporting requirements, providing teams with a clear roadmap for compliance.

This capability is especially valuable in global organizations where regulatory standards vary by region. By leveraging AI in finance to simplify document analysis, businesses can enhance their ability to identify and mitigate risks while ensuring adherence to diverse regulatory requirements. The time saved through automation also allows teams to focus on strategic initiatives that drive organizational growth.

3. Detect and Prevent Fraud to Strengthen Risk and Compliance Efforts

Fraudulent activities pose significant risks to organizations, from financial losses to reputational damage. AI offers powerful tools to combat fraud by analyzing vast datasets and identifying suspicious patterns or anomalies. For example, AI algorithms can detect unusual transaction behaviors indicative of money laundering or fraudulent claims.

By proactively identifying potential fraud, organizations can take preventive measures to safeguard their operations. AI in risk and compliance systems also enhances the efficiency of fraud investigations, enabling compliance teams to focus on high-priority, suspicious cases. Detecting and mitigating fraud in real-time strengthens overall risk management efforts and ensures a more secure business environment.

4. Enhance Cybersecurity by Streamlining Threat Detection

Cybersecurity is critical to effective risk management, particularly in an era of increasing digital threats. AI plays a pivotal role in enhancing cybersecurity by monitoring networks, analyzing data, and identifying potential risks. Through machine learning and predictive analytics, AI systems can detect anomalies that may signal cyberattacks, enabling organizations to respond swiftly.

AI also supports cybersecurity professionals by automating routine tasks such as log analysis and incident reporting. This allows teams to focus their efforts on addressing the most critical threats, improving the overall security posture. By integrating AI in risk and compliance for cybersecurity strategies, businesses can mitigate risks more effectively and ensure operational resilience.

5. Ensure Compliance with Industry Standards and Adopt Risk Management Best Practices

Adhering to industry standards is essential for maintaining regulatory compliance and minimizing risk. Generative AI in finance helps organizations align their practices with established guidelines by automating the assessment of internal processes against external benchmarks. This ensures that compliance efforts are both comprehensive and consistent.

In addition, AI systems can simulate risk scenarios to identify potential vulnerabilities and test the effectiveness of existing controls. By leveraging AI to align with best practices, organizations can demonstrate their commitment to compliance and build trust with regulators.

6. Collaborate with Experienced AI Consultants

Implementing AI in risk and compliance is a complex attempt that requires specialized expertise. Partnering with experienced AI developers and consultants helps organizations navigate this process effectively. These consultants bring deep knowledge of both AI technologies and the regulatory landscape, ensuring that implementations are aligned with organizational goals.

AI consultants can also provide valuable insights into optimizing existing processes and identifying opportunities for innovation. By collaborating with experts, businesses can accelerate their AI initiatives and maximize the return on their investments. This partnership is particularly beneficial for organizations new to AI, as it ensures a smooth transition and sustainable outcomes.

Leverage AI-Based Software for Long-Term Risk and Compliance Success

Adopting AI in risk and compliance is not just a short-term solution but a strategic investment in long-term success. AI-based software offers organizations the tools they need to stay ahead of evolving challenges, from regulatory changes to emerging risks. By integrating AI in financial services, businesses can enhance their ability to manage risks, ensure compliance, and drive growth.

Organizations must adopt robust and innovative tools with AI integration, like the Predict360 Risk and Compliance Software, to achieve sustainable success in risk and compliance. This comprehensive solution provides managers with complete visibility into enterprise risks on a single dashboard. By offering real-time updates and AI-powered insights, Predict360 Enterprise Risk Management software ensures that new risks are instantly reflected in all relevant metrics and shared with authorized stakeholders.

Predict360’s AI companion empowers businesses to quickly identify potential risks and controls across various business units and functions. This facilitates proactive recognition and mitigation of internal and external threats, fostering better controls and decision-making. Its cloud-based architecture ensures that the latest regulatory risks are closely monitored and seamlessly integrated into the system.

In addition to risk management, the Predict360 Compliance Management software helps businesses streamline the compliance process. From regulatory change management to document tracking, this platform utilizes the power of AI to enhance compliance efficiency while reducing costs. Its automation capabilities significantly reduce workloads, enabling organizations to achieve higher compliance levels without additional resources.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.