Home/ Blog / 6 Steps to Implementing AI in Banking

AI is transforming several industries, including financial services. AI has the potential to enhance customer experience, improve risk management, and optimize operational efficiencies. However, many banks have not moved beyond isolated pilot programs or limited AI applications.

Banks must move beyond piecemeal initiatives to unlock AI’s value and focus on integrating AI across their entire organization. This shift involves developing a holistic AI strategy, aligning AI initiatives with business goals, and prioritizing long-term scalability over short-term wins.

The journey from fragmented pilot projects to enterprise-wide adoption has challenges. However, successful entrepreneurs will gain a competitive advantage through data-driven decision-making, optimized processes, and proactive risk management.

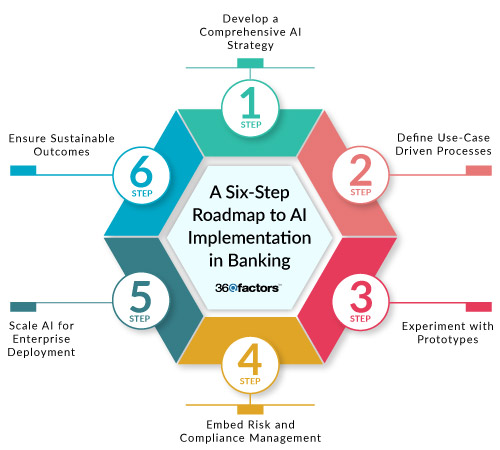

This blog outlines six critical steps to help banks achieve full-scale AI implementation, starting from strategy development to sustainable outcomes.

Step 1: Develop a Comprehensive AI Strategy

To compete in a data-driven landscape, artificial intelligence in banking must evolve to allow organizations to move from being AI-aware to becoming AI-driven competitors. This requires AI to move beyond a standalone initiative and become foundational.

Aligning AI with Business Vision

A successful artificial intelligence in finance strategy begins with alignment between AI capabilities and the bank’s broader business goals. Executives must ask critical questions during the strategy phase:

- What are the bank’s long-term goals, and how can AI support them?

- Which processes or customer experiences can AI enhance?

- How can AI-driven insights generate measurable value across operations?

Use these foundations to begin building your integration:

| Foundations for AI Integration | |

|---|---|

| Consider Ethics and Regulations | AI processes must remain transparent, moral, and compliant with regulatory requirements to build trust among customers and stakeholders. |

| Ensure Data Availability | Clean, accessible, and well-structured data is critical for the success of artificial intelligence in banking. Banks must prioritize modernizing legacy data systems to support AI models. |

| Establish an AI-First Culture | Building a culture that embraces AI involves training employees, encouraging cross-departmental collaboration, and promoting innovation. |

Step 2: Describe Use-Case Driven Procedures

One of the most significant challenges in adopting AI is the temptation to follow trends without a clear value-driven focus. Many banks initiate AI projects in response to market pressure, only to grapple with unclear goals and wasted investments.

Banks must transition from experimenting for innovation to developing business-value-driven solutions with artificial intelligence in banking that deliver results. Here are some use-case examples that offer measurable and immediate value:

| Examples of Immediate Value from AI Integration | |

|---|---|

| Service Optimization | Leverage AI to streamline and reduce costs for select operations through conversational AI agents. |

| Underwriting | Use AI models to automate credit approvals and enhance risk assessments by incorporating diverse data sources. |

| Collections and Recovery | Reduce customer delinquencies and improve debt recovery through personalized, AI-driven outreach strategies. |

To ensure a balanced approach, banks must develop a diverse portfolio of AI projects that combines quick wins with long-term strategic initiatives. For instance:

- Pursue “low-hanging fruit” like automating document scanning or fraud detection for faster ROI.

- Invest in more complex, high-value solutions like AI-driven regulatory compliance systems.

A diverse portfolio of AI initiatives enables banks to build experience with artificial intelligence in banking and refine their processes, avoiding overreliance on a single application and accelerating AI adoption across business units.

Step 3: Experiment with Prototypes

Ai in finance must be built with a vision for long-term integration. Many banks focus on short-term proof of concept, which limits their ability to scale solutions beyond the pilot stage. Instead, banks must plan prototypes with enterprise scalability.

| Considerations During the Prototyping Phase | |

|---|---|

| Data Readiness | Ensure sufficient, high-quality data is available to support AI models. |

| Strategic Objectives | Align prototypes with long-term goals to maximize ROI. |

Building Prototypes for Full Integration

Rather than treating prototypes as isolated experiments, banks should view them as foundational components of a larger artificial intelligence in banking ecosystem. Effective prototyping involves the following:

- Collaboration from engaged stakeholders from all affected business units

- Prototype integration compatibility with existing systems and processes

- Continuous evaluation of the solution’s value to the organization

Step 4: Build Confidence by Embedding Risk and Compliance Management

Unlike traditional approaches to risk management, considerations for artificial intelligence in banking must begin at the strategy development phase and remain integral to the deployment process.

Consider the following when mapping out potential AI-related risks:

| Important Factors in AI Risk Management | |

|---|---|

| Bias and Fairness | Ensure AI models produce fair, unbiased decisions through diverse data sources and rigorous testing. |

| Transparency | Implement explainable artificial intelligence in finance models that clearly outline decision-making processes. |

| Data Privacy | Safeguard customer data and ensure compliance with data protection regulations. |

Exploring New Partnerships to Expand AI Capabilities

AI adoption requires access to advanced technologies, vast datasets, and cutting-edge expertise resources many banks may not have internally. Collaborating with technology partners and fintech innovators enables banks to:

- Access emerging AI capabilities.

- Leverage external data sources for richer insights.

- Accelerate development and deployment timelines.

Step 5: Scale AI for Enterprise-Wide Deployment

Eventually, the experimental stage of artificial intelligence in banking will need to scale up and cover organization-wide operations. This can be difficult due to rigid legacy systems, insufficient talent, or an incomplete strategy for long-term integration.

Banks must transition from scattered pilot projects to a unified, scalable AI framework that can be adopted across the enterprise. Scaling AI effectively requires embedding it into core processes, ensuring it integrates seamlessly with existing operations.

Adaptive Technology and Flexible Systems

Outdated technology platforms often hinder banks from scaling AI projects. To overcome this, organizations need to modernize their infrastructure and move to cloud-based systems and AI-friendly technology platforms that provide scalability, flexibility, and real-time processing capabilities. Key benefits of modern systems include the following:

- Scalable Infrastructure like cloud platforms that allow AI in banking models to process larger datasets, adapt to increased workloads, and evolve without excessive manual effort.

- Scalable technology ensures AI tools connect with existing workflows, improving fraud detection, customer service, and operational reporting.

Step 6: Drive Sustainable AI Outcomes Through Continuous Learning

AI implementation does not end with deployment; it marks the beginning of an ongoing journey of improvement and adaptation. Unlike traditional systems that require static maintenance, AI models thrive on continuous learning and refinement.

Artificial intelligence in banking must adapt to real-world changes, evolving inputs, and unexpected challenges to remain effective, ensuring its outcomes remain relevant and reliable.

Achieve Long-Term Success with Predict360

A critical element that must be considered when integrating AI is risk and compliance management. To address managing regulatory compliance, mitigating risks, and ensuring ethical AI usage, banks must leverage advanced risk and compliance management tools to monitor, streamline, and optimize processes.

The Predict360 platform offers a unified, cloud-based solution to address these challenges, enabling businesses to manage risk proactively while achieving higher compliance levels at a lower cost.

How Predict360 Benefits Your Organization

There are multiple benefits to integrating a dedicated AI risk management tool into your organization but we have compiled a high-level overview here:

| Benefit Category | Key Advantages |

|---|---|

| Cost Reduction | Decreases compliance costs through complete automation of monitoring and testing; reduces manual workload and increases efficiency in catching violations. |

| Regulatory Intelligence | Automates updates and notifications when regulations change; provides real-time regulatory intelligence feed with latest reports and news |

| Risk Visibility | Offers predictive analytics combining internal KRIs with external market data (FRED, FFIEC); enterprise-wide risk register with automated roll-up capabilities |

| Workflow Automation | Streamlines compliance workflows for testing, monitoring, and tracking; automates audit scheduling and task management; offers a single collaborative platform |

| Integrated Platform | Unified system connecting regulations, risks, controls, audits, policies, and training; eliminates spreadsheets and data silos; single source of truth for all compliance and risk data |

| Enhanced Decision-Making | Shows AI-driven insights (Kaia GenAI companion) for complex regulatory queries; offers predictive risk analysis to identify emerging risks outside tolerance |

| Efficiency | Shortened testing times through centralized data; avoidance of duplicative tests across business units; real-time issue tracking and resolution monitoring |

Connecting risk and compliance management on a single, cloud-based platform, Predict360 ensures organizations can proactively manage risk, efficiently meet regulatory requirements, and reduce compliance costs, creating a robust foundation for long-term business success.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.