Home/ Blog / Advancing the Risk Management Function Beyond Traditional Boundaries in the Insurance Sector

The role of Chief Risk Officers (CROs) in the insurance industry is significantly transforming. Gone are the days when their responsibilities were kept to traditional risk assessment and mitigation strategies. Today, CROs are at the forefront of an evolving landscape where technological advancements and shifting market dynamics present unprecedented challenges and opportunities for the risk management function.

One of the primary obstacles is the often-subpar quality or lack of data. In many instances, relevant data becomes available too late, making it nearly useless for proactive risk management. This delay in data acquisition severely limits the CROs’ capability to anticipate and mitigate risks effectively.

Furthermore, the reporting of risk appetite metrics typically occurs several weeks after the end of a period. Consequently, significant time has passed when the Risk Committee reviews the risk profile and appetite, making any potential corrective actions less effective or moot. This lag hinders timely decision-making and compromises the overall agility and responsiveness of the risk management function.

Another significant issue is the inadequate investment in risk management insurance systems, which often need to catch up on other technological advancements within the organization. This discrepancy leads to a reliance on manual reporting processes, where risk analysts must aggregate data supplied by various business units. This is why understanding the insurance industry trends is significant to stay ahead.

How Artificial Intelligence May Change the Insurance World

The advent of Artificial Intelligence (AI) is set to redefine the operational and strategic patterns of the insurance industry. AI’s impact is anticipated to unfold in three significant stages influencing risk management function: Assisted Intelligence, Augmented Intelligence, and Autonomous Intelligence, each representing a leap forward in how insurance entities operate and interact with their customers and data.

Assisted Intelligence: Today’s Landscape

The insurance sector is experiencing the initial wave of AI transformation through Assisted Intelligence. This phase primarily focuses on automating repetitive, standardized, or time-consuming tasks. By streamlining these processes, AI enables insurers to enhance efficiency and accuracy, allowing employees to focus on more complex and nuanced aspects of their risk management function.

Augmented Intelligence: The Emerging Future

Looking toward the near future of insurance and risk management, the concept of Augmented Intelligence is expected to take center stage. This phase will mark a fundamental change in work within the insurance sector. Unlike the previous stage, which focuses on task automation, Augmented Intelligence fosters a collaborative environment where humans and machines work together to make decisions. AI systems will provide insights and analysis in this ecosystem, while human professionals will leverage their emotional intelligence, creativity, persuasion, and innovation to interpret data and make informed decisions.

Autonomous Intelligence: The Horizon Beyond

The long-term future vision for AI in the insurance risk management function points towards Autonomous Intelligence, a stage where adaptive, continuously improving intelligent systems could take over decision-making processes. In this scenario, AI systems would analyze and interpret data to make and execute decisions independently based on learned algorithms and patterns.

The journey toward fully autonomous AI in insurance is both exciting and daunting. It offers the potential for unprecedented efficiency, accuracy, and customer service but also requires careful navigation to address the accompanying risks and ethical dilemmas.

Megatrends: Four Global Shifts Changing the Way We Do Business

Like many others, the landscape of the risk management function for the insurance industry is not immune to the profound changes brought about by global megatrends. These shifts are reshaping how we live, work, and conduct business, presenting challenges and opportunities for the sector. Understanding these trends is crucial for insurance companies as they adapt their insurance management solutions to the evolving environment.

Rapid Urbanization

The United Nations projects that by 2030, 4.9 billion people will reside in urban areas, with the urban population expected to increase by 72% by 2050. This massive urban growth will significantly affect the insurance industry’s risk management function.

The Shift in Global Economic Power

The global economic landscape is shifting, with rapidly developing nations poised to gain the most, provided they can harness a large working-age population, attract investment, and improve education. This means navigating a complex array of geopolitical risks for insurers while seizing opportunities in emerging markets.

Demographic and Social Change

The world is experiencing significant demographic shifts, including an aging population in many regions. This demographic change pressures businesses, social institutions, and economies, affecting everything from business models to pension schemes. The insurance sector must respond by developing products and services that meet the needs of an older workforce and consumer base to enhance their risk management function while addressing the challenges of a shrinking labor force in rapidly aging economies.

Technological Breakthroughs

The rapid advancement of automation, robotics, and artificial intelligence is transforming the job market and business operations. While emerging economies may find it easier to adopt new technologies, established organizations must navigate the challenges of integrating these innovations into their existing insurance and risk management trends.

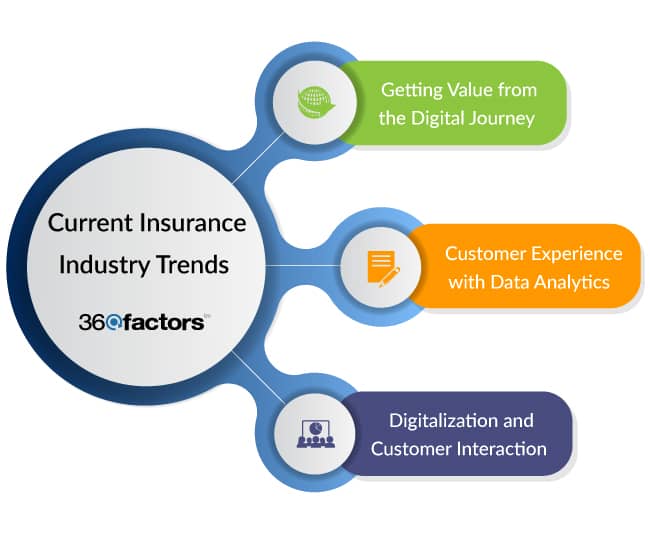

Current Insurance Industry Trends

The insurance industry is rapidly evolving, with the risk management function at the core of these changes, driven by significant shifts in technology and consumer expectations. Several key trends are reshaping how insurance companies operate and interact with customers.

Getting Value from the Digital Journey

The digital transformation journey is no longer a luxury but a necessity for insurance businesses aiming to stay relevant and competitive. Unifying and updating digital systems are two crucial steps toward creating unique customer journeys. Companies can significantly enhance their market position by leveraging new insurance models and digital platforms. The mantra “If we can imagine it, we can do it” reflects the newfound possibilities enabled by technological advancements.

Improving the Customer Experience with Data Analytics

In today’s data-driven world, utilizing innovative technology to enhance the risk management function and customer experience has become essential. Insurers are increasingly focusing on data analytics to understand customer needs better and tailor their services accordingly. This approach improves customer satisfaction and helps insurers differentiate themselves in a crowded market.

Digitalization and Customer Interaction

Digitalization is transforming the way insurers interact with their clients. Online portals and cloud platforms are becoming standard, offering policyholders access to their documentation, streamlining the claims process, and facilitating secure communication. This shift improves the customer experience and leads to more efficient back-office operations. By embracing digital channels to enhance the risk management function, insurers can provide more accessible, transparent, and responsive services, aligning with the expectations of today’s consumers.

Data and Technology Trends of the Future

As we venture deeper into the digital age, the insurance sector stands on the brink of a transformative era driven by data and technology trends. Several pivotal insurance and risk management trends will shape the future and help businesses harness the power of information technology. Understanding these trends is crucial for insurance companies aiming to stay ahead in a rapidly evolving market:

Growing Shared Economy

The rise of the shared economy has revolutionized traditional business models, fostering new types of business-to-business interactions and consumer services. However, this rapid growth presents unique challenges for the risk management function and regulatory compliance certainty. Insurance companies must navigate this new landscape, developing innovative solutions to cover the novel risks and liabilities emerging from shared platforms and collaborative models.

Data as an Asset

In today’s digital economy, data is an asset that can unlock new opportunities for business development and innovation. The vast volumes of data businesses retain are a goldmine for insights, driving more informed decision-making and enabling a shift towards AI implementation. Insurance companies must recognize the importance of safeguarding data and technology assets against potential threats and losses with a robust risk management function.

Responsible AI

The acceleration of AI development, fueled by advancements in cloud computing, has opened new avenues for efficiency and automation. AI’s potential to transform various aspects of the insurance industry, from underwriting to claims processing, is immense. Insurance companies must adopt a responsible approach to AI, ensuring that these systems are used responsibly, transparently, and with alignment to societal values.

Integrate AI-Powered ERM Software to Enhance Risk Management Function

Integrating AI-Powered Enterprise Risk Management (ERM) software, in the dynamic risk management function landscape, represents a significant leap forward. Predict360 ERM software, a cloud-based solution, exemplifies the transformative power of such technology in streamlining organizational risk management processes. Here is how this insurance risk management software can facilitate you:

Streamlining Risk Management

Predict360 ERM tool is an AI-powered solution that offers a comprehensive risk management approach, ensuring managers have complete visibility of enterprise risks on a single, intuitive dashboard. This integration facilitates the systematic identification and assessment of potential risks across various business functions and processes.

Proactive Risk Identification

The Predict360 ERM software aids organizations in proactively recognizing and understanding both internal and external risks that could impact their risk management function objectives. It maintains an up-to-date repository of risks, control measures, and mitigation strategies, enhancing decision-making capabilities for insurance businesses.

Enhanced Decision-Making with Advanced Analytics

Predict360 ERM app goes beyond traditional risk management by integrating Tableau BI visualization, enabling organizations to analyze risk data and scenarios effectively. This integration allows for informed decision-making that aligns with overall business objectives.

Continuous Risk Assessments

The automated monitoring feature of the Predict360 ERM solution enables continuous risk assessments, alerting the risk management team if a risk suddenly increases in severity. This feature ensures organizations can respond to, predict, and mitigate risks with agility, adapting to ever-changing business conditions that could impact their risk management function.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.