Home/ Blog / Major Elements, Value and Benefits of Regulatory Change Management Process for Financial Enterprises

Regulatory Change Management is the systematic approach to identifying, assessing, monitoring, and implementing changes in relevant laws, regulations, and guidelines that impact an organization’s operations. This process is essential for ensuring a business complies with current legal standards and anticipates and prepares for future regulatory shifts. Regulatory change management solutions encompass various activities, including tracking regulatory developments, evaluating their impact on business processes, and updating internal policies and procedures accordingly.

In the volatile financial environment, regulatory changes are inevitable and challenging. While crucial for maintaining the integrity and stability of the economic system, these changes bring a set of significant hurdles that organizations must overcome. Understanding these challenges is the first step toward developing a robust regulatory change management process. Let’s delve into the main challenges that arise from regulatory changes:

The High Cost of Compliance

One of the most daunting challenges is the cost associated with maintaining compliance. For smaller organizations, the financial burden can be substantial. These costs are not just limited to implementing compliance programs but also encompass the ongoing expenses of maintaining these systems.

Time: The Silent Challenge

The journey towards compliance is often a marathon, not a sprint. Regulatory changes demand time to understand the new requirements, assess their impact on existing policies, improve the regulatory change management process consistently, and implement the necessary changes.

The Complexity Problem

Regulations are rarely straightforward. Their complexity and volume can be overwhelming, making it difficult for organizations to ensure they have interpreted and applied them correctly. This complexity necessitates a clear and structured approach to RCM.

Significance of Regulatory Change Management

In an era where regulatory changes are frequent and can originate from multiple global sources, the ability to capture and track these changes is indispensable. Here’s why:

Ensuring Compliance

The primary goal of RCM is to maintain continuous compliance with all applicable laws and regulations. An effective regulatory change management process is crucial for highly regulated sectors such as finance, healthcare, and energy.

Avoiding Penalties

Non-compliance can lead to severe consequences, including hefty fines, legal challenges, and reputational damage. An effective regulatory change management solution helps organizations stay ahead of regulatory updates, allowing them to adjust their compliance programs before any serious issues arise.

Staying Competitive

Regulatory changes can significantly impact market dynamics and competitive landscapes. By staying abreast of these changes, companies can adapt strategies to maintain or enhance their market position.

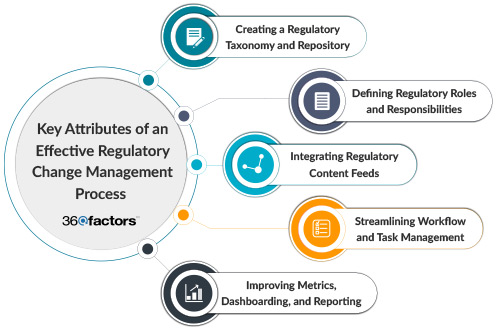

Key Attributes of an Effective Regulatory Change Management Process

A structured and effective regulatory change management process is imperative in the financial world. It is the backbone of compliance programs for financial organizations striving to navigate the complex regulatory landscape efficiently and effectively. Let’s explore the essential attributes that constitute an effective RCM process, ensuring that your organization remains compliant while fostering a culture of accountability and continuous improvement.

1. Establishing a Regulatory Taxonomy and Repository

The cornerstone of any proficient RCM process is the development of a comprehensive regulatory taxonomy and repository. This involves creating a structured, hierarchical catalog of regulatory areas affecting the organization and logically categorizing regulations to streamline management and accessibility. To ensure a smooth regulatory change management process, the taxonomy should be integrated with a repository that includes relevant regulations, providing clear links and mappings to various elements such as:

- Regulatory Associations: Including lawmakers, government agencies, and industry associations.

- Document Forms: Encompassing laws, guidelines, rules, and other regulatory documents.

- Information Sources: Identifying where regulatory information can be obtained, such as official websites and RSS feeds.

- Elements: Essential for classification, such as jurisdiction, related regulations, and the status of changes.

This structured approach ensures that regulatory information is organized, up-to-date, and easily accessible, facilitating more efficient management through the regulatory change management tool.

2. Defining Regulatory Roles and Responsibilities

An effective regulatory change management process depends on clear accountability. Ensuring that the correct information reaches the right individuals within the organization is crucial. This involves identifying subject matter experts (SMEs) for each regulatory category and subcategory who possess the requisite knowledge to assess the impact of regulatory changes on the organization. By setting roles and responsibilities, organizations can foster a culture of accountability and ensure that the most qualified individuals manage regulatory changes.

3. Integrating Regulatory Content Feeds

Staying ahead of regulatory changes requires access to reliable and timely information. Organizations should establish a network of regulatory content feeds, sourcing information directly from regulators, legal firms, consultancies, and other authoritative sources to improve the regulatory change management process. Leveraging cognitive technology processing can enhance the efficiency of capturing and interpreting regulatory updates.

4.Streamlining Workflow and Task Management

The backbone of an effective RCM process is a robust system for managing workflows and tasks. This system should facilitate the intake of regulatory changes, route them to the appropriate SMEs, and involve relevant stakeholders in the review and response process. Standardized workflows, task management, and escalation mechanisms ensure that tasks are completed promptly and efficiently, maintaining accountability and transparency.

5.Enhancing Metrics, Dashboarding, and Reporting

Organizations need comprehensive metrics, dashboards, and reporting capabilities to effectively monitor the regulatory change management process. Effective regulatory change management solutions provide insights into the regulatory landscape, showcasing recent changes, the status of reviews, and the overall impact on the organization. By tracking these metrics, organizations can gauge the effectiveness of their RCM process, identify areas for improvement, and ensure that they remain compliant with all relevant regulations.

Advantages of a Regulatory Change Process

Organizations that cultivate a sophisticated RCM process stand to gain significantly across various dimensions of their operations. Let’s explore the multifaceted benefits that a streamlined RCM process brings to the table.

Elevating Organizational Effectiveness

Enhanced organizational effectiveness is a major advantage of a refined regulatory change management process. This encompasses:

- Comprehensive Regulatory Insight: Achieves a deeper understanding of evolving regulatory landscapes and their implications on the organization.

- Proactive Compliance Posture: Enables the organization to anticipate, interpret, and navigate regulatory changes efficiently, ensuring ongoing compliance and demonstrating a commitment to regulatory excellence.

Boosting Operational Efficiency

Efficiency is the lifeblood of any thriving organization. A robust RCM process contributes to:

- Resource Optimization: Streamlines the use of human and financial resources, ensuring that regulatory changes are managed without unnecessary expenditure or waste.

- Sustainable Resource Management: Facilitates a balanced resource allocation that supports current compliance needs and future regulatory evolutions.

Cultivating Organizational Agility

In today’s fast-paced business world, agility is a critical competitive differentiator. An effective regulatory change management process empowers organizations with:

- Dynamic Adaptability: Fosters a culture that embraces change, allowing the organization to pivot and adapt swiftly to new regulatory demands.

- Strategic Competitive Advantage: Equips the organization with the foresight and flexibility to navigate regulatory changes more effectively than competitors, turning potential challenges into strategic opportunities.

Integrate RCM Software to Modernize Your Process

Integrating advanced Regulatory Change Management Software like Predict360 RCM software can transform the traditional RCM process into a streamlined, efficient, and proactive operation. Predict360 platform offers comprehensive features to enhance every facet of the regulatory change management process. It provides financial organizations with the latest regulatory intelligence, updates, and news, all consolidated on a single platform. This integration ensures that businesses are always in sync with the latest regulatory changes, enabling them to respond swiftly and effectively. Key features of the Predict360 RCM tool are outlined here:

Intelligent Regulatory Tracking: Predict360 RCM software streamlines the tracking of regulatory changes by providing automated updates and notifications. This ensures that businesses are always aware of the latest regulatory developments, enabling them to stay ahead of compliance requirements.

Automated Impact Assessments: This software automates the preliminary assessment of regulatory changes, identifying the business units affected and mapping out the potential impacts based on risk assessments. This feature is vital to enhance the regulatory change management process.

Comprehensive Management Tools: Predict360 RCM tool offers project plans that track and manage multiple tasks simultaneously. It integrates regulatory intelligence feeds for a holistic view of compliance activities, aiding in the efficient management of regulatory examinations and findings.

Streamlined Communication: The software makes it easy to keep relevant stakeholders informed about audits, policies, rules, and documents affected by regulatory changes, ensuring that all parts of the organization are aligned and responsive.

Executive Oversight: The executive dashboard within Predict360 regulatory management software provides a panoramic view of regulatory issues across the organization. It enables top-level management to make informed decisions and prioritize actions based on recent regulatory mandates and compliance data, enhancing the efficiency of the regulatory change management process.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.