Home/ Blog / How Proactive Risk Management Strengthens Financial Oversight and Resilience

The risk landscape is revolutionizing, driven by regulatory scrutiny, emerging financial risks, and increasing operational complexities. Financial institutions are expected to adopt proactive risk management strategies to safeguard financial stability, ensure compliance, and protect consumers from misconduct. Regulators now demand greater transparency in financial transactions, stronger fraud prevention mechanisms, and stricter compliance measures to combat economic crime and identify fraud and cybersecurity risks.

As financial networks become more interconnected, risk exposures become complex, making traditional risk management approaches inadequate. Organizations must shift toward a technology-driven risk management system that enables real-time data traceability, automated transaction monitoring, and AI-powered risk detection. Modern risk management solutions leverage predictive analytics and machine learning to enhance risk visibility, improve decision-making, and prevent regulatory breaches before they occur.

Strengthening Financial Crime and Conduct Risk Oversight

Financial institutions must adapt quickly as regulatory expectations for financial crime and conduct risk oversight grow stricter. Proactive risk management focused on data traceability, automated monitoring, and AI-driven risk detection is now essential. Here’s how organizations can stay ahead:

Enhancing Data Traceability for Regulatory Compliance

Data traceability has become a critical regulatory focus, requiring financial institutions to have end-to-end visibility at the transactional and customer level, as well as business systems and processes. This can be too resource-intensive for personnel, but an AI-powered risk management framework can ensure compliance with evolving regulations.

By implementing audit trails and data lineage tracking, institutions can proactively identify discrepancies, enhance reporting accuracy, and meet regulatory expectations for data transparency.

Automating Transaction Monitoring and Surveillance

Traditional transaction monitoring processes often rely on manual reviews, which can be inefficient and prone to oversight. By automating risk assessments and transaction surveillance, financial institutions can strengthen their oversight mechanisms and detect suspicious activities more effectively.

AI-driven transaction monitoring systems can analyze patterns and anomalies across vast datasets, enabling firms to mitigate risks such as fraud, market manipulation, and regulatory violations.

Strengthening Risk Detection and Compliance Culture

Beyond technology, fostering a risk-aware culture is essential for proactive risk management. Advanced risk intelligence platforms support this by providing risk and compliance managers with automated alerts, predictive analytics, and compliance dashboards that empower organizations to take timely action.

By embedding ethical accountability and regulatory best practices into risk management frameworks, firms can build trust, ensure compliance, and strengthen governance.

Key Actions to Improve Risk Management Systems

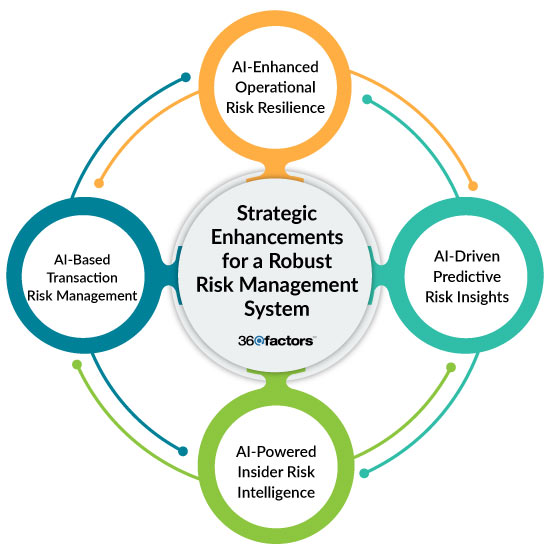

As financial institutions face growing regulatory scrutiny and evolving risk landscapes, enhancing risk management systems has become a strategic priority. Organizations must implement the following key actions to enhance risk management systems:

Building Operational Resilience with AI-Augmented Risk Management

AI-powered risk management solutions ensure financial institutions manage operating and regulatory risks carefully. AI-enabled systems streamline workflows, enhance audit trails, and enforce real-time security policies, reducing vulnerabilities and improving organizational resilience.

These tools can also help assess the efficacy of cybersecurity tools and controls, providing a bigger picture of cybersecurity posture for the top leadership. By embedding cyber resilience within risk management frameworks, institutions can safeguard critical infrastructure, protect customer data, and maintain operational integrity.

Detecting Risks with AI-Powered Predictive Analytics

Traditional risk detection methods rely on historical data, limiting their ability for proactive risk management. AI-powered predictive analytics leverages vast datasets to highlight patterns and forecast risks, making it easier to mitigate potential risks before they materialize.

Machine learning models show great potential in enhancing risk assessment and response mechanisms, ensuring institutions can detect and respond to unusual financial activities. These models can learn from evolving risk trends, making risk management more adaptive, intelligent, and precise. By integrating predictive analytics, financial institutions can strengthen transaction monitoring and risk governance in a more efficient and scalable manner.

Managing Insider Risk with AI Analytics

Insider risks remain a significant concern for financial institutions, as they often stem from employees, contractors, or third-party partners with authorized access to sensitive data. AI-powered risk analytics tools can raise alerts on suspicious user activities, unauthorized access, and potential misconduct, helping institutions identify risks quickly.

An effective risk management software solution can automate risk detection, allowing institutions to proactively prevent data leaks, financial fraud, and regulatory breaches. By continuously monitoring insider activities, AI-driven analytics strengthen internal controls, enforce compliance policies, and minimize operational disruptions.

Mitigating Identity and Transaction Risks with AI-Driven Risk Models

The rise of identity fraud and transaction-based financial crimes necessitates implementing robust verification systems for enhanced risk management. Verification systems use advanced biometric authentication, anomaly detection, and behavioral analysis to verify customer identities and reduce the risk of unauthorized transactions.

Continuous identity and transaction monitoring can strengthen fraud prevention mechanisms by flagging suspicious activities in real time. AI-powered identity verification solutions also ensure compliance with regulations and build trust with key stakeholders.

Choose the Right AI-Powered Risk Management Software for Financial Resilience

As financial institutions navigate an increasingly complex risk landscape, proactive risk management is no longer optional; it is essential for long-term stability and regulatory compliance. AI-driven risk management strategies, such as automated risk detection, predictive analytics, insider risk monitoring, and transaction security, have become critical in mitigating risks. However, financial institutions need a centralized, intelligent risk management software solution that provides real-time oversight and actionable insights to achieve true enterprise-wide risk resilience.

This is where Predict360 Enterprise Risk Management Software plays a transformative role. Predict360 ERM solution is an AI-powered, cloud-based risk management software that provides end-to-end risk visibility, real-time monitoring, and predictive risk intelligence. By integrating AI and automated workflows, Predict360 ERM software enables financial institutions to systematically identify, assess, and mitigate risks across all business functions. It consolidates all enterprise risks onto a single, customizable dashboard, ensuring that new risks are instantly reflected in risk metrics and are visible to all authorized stakeholders. This enhanced transparency strengthens risk governance and ensures proactive decision-making.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.