Home/ Blog / Overcoming Diminishing Returns in Risk and Compliance Management

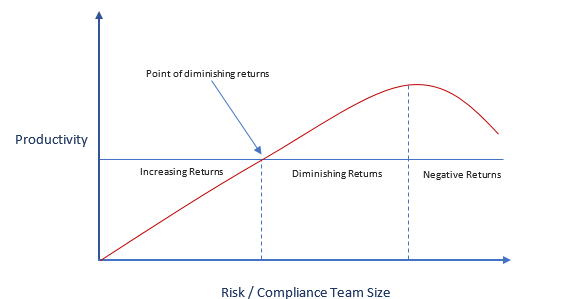

The law of diminishing returns is a concept which states that after a certain point in time, adding resources no longer yields an abundant return, and only gives marginal value. This law is certainly true in the world of risk and compliance management.

Financial organizations that try to improve compliance levels and conduct risk mitigation by increasing risk and compliance personnel may end up realizing that the improvement they see at first is not justified by the overall, long-term results.

The Law of Diminishing Returns for Risk and Compliance Productivity

In the risk and compliance management context, the law of diminishing returns means that adding team members to risk and compliance departments, without changing other factors, will increase productivity proportionally up to a point, after which each member added will deliver a lower bump in productivity.

Overcoming Diminishing Returns

The law of diminishing returns is not meant to be a defeatist approach that proclaims that there is no way to increase productivity. Instead, it is a law that demonstrates that only focusing on one factor and increasing it is not the key to unlocking better frameworks.

The smarter approach for financial organizations is to focus on other factors as well. GRC solutions provide an interface and a forum that allows employees across the organization to collaborate on making risk mitigation and compliance management improvements on multiple levels.

The Impact of Technology on Risk and Compliance Productivity

Looking at how other industries and domains have dealt with this problem of diminishing returns, it becomes apparent that technology is the factor that has the most influence on streamlining resources in the financial landscape.

The banking industry is a great example of how technology has helped organizations achieve higher productivity levels. Now, a single bank employee with a computer can accomplish more than a team used to be able to accomplish a few decades ago.

Risk and compliance technology brings similar improvements and benefits to risk and compliance management teams. GRC (governance, risk, and compliance) solutions improve productivity by introducing:

- Robotic Process Automation

- Streamlined Workflows

- Activity Monitoring

- Collaboration Frameworks

- Real-time Analysis

Robotic Process Automation

Many risk and compliance processes are completely automated with GRC technology. The automation of monitoring as well as report generation processes frees up the employees and allows them to focus on the big picture.

Instead of doing menial tasks manually, the teams can focus on creating new strategies and implementing changes that help the organization achieve its vision.

Streamlined Workflows

Many risk and compliance processes cannot be automated because they need the inputs and insights of experienced and skilled employees. GRC solutions streamline the workflows, providing interfaces and features which allow these tasks to be more visible and easier to manage.

Activity Monitoring

GRC solutions allow management to monitor all risk and compliance activities that are on-going, scheduled, or have been completed throughout the organization. Instead of having to wait for a report to be generated, they can get a top-level view of each department, and drill down to get more information about a specific activity.

Collaboration Frameworks

GRC solutions provide an interface and a forum that allows employees across the organization to collaborate on making risk mitigation and compliance management improvement. By including all stakeholders, and not just the risk and compliance departments, these frameworks ensure that every facet of risk and compliance is being managed and considered.

Real-Time Analysis

GRC solutions centralize risk and compliance data and provide real-time analysis of this data. If a risk goes up, it is instantly detected, and a notification is sent out to the risk management department.

Similarly, if there is a compliance violation, it is instantly detected, and the relevant stakeholders are notified. Management has a dashboard which shows a real-time analysis of risk, compliance, and other KPIs.

Adopting an Effective Risk Management Solution

Before integrating new technology into your organization, consider these key guiding principals for choosing AI-driven GRC platforms:

| Guiding Principle | What Good Looks Like (Questions to Ask) | AI-Specific Considerations |

|---|---|---|

| Business fit | Does it cover your key use cases without heavy custom dev? | AI models can be configured to your risk taxonomy, frameworks, and industry rather than “one-size-fits‑all” |

| Real-time insight | Does it provide dashboards, KRIs, and workflows that support decision-making? | Delivers real-time alerts, continuous control monitoring, and predictive risk scoring instead of static reports |

| Automation | Can it automate evidence collection, assessments, approvals, and remediation tasks? | Reduces manual work (e.g., auto-mapping controls, validating evidence, drafting policies) with measurable time savings |

| Data integration | Does it integrate cleanly with core systems for a single risk view? | Clear data governance model for AI (sources, lineage, quality, logging) and support for secure API-based data feeds |

| Accuracy and control | Can users understand why the system produced a score, suggestion and is there an audit trail? | Transparent (explanations, confidence scores), tuneable, and monitored for drift, bias, and false positives/negatives |

| Usability | Is the UX intuitive for non-technical risk owners? | Appear inside familiar workflows |

| Security, compliance & regional needs | Does the platform meet your security, residency, and regulatory requirements? | Secured (data isolation, encryption, access controls) |

Interested in finding more about how risk and compliance technology can help your organization’s productivity levels? Get in touch with our team to request a demo of Predict360, our GRC solution.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.