Home/ Blog / The New Era of AI in Financial Services: Revolutionizing Productivity and Client Experiences

Artificial intelligence in financial services has undergone noticeable growth due to the modernization of conventional methods. This technology brings efficiency, improves client experiences, and provides in-depth analytics. It marks a remarkable shift from traditional operational practices to innovative solutions, making it significant for financial enterprises to integrate and adapt into operations.

The Evolution of AI in Financial Services

From Algorithmic Trading to Cognitive AI

Algorithm trading began the AI in financial services journey decades ago, transforming trading procedures by automating recurring tasks and implementing trades at speeds beyond human capacity. Algorithm-based trading noticeably enhanced accuracy and efficiency for traders, enabling financial enterprises to capitalize on market growth with greater precision. Advanced AI systems have led to the establishment of cognitive AI, which is far ahead of the automation that we witnessed previously. Cognitive AI systems are developed to learn, understand, and interact like humans. They can analyze enormous datasets, identify patterns, and create insights that improve decision-making ability.

Data to Actionable Insights

Conventional data analysis methodologies are quite slow and time-consuming, resulting in missed opportunities and ineffective decision-making procedures. Currently, AI in financial services has the strength to revolutionize vast raw data into actionable insights, enabling financial enterprises to maximize the potential of their data assets through quicker analysis and decision-making.

Artificial Intelligence in Finance helps you get the most benefits from large data sets. They can process enormous data instantly, recognizing trends, correlations, and anomalies that may not be visible via traditional analysis. Such insights strengthen financial institutions’ ability to make more informed decisions, identify new business opportunities, and manage risk effectively.

Generative AI: A Game Changer

Generative AI has made a significant leap forward in the artificial intelligence landscape. Unlike conventional uses of AI in financial services, which mainly focus on data analysis and forecasting based on the available data, generative AI can create new content, including images, text, and even complicated financial models. Primarily, generative AI uses advanced algorithms and in-depth learning tactics to understand and duplicate the underlying data structures it processes.

One of the most potent aspects of generative AI is its dual ability to create and predict. In financial services, this translates into several practical applications that can transform how institutions operate and make decisions. It can automate the creation of financial reports, investment analyses, and market commentary. Generative AI in financial services can produce comprehensive reports that require significant human effort by ingesting raw data, such as financial statements, market news, and historical performance metrics. Generative AI’s predictive capabilities are valuable in forecasting market trends and identifying emerging opportunities. This technology can generate accurate predictions about future market movements by analyzing historical data and current market indicators.

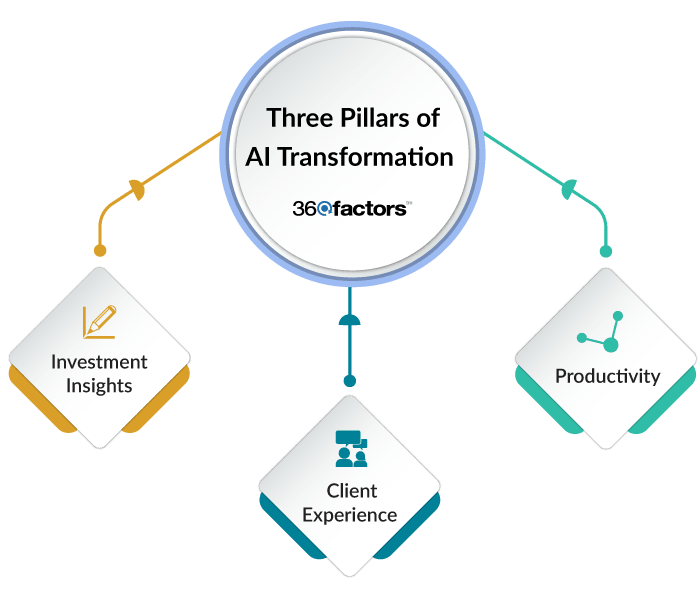

Three Pillars of AI Transformation

The integration of artificial intelligence in financial services is reshaping the industry across multiple dimensions. The transformation is centered around three main pillars:

Productivity

AI technologies substantially enhance productivity for businesses by automating routine tasks and optimizing processes. This automation reduces the time and effort required for manual tasks, allowing financial professionals to focus on more strategic activities.

Examples of AI in financial services are chatbots and virtual assistants. These AI tools can handle customer inquiries, process transactions, and provide account information, reducing the workload on human staff. Robotic Process Automation (RPA) can streamline back-office operations such as data entry, compliance checks, and reporting, ensuring accuracy and efficiency.

Fraud Recognition: AI systems can continuously monitor transactions for unusual patterns, flagging potential fraud in real-time.

Loan Management: AI algorithms can assess loan applications quickly by analyzing credit scores, financial history, and other relevant data.

Regulatory Compliance: AI tools are also automating the tracking and reporting of regulatory requirements, ensuring financial institutions remain compliant with the latest regulations without requiring extensive manual oversight.

Client Experience

AI in financial services improves client interactions by offering customized and timely services. AI systems can understand customer preferences and behaviors through advanced data analytics, allowing financial institutions to tailor their offerings and communication accordingly.

For example, AI-driven platforms can provide personalized investment advice based on an individual’s financial goals, risk tolerance, and market conditions. AI in finance can also predict when a customer might need a particular financial product, enabling proactive marketing engagement. Some noteworthy AI applications include:

Tailored Banking: A bank can consider implementing an AI-driven recommendation system that analyzes customer transactions and financial goals to suggest relevant products and services. Such moves to implement AI in financial services can lead to increased customer satisfaction and higher product uptake.

Wealth Management: An investment firm may consider using AI to develop personalized investment strategies for clients, based on their unique financial situations and preferences. This customized approach will result in enhanced client trust and loyalty.

Investment Insights

AI can provide vital investment insights by analyzing vast amounts of data and identifying patterns that may not be immediately apparent to humans. This enables financial analysts to make more informed decisions, improving investment outcomes.

For example, AI can analyze market conditions from news articles, social media, and financial reports, providing a comprehensive view of market conditions and potential investment opportunities. The application of AI in financial services through predictive analytics tools helps investors anticipate market movements and trends. By leveraging historical data and current market indicators, these tools can forecast future price movements, asset performance, and economic conditions.

Implementing AI Strategies

Here’s a step-by-step guide on how to effectively implement AI in your organization.

Develop a Strategic Approach

Simple Beginnings

Artificial intelligence in finance is vital for successful implementation. Financial institutions should begin by identifying specific business needs that AI can address, such as improving customer service or enhancing fraud detection. By focusing on manageable projects, organizations can gradually build their AI capabilities and scale up as they gain experience and confidence.

Integrated Technologies

Integrating AI in financial services with emerging technologies, such as blockchain and cloud computing, is essential for creating a cohesive technological ecosystem. This holistic approach ensures that AI applications are fully optimized and seamlessly interact with other digital tools and platforms.

Practical Steps

Assessment and Planning

Conduct initial assessments to identify areas where AI can add value. Develop a detailed plan outlining the goals, required resources, and implementation timelines. This plan should include key performance indicators (KPIs) to measure the success of AI initiatives.

Pilot Programs

Initiate pilot programs to test AI applications in a controlled environment before deploying them to live operations. These pilot programs allow organizations to refine the use of AI in financial services models, address technical challenges, and assess the real-world impact of AI solutions. Insights gained from pilot programs can guide full-scale implementation.

Continuous Improvement

Continuously evaluate and refine strategies for AI in finance to adapt to the evolving financial landscape. Stay updated with the latest AI advancements and incorporate them into your organization’s AI roadmap. Regularly review AI applications to ensure they deliver the expected benefits.

Conclusion

AI in financial services has advanced significantly, ushering in a new era of improved productivity and fostering client experiences and in-depth investment insights. By revolutionizing conventional methods with advanced AI technologies, financial enterprises can automate repetitive tasks, customize client interactions, and identify complicated investment opportunities. The significant power of AI in financial services lies in its capability to provide customized client experiences, streamline operations, and deliver relevant investment insights.

Financial institutions must also focus on continuous improvement and adaptation to navigate this evolving landscape. Regularly updating AI strategies and staying informed about the latest advancements is crucial for maintaining a competitive edge. In this context, Predict360 AI-based Risk and Compliance Intelligence software stands out as an effective solution for managing the complexities of AI in finance. This advanced platform leverages AI in financial services to automate repetitive tasks such as data collection, analysis, and reporting, freeing up valuable resources and enhancing operational efficiency.

Predict360 Risk and Compliance Management solution streamlines workflows across various departments, ensuring that all functions within a financial institution are aligned and operate seamlessly. With real-time monitoring of regulatory changes, compliance status, and risk indicators, financial institutions can proactively address potential issues or violations, thereby maintaining robust compliance.

Moreover, the Predict360 Risk and Compliance Management application enables more accurate identification and evaluation of risks. The platform facilitates better decision-making and resource allocation by prioritizing risks based on severity and likelihood through the power of AI in financial services.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.