Home/ Blog / AI in Finance: Strategic Approaches to Modern Compliance Management

Artificial Intelligence (AI) is no longer just a theoretical concept in financial services. It has become a practical tool for transforming compliance management. Just as blockchain technology revolutionized financial transactions, AI in finance is now reshaping compliance strategies, allowing financial institutions to automate processes, enhance governance, and improve risk management.

The compliance function has traditionally been risk-averse, prioritizing regulatory adherence over operational efficiency. However, with increasing regulatory scrutiny and the growing complexity of compliance requirements, financial institutions can no longer afford to rely solely on manual processes. AI bridges the gap, enabling compliance teams to streamline operations, reduce false positives, and proactively manage compliance.

As the adoption of AI in finance accelerates, compliance leaders must navigate challenges such as data privacy, AI explainability, and cybersecurity risks while ensuring regulatory alignment. Global regulatory bodies are developing frameworks to govern the use of Generative AI In financial services, reinforcing the need for responsible AI deployment.

This blog explores AI’s transformative role in compliance, key regulatory considerations, and strategic actions compliance leaders should take to harness AI’s full potential.

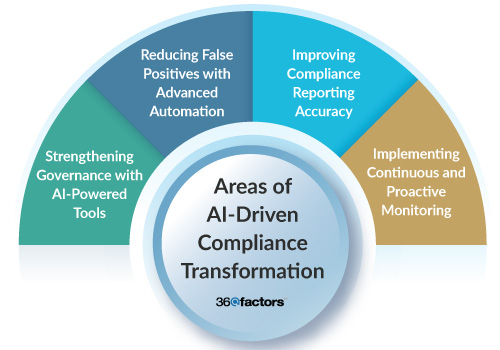

AI-Driven Compliance Transformation

AI in finance is modernizing compliance management by automating routine tasks, enhancing governance frameworks, and improving the accuracy of risk assessments. Let’s discover the key areas where AI is playing its major role in compliance transformation:

Governance Enhancements

Governance plays a crucial role in regulatory compliance, ensuring that financial institutions adhere to industry standards. AI-powered compliance tools strengthen governance frameworks by automating regulatory tracking and policy management. AI-driven natural language processing (NLP) models can scan thousands of regulatory sources, identify key updates, and generate summaries for compliance teams, helping them stay abreast of regulatory changes.

Additionally, AI in finance can assist in drafting policy documents based on regulatory updates, providing compliance teams with a structured starting point that can be refined by human oversight. This reduces the time and effort needed for regulatory mapping and policy updates, ensuring organizations remain aligned with evolving compliance requirements.

False Positive Resolution

A persistent challenge in compliance is the high number of false positives generated by traditional monitoring systems. Transaction monitoring, adverse media screening, and sanctions screening often produce excessive alerts, requiring manual investigation and increasing operational costs. Generative AI In financial services significantly improves false positive resolution by leveraging machine learning algorithms to refine detection logic.

AI in finance can filter out low-risk alerts while prioritizing high-risk cases by analyzing multiple data points such as customer history, transaction patterns, and behavioral indicators. For example, rather than flagging thousands of transactions based on generic name-matching, AI can incorporate contextual details like age, address, and employment history to narrow down alerts to only the most relevant ones. This not only reduces manual review workloads but also enhances the accuracy of risk detection.

Improved Reporting

AI is transforming compliance reporting by automating the generation of regulatory submissions, suspicious activity reports (SARs), and internal audit documentation. Traditionally, compliance teams spend significant time collecting data, analyzing transactions, and drafting reports. AI accelerates this process by extracting insights from structured and unstructured data, identifying key risk factors, and generating reports with contextual analysis.

Financial institutions can leverage AI in finance to ensure timely and accurate reporting while reducing compliance costs. AI also enhances regulatory submissions by maintaining a standardized reporting format, ensuring consistency, and minimizing errors.

Ongoing Monitoring

The traditional approach to compliance monitoring often relies on periodic reviews, leaving financial institutions vulnerable to undetected risks between assessment cycles. AI enables continuous and proactive monitoring by analyzing real-time transaction data, behavioral trends, and external threat intelligence.

Advanced models of generative AI in financial services can identify suspicious activities by detecting anomalies, analyzing customer profiles, and correlating multiple data sources to uncover regulatory violations. This proactive monitoring approach enhances financial crime detection, minimizes compliance gaps, and strengthens an institution’s overall risk management framework.

Regulatory Perspectives

As the implementation of AI in finance for compliance accelerates, regulatory bodies worldwide grapple with the need to establish governance frameworks that ensure fairness, transparency, and security.

AI Bias

AI systems are only as good as the data they are trained on. If AI models are built using biased or incomplete datasets, they may produce discriminatory or unfair outcomes, potentially violating regulatory requirements such as anti-discrimination laws.

Reinforcement learning techniques, where human feedback refines AI decision-making, can unintentionally introduce biases if not properly managed. Regulators increasingly focus on AI bias to ensure financial institutions do not inadvertently disadvantage certain customer groups. Organizations must implement rigorous model validation, fairness testing, and ethical AI principles to mitigate bias risks.

Explainability

One of the major regulatory challenges with AI in finance compliance is explainability, as well as understanding and justifying AI-generated decisions. Traditional compliance processes require clear documentation and audit trails, yet AI models, particularly deep learning systems, operate using complex algorithms that are difficult to interpret.

Regulators are expected to mandate minimum transparency standards, requiring financial institutions to provide clear rationales for AI-generated decisions. Compliance teams must ensure AI models are designed with explainability in mind, using techniques such as model documentation, feature attribution, and interpretable AI frameworks.

Data Management

AI’s effectiveness in compliance depends on the quality, security, and governance of customer data. Regulators worldwide are tightening data privacy laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), to protect consumer information.

When adopting AI in finance, businesses must ensure that their compliance systems align with evolving data protection requirements, including proper data handling, encryption, and access controls. Enhancing data governance frameworks will be key to maintaining regulatory compliance while leveraging generative AI in financial services for risk management.

Cybersecurity Risks

As AI becomes integral to compliance, it also introduces new cybersecurity vulnerabilities. Cybercriminals can target AI models to manipulate decision-making, extract sensitive data, or conduct fraud.

Regulatory bodies are focusing on strengthening cybersecurity frameworks to address these risks, emphasizing AI security controls, threat detection mechanisms, and robust incident response strategies. Financial institutions must adopt AI-specific cybersecurity measures to safeguard compliance operations and prevent unauthorized exploitation of AI-driven systems.

Strategic Actions for Compliance Organizations

Financial institutions must adopt a forward-thinking approach to successfully integrate generative AI in financial services. By taking strategic actions, they can enhance regulatory adherence and operational efficiency.

Challenge Traditional Models

Historically, financial organizations have taken a risk-averse approach to technological advancements, relying on manual processes and rigid frameworks. While this approach minimizes regulatory scrutiny, it often leads to inefficiencies, high operational costs, and backlogs in compliance workflows.

AI in finance presents an opportunity to modernize these legacy models. Financial institutions should conduct a top-down and bottom-up assessment of their compliance frameworks to identify areas where AI can drive automation, reduce errors, and enhance decision-making. Organizations must strike a balance between regulatory requirements and operational efficiency by designing a future-state compliance model that aligns with AI capabilities.

Customer Data Focus

AI-driven compliance solutions rely on high-quality, well-governed customer data to generate accurate risk assessments and decision outputs. However, many financial institutions struggle with fragmented or outdated data systems. To unlock AI’s full potential, compliance teams must prioritize data standardization, quality improvement, and governance enhancements.

Investing in data remediation efforts will yield long-term benefits, such as better fraud detection, more precise transaction monitoring, and improved regulatory reporting. Institutions should also ensure that models of AI in finance comply with evolving data privacy laws, such as GDPR and CCPA, to maintain customer trust and regulatory alignment.

Focus on Augmentation

A common concern surrounding AI adoption is the fear of workforce displacement. However, AI should be seen as an augmentative tool rather than a replacement for human expertise.

AI excels at automating repetitive compliance tasks such as regulatory tracking, false positive resolution, and report generation, allowing compliance professionals to focus on complex risk assessments, investigations, and strategic decision-making. Organizations should prioritize AI in finance implementations that enhance, instead of replacing, human-led compliance functions.

Implement AI Compliance Software for Improved Operations

As financial institutions embrace AI-driven compliance strategies, implementing an advanced compliance management platform is essential to maximize efficiency, reduce costs, and ensure regulatory adherence. While AI can automate processes and enhance decision-making, organizations need an integrated system to manage compliance workflows effectively.

Predict360 Compliance Management Software offers a comprehensive, AI-powered solution designed to streamline compliance processes, reduce manual workload, and improve risk visibility. It helps organizations transition from reactive compliance management to a proactive, intelligence-driven approach.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.