Home/ Blog / Managing Static Reporting Requirements with a Dynamic Regulatory Change Management Process

In the current financial environment, regulatory compliance stands as a foundation stone. As organizations navigate their ways, they are continuously challenged to adjust to changing regulations. The regulatory change management process is pivotal to this adaptation, bridging the gap between regulatory changes’ fluidity and static reporting requirements. This blog will delve into the intricacies of managing such changes and highlight the tools that can smoothen the significant process.

Steps to Meet the Growing Need for RCM Reporting

Regulatory change management ensures financial organizations remain agile and compliant in the rapidly evolving regulatory environment. The requirement for regulatory reporting has seen a substantial uptick, needing a more proactive and comprehensive approach. Here’s a deep dive into the steps organizations can take to sustain the expanding need for RCM reporting:

Adopt the New Data Environment

A robust increase in the demand of data-based reporting characterizes the existing regulatory change management process model. With the intricacy of data needs for regulatory reporting on the rise, institutions now face frequent informational guidance concerning data definitions. This shift needs a broader perspective on regulatory changes, moving beyond traditional sources like written statements and regulator websites.

Expand Stakeholder Involvement

The days when corporate finance or regulatory reporting could independently manage the RCM are long gone. Today, data sourcing crosses across the banking organization, demanding shared ownership. Business lines, risk, legal, and compliance functions must now actively participate in planning, monitoring, and implementing policy changes in the overall regulatory change management process. Leveraging Regulatory Change Management Software can facilitate this collaborative approach, ensuring all stakeholders are on the same page.

Remain Updated with Multiple Information Sources

Organizations must be vigilant to stay up to date with regulatory changes. Information about reporting needs comes from various sources, including interpretations, supervisory expectations, and the report clearance procedure. Moreover, requirements are often surrounded in the rule-making process. This calls for a detailed analysis of these rules, specifically for reporting implications. Institutions must also keep an eye on international agreements, tracking activities and recommendations of global regulatory bodies. The right bank compliance software can foster tracking for this regulatory change management process, ensuring that no necessary update goes unnoticed.

Analyze and Adapt

The rising number of sources for modifications to reporting requirements represents new challenges. Organizations must be adept at tracking new and revised data needs. This involves recognizing the regulatory changes and understanding their effect on the institution. Inquiries like “Is the data available?”, “How will these needs impact the firm?” and “Are new internal controls required?” gain utmost importance. Regulatory Change Management Software can improve this analysis phase, offering insights and assisting a smoother transition.

Engage with Policymakers

Collaboration with regulators and policymakers during the regulatory change management process is crucial. A conversation with policymakers ensures that data conditions are practical and implementation dates are realistic. Institutions should actively work with industry groups, advocate the industry view, and engage in one-on-one interactions with policymakers. This proactive approach allows institutions to influence requirements and ensures they are always ahead in the regulatory change management journey.

Internal Changes Matter

Organizations need to be careful of not just external regulatory modifications. Internal changes, such as technology implementations, data quality developments, and legal entity changes, can directly impact regulatory reporting. A successful regulatory change management process should account for these internal shifts, guaranteeing that all stakeholders are aligned and that the company remains compliant.

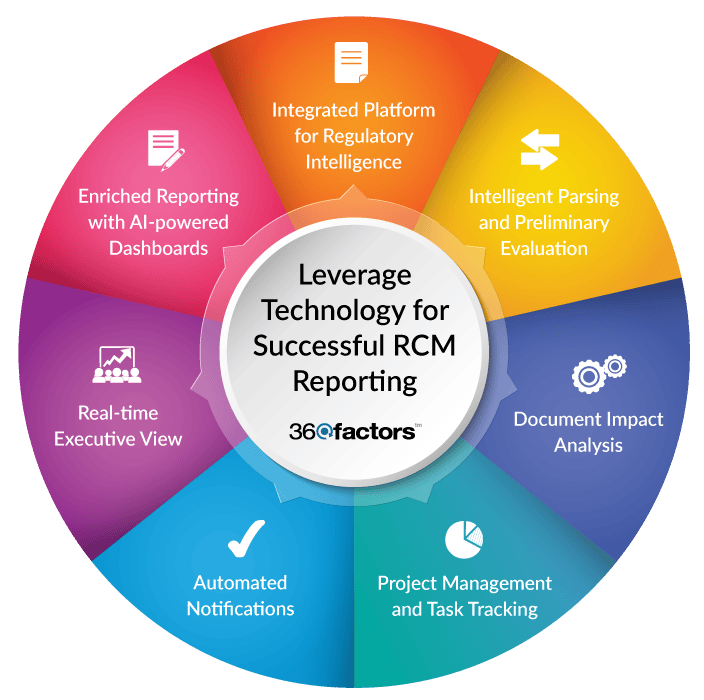

Leverage Advanced Technology for Successful RCM Reporting Procedures

Financial organizations need advanced solutions to stay abreast of the dynamic regulatory compliance environment. Predict360 Regulatory Change Management Software, for instance, offers features to streamline and enhance the regulatory change management process.

Integrated Platform for Regulatory Intelligence

Predict360 RCM combines regulatory intelligence, updates, and news from various external sources into a single feed. This ensures that organizations are continuously updated with the latest regulatory changes without filtering through multiple sources.

Intelligent Parsing and Preliminary Evaluation

The software smartly parses regulatory updates to emphasize changes and determine their applicability, enhancing the regulatory change management process. It also provides an automated preliminary assessment of the impact of these changes, identifying the business units that might be affected based on risk mapping.

Document Impact Analysis

Predict360 RCM analyzes artifacts within the organization that regulatory changes, such as policy and procedure documents, might impact. This ensures that all relevant documents are updated as per the latest requirements.

Project Management and Task Tracking

The software offers project plans that track and manage multiple simultaneous tasks. It integrates regulatory intelligence feeds and offers regulatory examinations and findings, ensuring that all regulatory change management tasks are handled efficiently.

Automated Notifications

Stakeholders are automatically notified about all related audits, policies, rules, and documents affected by changes. This ensures that everyone involved in the regulatory change management process is on the same page and can take timely action.

Real-time Executive View

Predict360 RCM provides a real-time executive view of regulatory issues across the organization. Augmented by Business Intelligence tools, this allows top management to have a bird’s eye view of the entire regulatory change management landscape and make informed decisions.

Enhanced Reporting with AI-Powered Dashboards

Predict360 RCM ensures that regulatory change management activities are efficiently managed by providing visually detailed dashboards and automated reporting. These intuitive reports allow managers to quickly drill down for more details about activities and open issues.

Conclusion

The financial environment is continuously changing with new rules, and regulatory changes demanding swift action. As we have discovered, the regulatory change management process is no longer a static endeavor but a versatile one that needs agility, insight, and the appropriate tools. Organizations should implement advanced change management software that identifies constant and on-demand reporting requirements from broader regulatory initiatives.

Institutions must embrace a proactive approach, widening stakeholder involvement and leveraging Predict360 Regulatory Change Management Software to navigate the complexities of compliance. Predict360 RCM, with its AI-powered features, is considered a beacon for institutions, offering a unified platform that streamlines the regulatory change management process and ensures timely compliance.

Moreover, the challenges from the ever-increasing sources of regulatory changes necessitate a holistic approach that encompasses both external and internal changes. By integrating solutions like Predict360 Regulatory Change Management, financial institutions can monitor and adapt to external regulatory changes and ensure that their internal processes, policies, and controls align with them.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.