Home/ Blog / Impact of Section CFPB 1071 and Financial Institutions’ Compliance Concerns

In today’s competitive age, where fairness, transparency, and inclusivity are paramount, the financial sector is constantly reforming to fulfill challenging demands. One of the most recent noticeable regulatory challenges is the implementation of Section 1071 of the Dodd-Frank act. This pioneering legislation has incredible implications for financial enterprises, specifically when it comes to small business lending.

CFPB 1071 entails collecting and reporting data associated with credit applications for women-owned, small, and minority-owned businesses. Undoubtedly, compliance difficulties exist as unique challenges for financial institutions to implement this legislation, but the intentions behind this Regulation are noble.

In this blog, we will walk through the evolution of section 1071, discovering its background, the final rule and compliance challenges for financial enterprises, and how incredible solutions can empower businesses to navigate these new hardships.

Background of 1071 Section

The Dodd-Frank Wall Street Reform and Consumer Protection Act presented a significant change to the financial environment with the introduction of section CFPB 1071 in 2010. This section has updated the Equal Credit Opportunity Act (ECOA), demanding that financial enterprises collect and report specific data regarding credit applications for minority-owned, woman-owned, and small businesses.

Financial enterprises must collect, and report data points demanded by section 1071, associated with the purpose for requesting credit, type, applicants’ business, and ownership demographics. The rule broadly explains the responsibilities of a financial institution and connects it to the “covered financial institution” that fulfills criteria, including at least 100 covered credit transactions for small businesses in the prior two calendar years.

According to this CFPB 1071 rule, the small business, as per the small business act and Regulations, refers to a business with a gross annual revenue of $5 million or less in its previous financial year. Congress intended the small business lending rule to make the nation’s first relentless and complete database associated with small businesses.

This will enable enforcement agencies to evaluate the possible areas for far-ending enforcement and allow stakeholders to detect business and community development demands better. Section 1071 also encourages using technology partners and industry consortia for authentic and cost-efficient data collection and reporting.

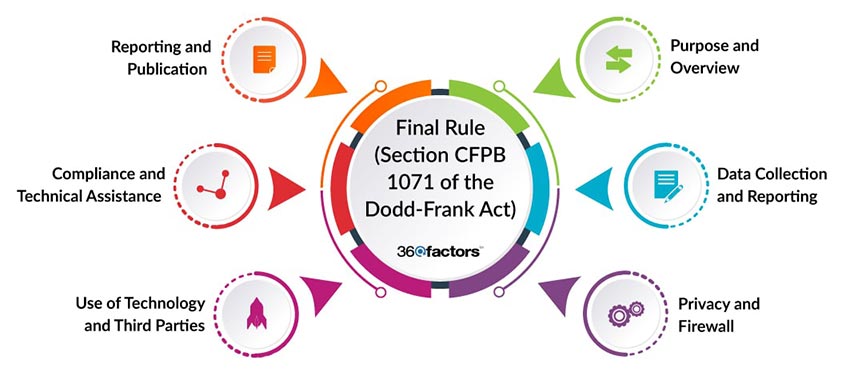

Final Rule (Section CFPB 1071 of the Dodd-Frank Act)

The Consumer Financial Protection Bureau (CFPB) had proposed changes to regulation B, executing reforms to the Equal Credit Opportunity Act (ECOA) as instructed by section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. These amendments aim to ensure that covered financial enterprises collect and report data on credit applications for small businesses, particularly those owned by minorities and women.

Let’s explore the changes in detail:

Purpose and Overview

The Dodd-Frank Act’s Section CFPB 1071 was created to support the enforcement of Fair lending laws and allow various stakeholders, including creditors, communities, and government entities, to detect minority-owned and women-owned small businesses’ needs and community development requirements.

Data Collection and Reporting

Financial institutions must collect data points as specified in CFPB compliance section 1071. This entails information regarding the type of application created, its purpose, and the amount applied for. It also includes other details regarding the applicant’s business, including annual revenue, the number of principal owners, and the years of operation within the industry. Furthermore, demographic data regarding their business ownership, including gender, ethnicity, and race, must be collected to adhere to CFPB 1071.

Privacy and Firewall

Specifically, collected data must be protected from underwriters and other essential personnel to safeguard the applicant’s privacy. This firewall ensures that demographic information remains confidential and is utilized mainly for the aims outlined in the Regulation.

Reporting and Publication

Financial enterprises must report the collected data to the CFPB annually. Then it will be made available to the public, guaranteeing changes and deletions to protect privacy concerns.

Compliance and Technical Assistance

The CFPB provides several resources to facilitate financial enterprises understanding and compliance with the latest rule of CFPB 1071. This involves a sample data collection form, a dedicated support program, and technical guidance for data submission.

Use of Technology and Third Parties

Financial enterprises can collaborate with third parties, such as industry consortia, to establish tools and services that facilitate data collection and reporting to implement CFPB regulations.

Compliance Concerns for Financial Institutions

The Consumer Finance Protection Bureau also believes that dealing with factoring as created under the rule could result in complaints, concerns, and inconsistencies associated with the existing Regulation B, which currently entails factoring as a purchase of accounts receivable that is not subjected to ECOA.

The Bureau asked for comments on the proposed legislation from community banks, credit unions, and trade associations. A few commenters opposed the proposed CFPB 1071 demand because it would impose noticeable costs on some lenders. One commenter recognized the costs as essential for making and sustaining policies and procedures, executing CFPB compliance rules constantly, and conducting regular training and audit compliance. The other commenters contributed that the proposal of section 1071 would need substantial reforms to its loan procedures, systems, and compliance protocols to execute.

Another commenter said that dependency on proxying, visual observation, or inference would impose significant cost and compliance concerns. A good range of commenters asserted that lenders may experience huge costs to train employees to make determinations while following CFPB 1071. One of them said that the training could be challenging for frontline employees currently trained for non-discrimination as ECOA and other laws prohibit the collection of racial and ethnic information. This would conflict with current training if employees are asked to collect such data to comply with section 1071.

A few commenters recommended that if public data expose proprietary commercial lender informational data, financial enterprises may be compelled to engage in anticompetitive attitudes, including price fixing. That would create or provide less favorable terms to borrowers because CFPB 1071 will homogenize the market and limit its capability to compete. According to one, compliance concerns caused by the release could result in restricted availability of products by financial institutions, as witnessed after the publication of HMDA and CRA data.

In a Nutshell

Executing CFPB compliance section 1071 creates a complex environment for financial enterprises. It demands careful consideration of a lender’s data collection and accountability for making decisions about a loan application. The rule allows better recognition of business and community development requirements. The web of conflicting compliance requirements for CFPB 1071, such as balancing privacy and transparency considerations simultaneously, presents unique difficulties that financial enterprises must manage.

The resources and support provided by the CFPB regarding potential collaboration with technology partners offer avenues for financial institutions to fulfill these new challenges successfully. In the current challenging landscape of Financial Regulation, the execution of section 1071 presents a noticeable step toward encouraging transparency and fairness in lending to minority-owned and women-owned small businesses. Undoubtedly the intentions behind this CFPB 1071 rule are commendable, but it comes with a wide range of compliance challenges. This is where the Predict360 Risk and Compliance management solution can be useful.

Predict360 is an ABA-endorsed risk and compliance system software uniquely positioned to strengthen financial enterprises to navigate the challenges of Section 1071 compliance. Let’s find out how it helps:

Identification of Risks

The powerful features of Predict360 enable financial institutions to monitor and identify any issues in fair lending, due to current and new legislation. Its powerful analytics and real-time insights give a holistic perspective of the risk landscape, enabling proactive risk management.

Assessment and Analysis

Financial institutions can employ Predict360 to examine and analyze fair lending risks and controls. Its user-friendly interface and customized dashboards enable in-depth research, ensuring risks are identified and handled effectively in compliance with CFPB 1071.

Streamlined Compliance

Predict360 compliance software makes it easier to automate the data gathering and reporting requirements of Section 1071. Its connection with current systems guarantees that compliance is attainable and efficient, easing the regulatory risk strain on financial institutions.

Continuous Monitoring and Reporting

Predict360 allows for constant monitoring and automated reporting, ensuring financial institutions meet compliance deadlines and maintain accurate records for CFPB 1071.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.