Home/ Blog / Impact of Recent Regulatory Changes on IT and Cyber Risk Management

Recent regulatory changes have significantly elevated the role of IT and cyber risk management in the financial sector and beyond. These changes stem from a growing awareness of the vulnerabilities that modern businesses, particularly financial organizations, face in an increasingly digital world.

Regulatory bodies have also recognized the need to safeguard financial institutions and their customers from the escalating threats associated with IT and cybersecurity risks.

In this blog, we consider the impact of recent regulatory changes on IT and cyber risk management and what financial organizations can do to manage risks effectively.

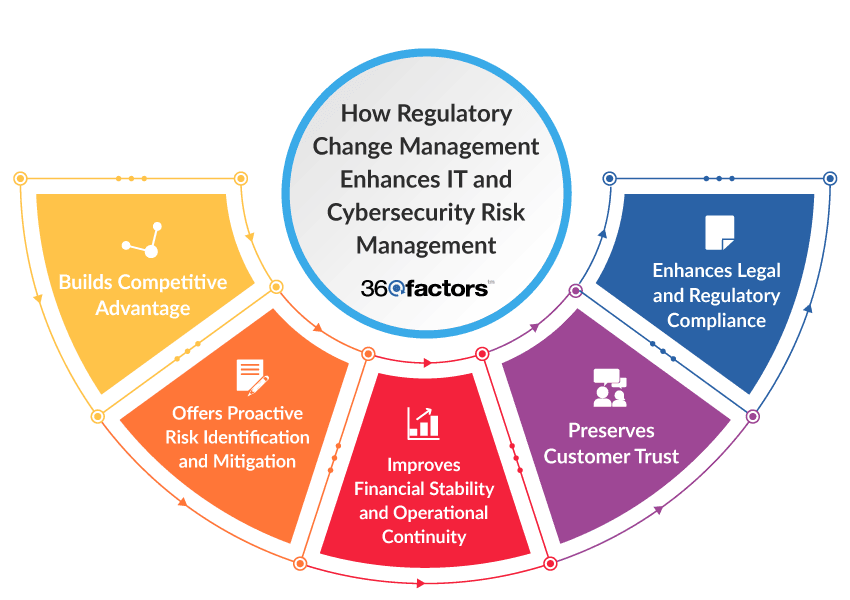

Importance Of Regulatory Change Management for IT And Cyber Risk Management

Financial institutions are increasingly coming under a watchful regulatory eye due to the sensitive data and financial assets they manage. The consequences of inadequate IT risk management can be far-reaching, affecting not only the institutions themselves but also the broader economy.

Here are some of the main reasons why regulatory compliance has become essential for maintaining trust and ensuring stability in the financial sector.

Legal and Regulatory Compliance

Financial institutions operate within a highly regulated environment that demands strict adherence to established standards. The protection of sensitive financial data, customer information, and the overall integrity of financial systems is not just a matter of best practices but is enshrined in legal and regulatory requirements.

Regulatory bodies, such as the Federal Trade Commission (FTC), Office of the Comptroller of the Currency (OCC), and Cybersecurity and Infrastructure Security Agency (CISA) have established guidelines to ensure that financial institutions implement robust IT and Cyber Risk Management frameworks to safeguard against potential threats.

Preserving Customer Trust

Trust is the foundation of any successful financial institution. Customers entrust their sensitive information to banks, and any compromise in the security of this data can erode trust rapidly. Active RCM in IT and Cybersecurity Risk ensures banks proactively maintain and enhance customer confidence.

Adherence to industry information security standards and regulatory requirements not only protects the institution but also reassures customers that their financial transactions and personal information are handled with the utmost care.

Financial Stability and Operational Continuity

The financial sector plays a pivotal role in maintaining economic stability. Disruptions to financial systems due to IT failures or cyberattacks can have cascading effects on the broader economy.

Active RCM ensures financial institutions are cognizant of potential risks, providing a buffer against disruptions. By identifying and mitigating IT risks through a comprehensive RCM strategy, organizations enhance their operational resilience and contribute to the overall stability of the financial ecosystem.

Proactive Risk Identification and Mitigation

RCM empowers organizations to take a proactive stance toward risk. Rather than merely reacting to incidents, financial institutions can systematically identify, assess, and mitigate potential IT and Cybersecurity risks.

This proactive approach not only minimizes the impact of adverse events but also aids in the strategic allocation of resources to address high-priority risks, optimizing the overall risk posture of the organization.

Competitive Advantage

In a landscape where cyber threats are constantly evolving, having a robust RCM framework can provide a competitive advantage. Financial institutions that demonstrate a commitment to IT and Cyber Risk Management not only meet regulatory requirements but also differentiate themselves in the eyes of customers and investors.

This commitment becomes a valuable asset, showcasing the institution as a reliable custodian of financial assets and information.

Focus Areas for IT and Cyber Risk Based on Recent Regulatory Changes

The US regulators have issued a series of changes in recent years that address the ever-evolving landscape of IT and Cyber Risks. These regulations cover the following domains.

Cybersecurity Measures

Regulatory bodies consistently emphasize the implementation of robust cybersecurity frameworks as a fundamental aspect of IT Risk Management. These frameworks include but are not limited to the following measures:

- Network Security: Ensuring secure configurations, firewalls, and intrusion detection systems.

- Endpoint Security: Protecting individual devices from malware and unauthorized access.

- Data Encryption: Safeguarding sensitive information during transmission and storage.

- Access Controls: Implementing role-based access controls to restrict unauthorized access to critical systems.

Incident Response Plans

Recognizing the inevitability of cyber incidents, regulatory bodies stress the importance of having well-defined incident response plans. These plans should encompass:

- Identification and Classification: Rapid identification and classification of incidents.

- Containment and Eradication: Swift containment to prevent further damage and eradication of the cyber threat.

- Communication Protocols: Clearly defined communication protocols internally and externally, including with regulatory bodies.

- Post-Incident Analysis: Conduct thorough post-incident analyses to learn from the event and improve future response capabilities.

Employee Training and Awareness

Human factors remain a significant contributor to IT risk assessment and management. Regulatory bodies recommend robust training programs to enhance employee awareness of cyber threats, including:

- Phishing Awareness: Educating employees on recognizing and avoiding phishing attempts.

- Security Policies: Promoting best practices for password management, device security, and safe online behavior.

- Reporting Procedures: Establishing clear and accessible procedures for employees to report potential security incidents promptly.

Continuous Monitoring and Threat Intelligence Sharing

The dynamic nature of cyber threats necessitates continuous monitoring of IT systems and the sharing of threat intelligence. Regulatory bodies encourage organizations to:

- Implement Monitoring Tools: Deploy advanced monitoring tools for real-time threat detection.

- Collaborate on Threat Intelligence: Engage in information sharing with other organizations and cybersecurity entities to stay abreast of emerging threats.

- Regular Risk Assessments: Conduct periodic IT risk assessments to identify new vulnerabilities and adapt security measures accordingly.

Regular Updates to Security Protocols

The regulatory landscape and the cyber threat landscape are in a constant state of flux. Regulatory bodies recommend that financial institutions:

- Stay Informed: Stay informed about changes in regulatory requirements and emerging cyber threats.

- Regularly Update Security Protocols: Adapt security protocols in response to evolving risks and regulatory updates.

- Conduct Compliance Audits: Regularly audit and assess compliance with security protocols to ensure ongoing effectiveness.

Predict360 ITRA for Best IT Risk Management

Predict360 IT Risk Assessment is a comprehensive, integrated risk management and compliance platform that empowers businesses to effectively meet the challenges posed by recent regulatory changes.

Its main features include the following.

- Comprehensive Risk Assessment: Predict360 ITRA provides tools for conducting in-depth IT risk assessments, allowing organizations to thoroughly identify and evaluate IT and cyber risks.

- Regulatory Compliance: By leveraging its RCM capabilities, the platform ensures that organizations remain compliant with evolving regulatory requirements by providing insights, news, and feeds for risk mitigation strategies.

- Incident Response: Predict360 IT Risk Assessment supports the development of robust incident response plans, helping organizations respond effectively to IT incidents while providing a detailed audit trail for reporting.

- Reporting and Transparency: The platform streamlines the reporting process, facilitating precise and timely reporting to management, board members, and regulatory bodies. It ensures that organizations maintain the transparency needed to meet regulatory standards.

In a regulatory landscape that is becoming increasingly stringent in its expectations, Predict360 ITRA is a valuable tool for organizations seeking to navigate IT and cyber risk management with confidence. It equips businesses with the tools and insights to meet regulatory standards, protect sensitive data, and maintain operational integrity in an ever-evolving digital environment.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.