Home/ Blog / Harnessing Generative AI for Improved Risk and Compliance Management in the Financial Sector

The integration of Generative Artificial Intelligence in the financial services organizations is revolutionizing risk and compliance management procedures, offering unprecedented opportunities for efficiency and precision. As financial institutions tackle complex regulatory environments, adopting generative AI promises to transform traditional approaches, making them more adaptable and effective.

The promise of generative AI extends beyond mere automation; it enables a dynamic, responsive framework for risk and compliance management, setting a new standard for the industry. However, adopting such transformative technology has its challenges. Institutions must navigate through regulatory uncertainties, data integrity issues, and the integration of legacy systems with innovative solutions. By leveraging AI, financial institutions can harness the power of advanced algorithms to predict, analyze, and mitigate potential risks with unparalleled accuracy. As we delve deeper into the capabilities and potential of generative AI, it’s clear that its impact on risk and compliance management procedures will be profound and far-reaching.

Expectations of Generative AI Capabilities for Financial Industry Experts

The financial industry is poised for a significant transformation driven by the capabilities of generative AI. Experts have high expectations for how these advancements can refine and revolutionize risk and compliance operations. Integrating AI for risk and compliance solutions will bring significant improvements, particularly in risk prediction, fraud detection, customer service, and regulatory compliance.

According to a survey conducted by KPMG, Industry leaders eagerly anticipate a significant application of generative AI in fraud prevention. Seventy-six percent of financial services executives surveyed believe that generative AI will enhance fraud detection mechanisms at their organizations, resulting in improved risk and compliance management procedures.

Furthermore, the role of AI in risk and compliance management will be transformative. Sixty-eight percent of the surveyed executives identified compliance and risk as primary areas for AI applications. Generative AI can automate tedious, labor-intensive tasks such as monitoring transactions for suspicious activities or ensuring adherence to regulatory requirements, thereby enhancing the overall effectiveness and efficiency of risk and compliance functions.

The financial sector’s journey towards integrating generative AI into risk and compliance is not merely about adopting new technology; it’s about reshaping the foundation of how financial institutions operate and comply with regulatory standards. Generative AI has the potential to redefine the landscape of risk and compliance management procedures, providing unprecedented levels of accuracy, efficiency, and security.

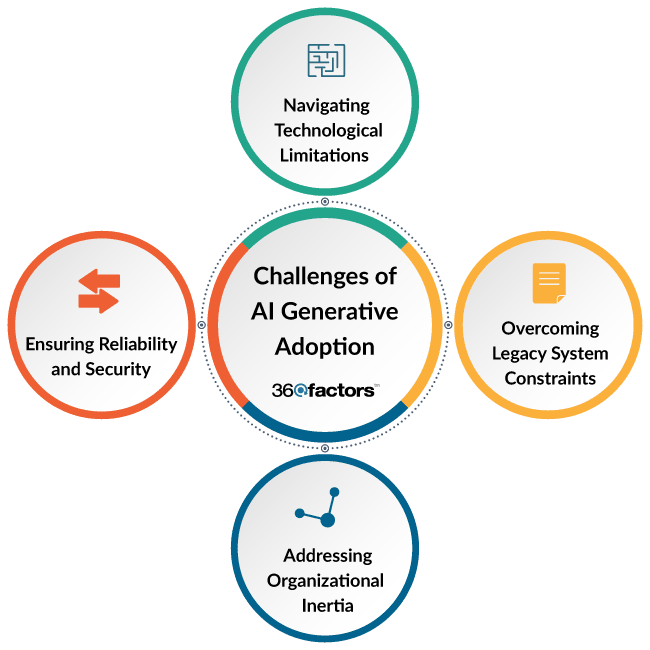

Challenges of Generative AI Adoption

Navigating Technological Limitations

One primary hurdle financial institution face in adopting generative AI revolves around the existing IT and digital infrastructure. Nearly 40% of financial services executives have reported that their infrastructure is underdeveloped, which poses a significant barrier to implementing sophisticated AI for risk and compliance solutions.

Overcoming Legacy System Constraints

Legacy systems present a complex challenge, particularly for banks. These outdated frameworks restrict innovation and drain budgets that could otherwise support new technological endeavors like integrating AI into risk and compliance management procedures. The slow transition to more flexible cloud environments further delays AI’s potential risk and compliance enhancement opportunities.

Addressing Organizational Inertia

The established procedures and cultural norms within traditional financial institutions can significantly hinder their ability to adapt to rapid technological advancements. This contrasts sharply with the agility of fintech startups, potentially causing established entities to fall behind in the race for efficiency and innovation in risk and compliance management.

Ensuring Reliability and Security

While the potential of generative AI is vast, concerns surrounding reliability, data privacy, and intellectual property must be addressed. These concerns are critical, especially when integrating AI tools into established risk and compliance management procedures, necessitating a strategic and thoughtful approach to overcome these obstacles and harness the full power of AI.

Important Steps for Improving Risk and Compliance Procedures

The advent of generative AI in financial services heralds a new era in risk and compliance management. To harness this transformative power, institutions must adopt a systematic approach:

Enhance Data and System Foundations

Data is the lifeblood of any AI system. The first step involves thoroughly auditing the existing data infrastructure of financial institutions to integrate AI into their risk and compliance management procedures. This involves assessing the quality, accessibility, and security of data, which is critical for the accurate functioning of AI algorithms. Issues like data silos, outdated systems, and inconsistent data formats can significantly impede AI’s potential.

Moreover, the underlying IT infrastructure must be robust and agile to support AI functionalities. Transitioning to cloud-based solutions can provide the scalability and flexibility required for dynamic AI applications. The cloud environment facilitates easier data integration, faster processing capabilities, adoption of better AI risk and compliance tools, and algorithm support.

Enhancing data and systems is not a one-time task but a continuous process that involves regular updates and maintenance to adapt to new technologies and requirements for risk and compliance management procedures. Financial institutions must invest in ongoing training for their IT teams and adopt a culture of continuous improvement and innovation.

Create Guidelines for Ethical AI Utilization

Integrating AI raises significant ethical considerations. To address these, financial institutions must establish a comprehensive framework that defines the ethical use of AI. This includes creating policies that ensure transparency, accountability, and fairness in AI applications.

Such a framework should address potential biases in AI algorithms, safeguard customer privacy, and ensure compliance with all relevant regulations. It should also include mechanisms for monitoring AI systems for ethical adherence and rectifying issues.

Developing these guidelines should involve stakeholders from various departments, including legal, risk, and IT, to create comprehensive risk and compliance management procedures. This collaborative approach ensures that the ethical framework is comprehensive and aligned with the institution’s objectives and values.

Cultivate Strategic Collaborations

In the fast-paced world of technology, keeping up with the latest developments can be challenging. Strategic partnerships with tech firms and fintech startups can provide financial institutions access to the latest AI innovations and expertise.

These collaborations can take various forms, including joint ventures, licensing agreements, or innovation labs. Financial institutions can leverage new technology through these partnerships and gain industry insights and regulatory expertise.

Such collaborations can also accelerate the development and integration of AI solutions into risk and compliance management procedures, enabling financial institutions to stay ahead of the curve.

Develop AI Literacy Within the Workforce

For AI integration to be successful, the workforce must understand and embrace the technology. This involves training employees on how to use AI tools and educating them on the principles of AI and its implications for risk management and compliance.

Financial institutions should develop comprehensive training programs that cover AI’s technical and ethical aspects. To improve risk and compliance management procedures, these programs should be tailored to different organizational roles, from executives to front-line staff.

In addition to training, institutions should also consider hiring AI and data analytics experts who can lead the development and implementation of AI solutions. These specialists can also serve as internal educators and AI champions, helping foster a culture of innovation and continuous learning.

Apply AI Innovations

Applying AI to Compliance Management involves identifying areas where AI can have the most significant impact. This could include automating routine compliance checks, enhancing fraud detection systems, and developing predictive models for risk assessment.

Implementing AI should start with pilot projects addressing specific risks and compliance issues. These projects can provide valuable insights into the effectiveness of AI for risk and compliance solutions and help identify any adjustments needed before a broader rollout.

As AI technologies are integrated, it is essential to maintain a balance between automation and human oversight. AI systems should be designed to augment human decision-making, not replace it. This involves setting clear guidelines for when and how human experts should review AI recommendations.

Track Performance and Refine AI Systems

The final step in integrating AI into risk and compliance management procedures is establishing a framework for measuring the performance of AI systems. This framework should include key performance indicators (KPIs) that reflect the objectives of the AI initiatives, such as improved risk assessment accuracy, reduced compliance costs, or faster response times.

Regular monitoring of these KPIs can help financial institutions understand the impact of AI on their risk and compliance operations. This data can then be used to refine AI systems, adjust strategies, and ensure that AI solutions continue to meet the institution’s goals and compliance requirements.

Conclusion

Generative AI can transform and improve risk and compliance management procedures in the financial sector. The dynamic regulatory landscape and the increasing complexity of financial products and services demand a more agile, precise, and efficient approach to compliance and risk management. This is where advanced software solutions, like Predict360 Risk and Compliance Management Software, come into play.

The Predict360 AI Risk and Compliance Tool embodies this next-generation approach by leveraging AI-augmented technology to redefine traditional practices. This platform streamlines tasks and workflows and establishes a new paradigm in understanding and managing organizational risks and compliance management procedures.

A standout feature that exemplifies the innovative spirit of Predict360 is its RCSA (Risk Control Self-Assessment), integrated with OpenAI’s GPT-4, a leading-edge language model utilized daily by millions. This integration allows customers to harness AI-driven insights, directly generating recommended risks and controls from user-submitted regulatory documents. This feature streamlines the risk assessment process and ensures that suggestions are tailored and relevant to the organization’s regulatory framework. These recommendations can be easily refined and customized before being incorporated into the institution’s risk taxonomy.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.