Home/ Blog / Getting Better Insights from Risk Reports

Top risk reporting priorities include early detection and assessment of risks. Risks are easier to mitigate if they are discovered earlier. Risk management technology can help banks monitor risk levels based on internal and external metrics. This enables banks and other financial institutes to create a real-time risk reporting dashboard that can help management view real-time risk levels. This can have profound effects on the way risks are managed; instead of waiting to discover risks in an audit and reacting, businesses can proactively create plans for upcoming risks that have been detected.

Does your business have a modern risk mitigation framework or is its productivity and efficiency being bottlenecked by outdated practices? Do you know what your risks at this very moment, and how risks have changed since your last risk assessment, control test, compliance test, or audit? How long does it take to create a risk report and get an update in your organization today? Days? Weeks?

Do you want a risk program that goes beyond historical data and includes predictive components?

Do you want your risk program to factor in external data to predict the trajectory of risks?

Do you want to stay on top of corrective activities related to risk?

If your answer to any of these questions is “Yes”, you should continue reading.

Most businesses are not harnessing the full power of risk reports. It is now possible to get much more out of risk data than ever before. The standards we have for risk performance were created before the advent of risk management technology, and they are thus outdated.

The limitations of contemporary risk reporting models

Contemporary risk reporting is often incomplete, inaccurate, out of date, and does not provide actionable intelligence. Risk intelligence should go beyond just reporting on the status of the last set of testing; they should help management fix mistakes and course correct before the risk becomes reality. Providing such insights requires accurate and real-time reporting based on internal and external data that gives insight into the trajectory of the bank’s risks. Manually compiling all this data and generating insights is a very resource-intensive task and can be error prone.

Do you want a risk program that goes beyond historical data and includes predictive components? Share on XManual reporting is possible but unsustainable

Management must dedicate employees to the creation of these reports if they want to receive them consistently, which quickly becomes unsustainable from a financial point of view and ultimately results in risk managers looking at outdated data. The reports made from outdated data are not predictive; they inform you what your risk was, not where it is now or where it is headed.

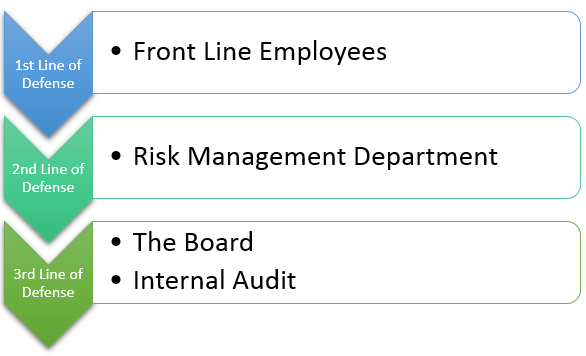

Improving risk reporting requires a three-pronged approach across the three lines of defense.

The Three Lines of Defense

The three lines of defense model helps us understand what each line needs to improve risk mitigation.

Read also: 5 Steps of Risk Management Process

First (front) Line of Defense

The first line of defense is the front line which comprises of client-facing employees and employees that are responsible for the different processes that occur within a bank. This includes the bank tellers, the customer support agents, and the employees underwriting loans. These employees are also responsible for taking customer complaints, finding violations or errors in customer records, and noting down any incident they come across.

The first line of defense is the front line which comprises of client-facing employees and employees that are responsible for the different processes that occur within a bank. This includes the bank tellers, the customer support agents, and the employees underwriting loans. These employees are also responsible for taking customer complaints, finding violations or errors in customer records, and noting down any incident they come across.

The front line of defense needs to have an easy mechanism to input and generate data that is integrated into the risk framework of the bank. This allows banks to use that data for predictive risk analysis.

Second Line of Defense

The second line of defense is the risk management team within the organization; the team that performs testing (compliance or control testing).

There are three problems facing the Second Line in many organizations. Corrective actions, follow up and follow through are manually and poorly tracked, usually through an ad-hoc system or even worse, through the use of Excel spreadsheets and email threads. This can lead to issues falling through the cracks, a lack of visibility into where an issue is at and ultimately into extended remediation times. Because of the manual nature of testing and the follow up and follow through, it is infrequent. This leads to decision makers looking at outdated data and leading to long periods where issues are occurring yet go undetected. Lastly, the results of testing do not inform risk within an organization, again leading to decision makers looking at outdated data that may or may not be accurate at the moment.

Third Line of defense

The third line of defense represents oversight. It includes the board, the internal audit team, and other business leaders that play a significant role in the operations of the business. They are often in the dark about issues, because they must rely on outdated reports handed to them by the Second Line. At this point, it is often too late to react. Manual systems cannot provide them real-time visibility into risk processes throughout the organization.

The third line of defense needs risk reporting and intelligence that deliver insight into their current risk profile, allowing them to promptly react and chart the correct course for the organization. Real-time data allows them to monitor risk processes and coverage across the organization. They also need internal and external risk indicators integrated into their risk program to help them evaluate what their actual risk is today.

Predictive analytics and risk management

Risk management is still considered to be closely tied to history – we look at the data that we have and draw a conclusion from it. While this is essential, it also gives us limited information. We don’t simply need to know what risks the business is currently facing – that is just part of it. We also need to know what those risks will look like in the future, because getting that prediction right means that we can provide the board with intelligence and insights which can drive the future of the business.

Predictive risk analysis takes the latest internal data and the latest external key risk indicators to determine the risks related to each domain of your organization. It uses the latest intelligence reports and market insights to alert you about high-risk areas business domains and processes for the next year.

Read also: Financial Risk Management Software

Integration is important when it comes to predictions – bringing all three lines of defense under one risk management system is a requirement. The risk predictor needs complete and accurate data to be able to provide useful risk predictions and that is only possible if all the data is being entered, stored, and analyzed within one framework.

Predictive analytics will unleash the true power of risk management. Instead of models based simply on historical performance or assumptions, these systems will be fine-tuned to the point where they will be going through every news item, regulatory change, and market data source to identify the changes we can expect in our business environment. This means that managers of the future will have access to a lot more insights and intelligence than anything possible now, which will help not just some selected organizations but the whole industry manage risks better.

Want to find out how your business can improve its risk management? Get in touch with our team and see what our Risk Insight solution can do for your organization.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.