Home/ Blog / Uncovering Innovation and Growth with Generative AI in Modern Banking

Generative AI is swiftly reshaping the banking sector, revolutionizing operational processes, elevating customer experiences, and fostering innovation throughout financial services. Banks, traditionally reliant on data-driven and language-intensive processes, leverage Generative AI in banking to enhance productivity, deliver hyper-personalized customer engagement, and drive operational efficiency. From automating routine tasks and streamlining workflows to enabling complex decision-making and augmenting human capabilities, AI is redefining traditional banking roles and reshaping operational models.

Research reveals that up to 73% of banking tasks have a high potential for AI-driven transformation, with early adopters already witnessing productivity gains of 22-30%, revenue growth of 600 basis points, and improved return on equity by 300 basis points. However, this transformation is not without challenges. Data security risks, operational resilience concerns, and regulatory compliance complexities remain critical hurdles that must be addressed.

This blog explores how generative AI in banking offers banks a competitive edge, transforms workforce roles, and enables innovative deployment strategies across tools and operational frameworks.

Embrace Generative AI for a Competitive Edge

Generative AI is transforming business operations at an exceptional pace, with the banking industry rising as one of its most significant beneficiaries. Known for its data-driven workflows, banking presents a unique environment where AI can optimize efficiency, decision-making, and customer experiences with the least risks using an integrated risk management platform.

Research highlights that 73% of banking tasks have a high potential for AI-driven transformation, with 39% suitable for automation, mainly routine and repetitive activities such as data entry and transaction processing. Additionally, 34% of tasks can be augmented by AI, enhancing roles that require human judgment, such as credit analysis and customer relationship management. Meanwhile, only 27% of functions are unlikely to see immediate transformation, underscoring the vast scope of AI’s impact across banking operations.

Early adopters of generative AI in banking are already scaling their initiatives across organizations, going beyond inaccessible pilot projects to fully integrated AI ecosystems. These forward-thinking institutions are witnessing extensive financial improvements, including a 22-30% boost in productivity, a 600 basis points rise in revenue growth, and a 300 basis points increase in return on equity. These measurable outcomes demonstrate that generative AI is not just a technological upgrade but a strategic lever for sustainable growth.

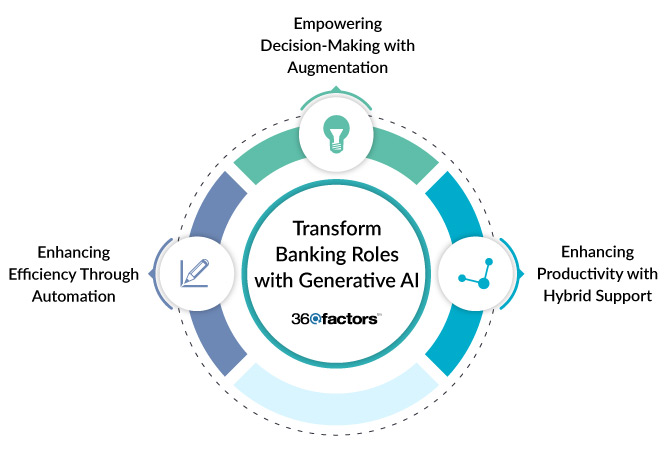

Transform Banking Roles with Generative AI

Generative AI is reshaping traditional banking roles, driving efficiency, improving decision-making, and enhancing productivity across the workforce.

Enhancing Efficiency Through Automation

Repetitive and data-heavy tasks have long consumed significant time and resources in banking operations, especially in front-office roles such as tellers. Generative AI in banking offers an opportunity to streamline these tasks by reducing manual intervention and minimizing errors.

Routine tasks such as data entry, transaction processing, and documentation handling can now be seamlessly automated. Studies indicate that up to 60% of routine teller activities have a high potential for automation, resulting in faster processing times, improved accuracy, and cost efficiency.

By automating these activities, tellers and similar roles are freed from mundane, repetitive tasks, allowing them to focus on customer-facing responsibilities and relationship management, ultimately enhancing the overall customer experience. However, some ambiguity or bias can occur in the database that requires the implementation of an effective ERM system to assess such uncertainties.

Empowering Decision-Making with Augmentation

Not all banking tasks can or should be fully automated. Roles requiring critical judgment, such as credit analysts and relationship managers, demand a level of human insight that AI cannot replace but can significantly enhance.

The tools that facilitate the adoption of generative AI in banking empower these professionals by providing data-driven insights, streamlining data analysis, and enabling better preparation for client interactions. Tasks such as risk assessments, loan evaluations, and strategic financial advice are greatly enhanced by AI tools, improving the quality and speed of decision-making.

Approximately 34% of banking roles fall into this category, where AI acts as an augmentation layer that offers valuable insights while leaving critical decisions in the hands of skilled professionals. This cooperative relationship between AI and humans ensures that decision-making remains data-informed and customer-centric.

Enhancing Productivity with Hybrid Support

Some banking roles, such as customer service agents, combine repetitive tasks with responsibilities that require human judgment and interaction. Generative AI in banking supports these hybrid roles by automating specific processes while augmenting others.

Research shows that 37% of routine tasks performed by customer service agents can be automated, allowing agents to focus on more meaningful customer interactions. Additionally, 28% of judgment-based tasks can be augmented with AI tools, providing agents with insights and suggestions to improve client communication and resolve queries effectively.

This hybrid approach enhances productivity by enabling employees to handle higher volumes of tasks without compromising quality. Customer satisfaction improves as agents can deliver faster resolutions and more personalized service experiences.

While generative AI offers substantial benefits across automation, augmentation, and hybrid support, it also introduces specific risks. These include data inaccuracies, operational disruptions, cybersecurity vulnerabilities, and inconsistencies in human-AI collaboration. To address these challenges, banks must implement robust, integrated risk management platforms to monitor real-time AI performance and highlight its risks.

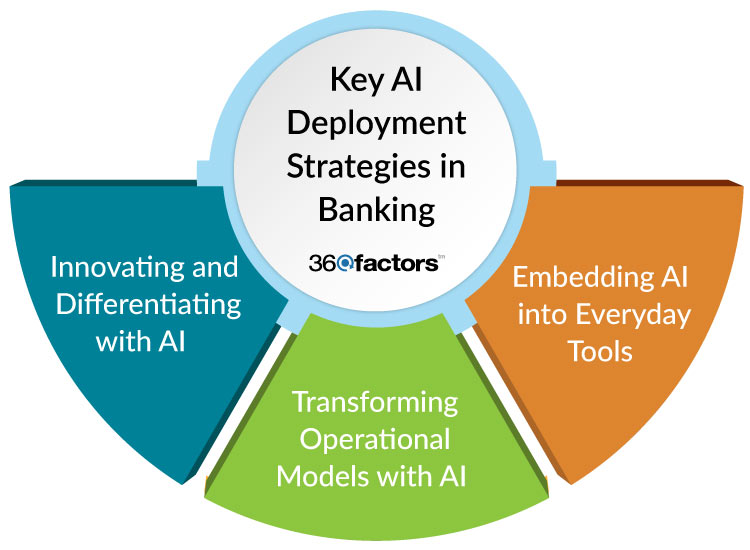

Key AI Deployment Strategies in Banking

Generative AI in banking is not just a tool; it’s a transformative force that is reshaping how banks operate, innovate, and deliver value. Successful integration of AI across banking workflows depends on well-defined strategies that embed AI seamlessly into everyday tools, transform operational models, and drive innovation.

Embedding AI into Everyday Tools

Integrating generative AI into daily-use tools has become a cornerstone of banking innovation. By embedding AI capabilities into widely used applications, banks enhance productivity and enable employees to work smarter.

Productivity Tools: Platforms like Microsoft 365 Copilot embed AI-driven features directly into Word, Excel, and Outlook, automating routine tasks like drafting emails, analyzing data, and generating reports.

Customer Relationship Management (CRM) Systems: Solutions like Salesforce Einstein are leveraging generative AI to offer intelligent suggestions, customer insights, and predictive analytics for relationship managers and sales teams.

Design and Content Generation: Tools like Adobe Firefly allow banks to generate creative content, marketing materials, and tailored visual assets using simple prompts.

By embedding generative AI in banking into these familiar tools, banks minimize adoption barriers, ensure seamless integration into existing workflows, and empower employees with AI-powered insights without requiring extensive retraining.

Transforming Operational Models with AI

AI is driving a fundamental transformation in how banking operations are structured and executed, enabling efficiency gains, cost savings, and improved service delivery.

Back-Office Automation: Tasks such as document processing, data entry, and compliance checks are automated, reducing manual errors and improving speed.

Call Center Enhancements: Generative AI transforms customer service centers by providing real-time transcription, sentiment analysis, and automated query resolution.

Legacy System Modernization: Generative AI in banking is used to analyze and modernize legacy codebases, accelerating system upgrades without causing operational disruptions.

These transformations reduce operational costs and enable banking systems to become more agile, scalable, and capable of supporting future innovations when integrated with an effective ERM system.

Innovating and Differentiating with AI

Generative AI empowers banks to differentiate themselves in a competitive market by driving product innovation, customer experience, and marketing strategies.

Hyper-Personalized Products: AI enables the creation of financial products tailored to individual customer needs and behaviors.

Advanced Marketing Campaigns: AI generates thousands of customer-specific scripts and marketing materials in seconds, optimizing engagement strategies.

Predictive Customer Insights: By analyzing internal and external datasets, AI can predict customer intent and behavior, allowing banks to address customer needs proactively.

Dynamic Pricing Models: Banks can use generative AI in banking to offer real-time, dynamic pricing strategies based on customer profiles and market conditions. These innovations redefine customer engagement, making interactions more personalized, relevant, and proactive, ultimately increasing satisfaction and loyalty.

While deploying AI across tools, operations, and innovative strategies brings unparalleled advantages, it also introduces inherent risks. These risks include data privacy vulnerabilities, operational resilience challenges, and a lack of transparency in AI decision-making processes. Some tactics to address these risks could be:

- Establish stringent measures to protect customer data and ensure AI models comply with privacy regulations.

- Continuous monitoring of AI systems to promptly detect and address potential failures or disruptions.

- Implementing integrated risk management platforms such as Predict360 ERM software.

Strengthening Risk Management with Predict360 ERM Software

Embracing generative AI in banking to enhance productivity, automate tasks, and deliver hyper-personalized customer experiences has become critical. Predict360 Enterprise Risk Management (ERM) Software offers a centralized real-time risk identification, monitoring, and mitigation platform, ensuring seamless integration across AI-driven workflows.

With real-time dashboards, centralized risk repositories, Tableau BI integration, and automated compliance updates, Predict360 empowers banks to proactively manage operational vulnerabilities, data privacy risks, and cybersecurity risks. Predict360 is an that provides leadership teams unparalleled visibility and control over emerging risks by aligning risk management strategies with regulatory requirements.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.