Home/ Blog / Harness the Power of Generative AI in Finance for Transformative Results

Generative AI is swiftly reshaping the financial sector, moving beyond experimental use to provide real value in primary operations. This unique technology has the potential to enhance how financial organizations work, from improving productivity to enhancing customer experiences to facilitating data-driven decision-making. By integrating generative AI in finance into core processes, financial enterprises can foster innovation, streamline operations, and make a more robust client network.

A well-prepared foundation is required to harness these advantages. Financial companies must focus on successful governance, data management, and seamless execution of generative AI in risk management. As they look to utilize the complete potential of generative AI, organizations also experience emerging risks that need thoughtful management. This blog will walk through the actionable phases for financial businesses to leverage generative AI successfully with a minimum failure rate.

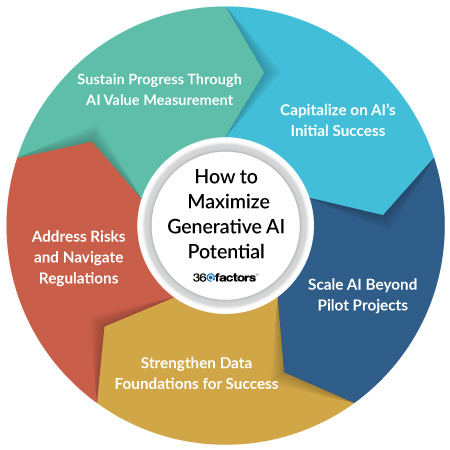

How to Maximize Generative AI Potential

Financial enterprises must go beyond initial deployments and embrace the structured scaling and integration method to unleash the hidden potential of generative AI in finance. Each step discussed here shows the transformative asset, allowing financial organizations to attain increased efficiency, resilience, and competitive advantage.

Capitalize on AI’s Initial Success

Financial businesses have started to experience notable returns on their early investments in generative AI. According to recent Deloitte research, 67% of surveyed organizations plan to increase their investments in generative AI due to the fantastic benefits for business growth. For many institutions, this early success is reflected in superior efficiency, productivity, and cost savings, with 42% of respondents citing these gains as the most critical outcomes.

Some use cases of generative AI prove specific values. For example, AI-based customer service tools can manage voice and chat interaction, allowing automated responses and spotting cross-sell opportunities. This practical application enhances customer experience and contributes to revenue growth by seamlessly integrating AI into client interactions. Other financial organizations have leveraged generative AI in finance to improve decision-making and accelerate operations, demonstrating the technology’s versatility across various functions.

Financial institutions can build a robust case for scaling AI projects by capitalizing on these initial success points. Sharing these results with stakeholders will nurture a supportive environment for wider AI adoption.

Scale AI Beyond Pilot Projects

Many organizations struggle to move beyond initial experimentation, as implementing generative AI through pilot projects can be complicated. Despite promising initial success, 68% of organizations report that only a tiny portion of their generative AI projects, that is, 30% or less, have progressed to total deployment. This slow scaling rate can significantly hinder technology infrastructure, data management, and governance.

According to recent findings, only 45% of companies feel sufficiently prepared regarding technology infrastructure, and merely 41% feel confident in their data management expertise. Even fewer are ready in strategy (37%) and risk and governance (23%), with only 20% of organizations feeling they have the necessary talent to support widespread AI adoption. These statistics highlight an everyday reality: while many organizations are eager to implement generative AI in finance, they frequently need more initial elements for expansive deployment.

To win scaling, companies must invest in technology programs that can support multiple AI applications and ensure strong data management practices are in place. Moreover, risk and governance frameworks must be reinforced to address AI’s unique challenges, such as transparency, accountability, and regulatory compliance.

Strengthen Data Foundations for Success

A strong data foundation is vital for reaping the maximum benefits of generative artificial intelligence in finance. Data quality, lifecycle management, and governance become essential when financial enterprises scale their AI initiatives. As per the survey, 75% of businesses have increased their technology investments in data lifecycle management to support generative AI. This heightened focus reflects an understanding of data readiness, ensuring data is high-quality, accessible, and well-managed.

As generative AI has specific requirements for data architecture and handling, unforeseen flaws, such as data quality, privacy, and security, often emerge during implementation. The surveyed leaders revealed they faced challenges in using sensitive data (58%), managing data privacy (58%), and guaranteeing data security (57%) in their AI models. These hurdles underscore the effectiveness of agile data management approaches that can adapt to AI demands.

To manage these challenges, companies are enhancing data security (54%), strengthening data quality practices (48%), and renewing governance frameworks (45%). These measures uphold responsible and efficient data usage, ensuring that models of generative AI in finance and other sectors operate on accurate and compliant data. Strengthening data foundations allows financial institutions to scale generative AI with certainty and unlock their full potential while minimizing risks associated with data management.

Address Risks and Navigate Regulations

AI compliance risks and regulatory concerns also rise with the growing adoption of generative AI. Some companies are increasingly concerned with the challenges, including regulatory compliance (36%), effective risk management (30%), and the absence of a robust governance model (29%). These attributes have emerged as some of the most critical hurdles to effective AI deployment, mainly as companies transition from small-scale pilots to more integrated AI strategies across their operations.

Distinctive risks of generative AI in finance, such as privacy concerns, AI model bias, and new attached surfaces, necessitate a proactive risk management approach. Companies must execute stringent governance practices to ensure that AI use decreases potential hurdles and aligns with regulatory standards. Developing a governance framework, checking regulatory requirements, and conducting regular internal audits have been identified as critical actions, with approximately 51% of organizations setting up governance structures and 49% focusing on regulatory compliance.

Integrating risk management software solutions can solve these problems by offering a centralized system for tracking AI-related risks and conducting evaluations. These platforms allow companies to sustain visibility over emerging risks and apply consistent risk mitigation approaches. By supporting AI risk assessments, such software solutions improve security and develop stakeholder trust, ensuring that AI systems operate within secure boundaries.

Sustain Progress Through AI Value Measurement

Realizing the importance of generative AI in finance helps maintain its momentum within organizations. As per recent data, 41% of organizations need help to define and measure the impact of generative AI efforts. This concern can be attributed to the experimental nature of AI programs, where results are frequently indirect or qualitative. Implementing generative AI with demonstrable benefits can be essential to securing continuous investment and upholding AI scales beyond pilot stages.

Organizations are initiating formal strategies to measure and communicate the value of Gen AI successfully. Around 48% of companies use specific KPIs tailored for evaluating AI performance, while 38% have built frameworks dedicated to assessing AI investments. These actions clarify AI’s impact, making it easier to track tangible benefits, such as efficiency gains or enhanced decision-making. Implementing structured measurement processes validates AI’s benefits and aligns AI initiatives with organizational goals. By demonstrating clear outcomes, financial institutions can ensure sustained commitment to AI, allowing it to evolve as a core component of their long-term strategy.

Adopt an Effective Risk Management Platform to Manage AI Risks Effectively

Financial organizations are expanding their use of generative AI in finance, and managing related risks becomes paramount to ensure secure, and effective operations. Integrating a dedicated risk management platform, like Predict360 Enterprise Risk Management Software, can provide an organized approach to monitoring and mitigating AI-related risks. Predict360 ERM offers comprehensive tools and features that enable organizations to handle complex risk landscapes effectively.

Predict360 ERM software provides a centralized dashboard that extends risk visibility across the organization, allowing authorized stakeholders to stay updated on emerging risks. It helps organizations maintain a dynamic and up-to-date view of potential risks by instantly reflecting new risks in all relevant metrics. This capability is critical as initiatives of generative AI in finance progress from pilot stages to full-scale deployment, where proactive risk assessment becomes crucial.

With integrated features like real-time monitoring and automated reporting, the Predict360 ERM tool facilitates timely interventions by management. It also offers Tableau BI and Power BI integrations, allowing companies to visualize and analyze risk data to make informed decisions.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.