Home/ Blog / Explore CFPB Section 1071 Compliance Changes and the Next Steps for Financial Institutions

Staying abreast of regulatory changes is a hallmark and necessity of proactive financial institutions in the current dynamic world of financial services. The Consumer Financial Protection Bureau (CFPB) has introduced the CFPB Section 1071 rule in its commitment to ensuring fairness and transparency; this regulation was created to redefine the world of small business lending. The rule stemming from the Dodd-Frank Wall Street Reform and Consumer Protection Act entails the significance of equal credit opportunities, particularly for small minority and women-owned businesses.

But how does it connect to the financial institutions, how will it influence their operations, and more importantly, how can they prepare for this transformation? This web blog delves deeper into the nuances of CFPB Section 1071, identifying the critical changes, understanding the data elements, and presenting the steps financial institutions can take to ensure streamlined CFPB compliance.

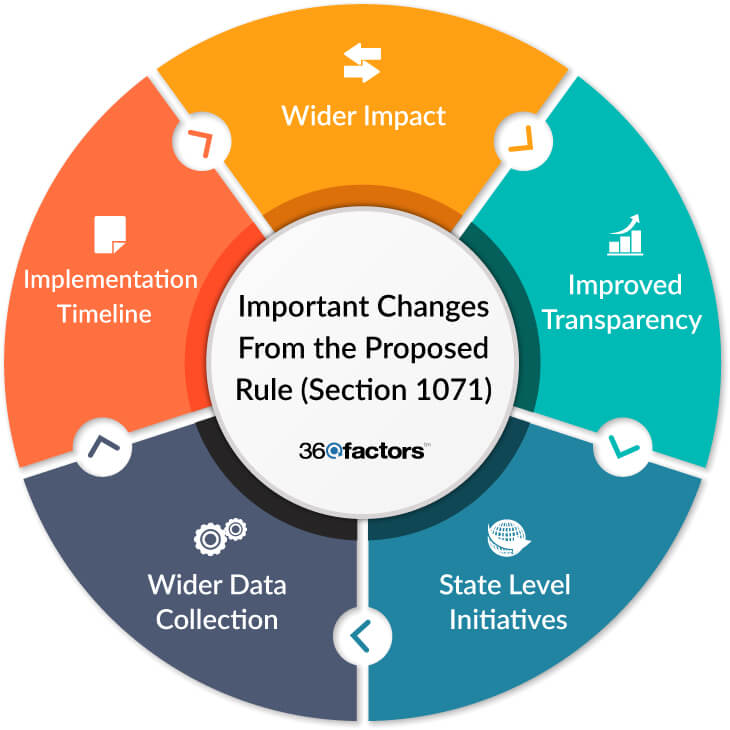

Important Changes from the Proposed Rule (Section 1071)

Financial institutions have recently witnessed significant regulatory shifts, with the CFPB at the front of these reforms. One of the most forecasted changes was the introduction of the notice of proposed rulemaking (NPRM) under section 1071 of the Dodd-Frank Wall Street Reform. The implications of this rule apply to all financial enterprises of all types and sizes. Let us discuss the noticeable changes in this proposed rule:

Wider Impact

Unlike prior regulations, CFPB Section 1071 does not just target conventional depository institutions. It includes a broader range of financial entities, including fintech and non-banking lenders. This comprehensive approach ensures that a wider spectrum of financial enterprises comply with the CFPB’s guidelines, promoting CFPB compliance across the board.

Improved Transparency

One of the primary objectives of section 1071 is to promote greater transparency in small business lending. The goal is to detect opportunities and weaknesses and ensure equal credit opportunities, particularly for minority, women, and small-owned businesses in the US. This step by the CFPB is not just about compliance; it is about promoting the federal lending environment.

State Level Initiatives

Along with the Consumer Finance Protection Bureau’s efforts, the state regulators are also taking steps in this direction. For example, New York is proposing revisions to the Community Reinvestment Act, influencing data collection from loan applications by women and minority-owned businesses.

These state-level initiatives and CFPB Section 1071 demonstrate that there is a nationwide push towards more equitable and fair lending practices.

Wider Data Collection

The aim of NPRM under section 1071 is not just to create guidelines. Its objective is to make the first complete database of small business credit applications in the US. This will give regulators a bird’s eye view of the lending environment, ensuring that the compliance system is available and functioning as it should be.

Implementation Timeline

Financial enterprises in the US need to be mindful of the expected implementation timeline. Section 1071 was published in October 2021, with the final rule published in March 2023 , but it is predicted to come into effect by January 2024, giving financial institutions considerable time to adjust their compliance systems and tools.

The updates delivered regarding the CFPB Section 1071 are not just regulatory; they represent a shift toward a more inclusive, transparent, and CFPB-compliant financial environment.

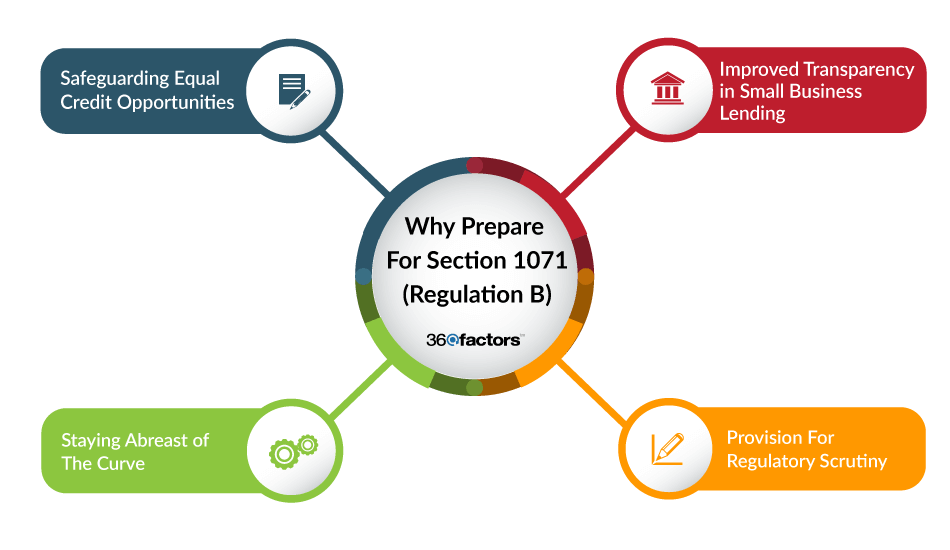

Why Prepare for Section 1071 (Regulation B)

The financial world is continuously reforming, and with the introduction of the new rule of CFPB section 1071, it is not hidden that change is on the horizon.

Let us consider why it is essential for financial enterprises to gear up for this change and start preparing well in advance to implement the changes in their systems.

Improved Transparency in Small Business Lending

The primary objective of CFPB Section 1071 is to bring greater transparency in small business lending. By accepting the data collection, and reporting data points associated with loan applications, the CFPB ensures that a broader database of small business credit applications is collected in the US. This level of transparency supports informed decision-making and promotes trust among stakeholders.

Safeguarding Equal Credit Opportunities

CFPB Section 1071 is more than just a regulation, it is about fairness. It ensures that the regulation guarantees that small, women and minority owned businesses have equal credit opportunities. By detecting and addressing failed lending applications, the CFPB ensures that no business is left behind because of discriminatory practices.

Provision For Regulatory Scrutiny

With the arrival of CFPB Section 1071, financial enterprises can expect greater scrutiny from the CFPB. The data collected will be used to prioritize financial enterprises for additional fair lending supervisory and examination reviews. While compliant with CFPB regulations, businesses will avoid potential penalties and position themselves as industry leaders.

Staying Abreast of The Curve

Financial institutions can understand the situation given that New York state regulators introduced an initiative with similar requirements as the CFPB Section 1071. By appropriately preparing for CFPB Section 1071 execution and compliance, organizations can easily navigate the changing regulatory environment.

Financial organizations must function with fairness, transparency, and innovation at heart.

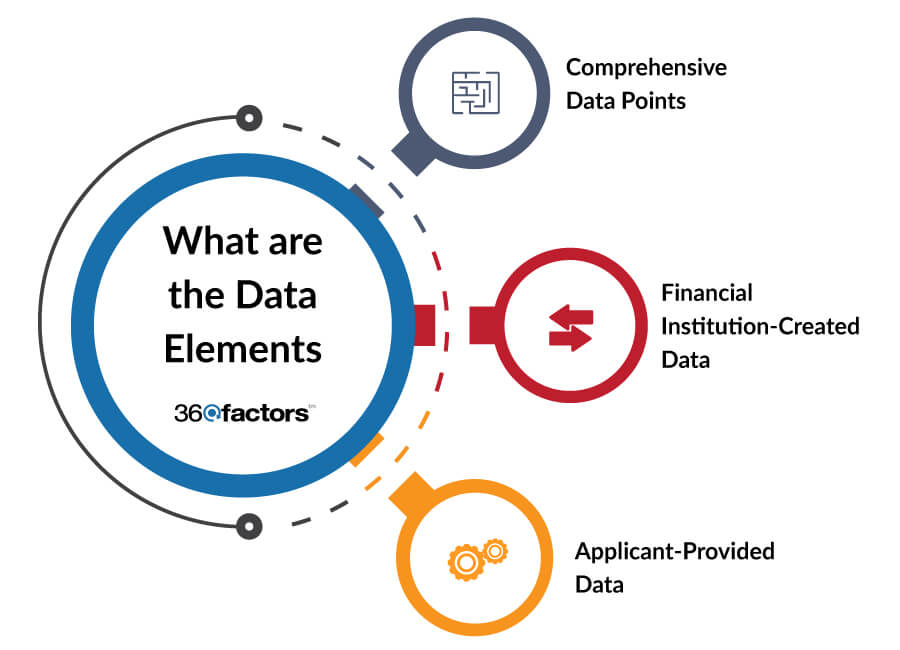

What are the Data Elements?

Understanding the new rule CFPB Section 1071 needs a deep dive into the data elements that financial organizations will be mandated to collect and report on. Such elements are core to the CFPB’s objective of improving transparency and ensuring fair lending practices in small business lending.

Let us discuss these data points below:

Comprehensive Data Points:

The CFPB Section 1071 draws a complete list of over 20 data points. These mandatory metrics will offer a centralized view of small business lending activities and support detecting potential inequitable practices.

Financial Institution-Created Data:

Covered financial institutions must create and present loan application data components to stay CFPB compliant. These are some examples:

- Identifiers exclusive to each application, like the origination date and the approach used.

- The application’s outcome, including approval, refusal, or other consequences.

- If the application is refused, lenders must provide a detailed explanation for the rejection.

- Data points relevant to price information will be required for approved or originating applications.

Applicant-Provided Data:

This category of CFPB Section 1071 includes data points that could be identified by evaluating the applicant’s information submitted throughout the loan application procedure. It consists of the following:

- Information about the credit being requested.

- Details regarding the applicant’s company are relevant.

- Demographics of the applicant business’ significant owners or business status, including whether the business is minority or women owned.

- The ethnicity, race, and gender of the principal owner.

Conclusion

The nature of the financial landscape is dynamic and intricate. With the arrival of CFPB Section 1071 by the CFPB, it is witnessed that the sector is moving towards a more equitable and transparent future. While the journey to compliance may seem challenging, it is vital to examine this as a chance, that is, an opportunity to re-explain the lending approaches, promote trust, and win the cause of minority, small, and women-owned businesses.

But how can financial organizations navigate this complicated war? The answer remains the use of appropriate tools.

Predict360, the ABA-endorsed risk and compliance management software, has emerged as a industry leader in this regard. This platform is not just about being CFPB compliant; it is about employing technology to identify, evaluate, and act on existing and emerging fair lending risks and setting appropriate controls.

With Predict360’s robust compliance software and risk management system, financial institutions can flawlessly integrate the data elements mandated by CFPB Section 1071, ensuring precision, timeliness, and compliance. Moreover, its intuitive interface and advanced analytics capabilities encourage institutions to derive actionable insights, fostering proactive risk management.

Detection of Risks: Predict360’s advanced analytics expertise lets financial institutions flawlessly recognize new and existing fair lending risks.

Comprehensive Risk Assessment: Predict360 offers a robust framework for risk assessment. It assesses the magnitude of each risk, its potential impact, and the probability of its occurrence.

Streamlined Compliance Management: With CFPB Section 1071 introducing many data elements and reporting requirements, Predict360’s compliance management features make it the ideal solution. The platform ensures that all data is precisely captured, gathered, and reported, making CFPB compliance a piece of cake.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.