Home/ Blog / Empowering Organizations Through an Effective Risk Management Framework

We are witnessing an era of uncertainty as the nature of risk is evolving quickly. Gone are the days when risks could be easily categorized and managed in isolation. Today, risks come in various forms: interconnected, fast-moving, and more unpredictable than ever before. Risks such as industry disruption, market volatility, and geopolitical instability are pervasive, while tech-related risks continue to increase. For example, reports show that the global cost of cybercrime has risen from $445 billion in 2015 to over $2 trillion in 2023, reflecting the urgent need for effective risk management.

Regulatory pressure has also increased, with several non-financial organizations and European banks being fined over the last decade. Operational risks in leading banks are compounded due to talent shortages in AI and analytics. In this evolving risk landscape, organizations must adopt an integrated risk management model that embeds risk management into decision-making at all levels. It is about building resilience in the company by predicting and tracking risks before they materialize, embedding risk awareness into every decision, and ensuring that risk management helps overcome challenging circumstances.

The New Vision for Risk Management

Companies need integrated and effective risk management frameworks rather than traditional practices focusing on reactive measures. The new risk management vision focuses on a proactive and integrated approach embedded across every business function. This approach transforms risk management from a compartmentalized function into the centralized part of strategy and decision-making at all levels through an ERM system.

This enables financial organizations to evaluate and address economic and operational risks in real-time, from regulatory changes to supply chain vulnerabilities. By making risk management an integral part of regular operations, businesses can respond strategically and swiftly to emerging challenges. This model protects the company from risks and improves resilience, adaptability, and agility. With risk insights woven into every business decision, businesses are better equipped to predict challenges and make an informed decision that fosters stability and growth.

Three Pillars of Modern Risk Management

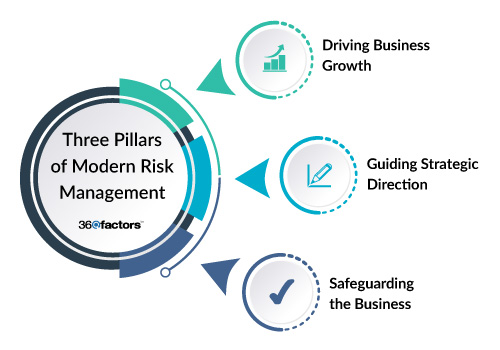

A modern and effective risk management approach is based on three essential pillars: driving business growth by leveraging risk insights, guiding strategic direction by predicting future events, and safeguarding the business through proactive risk detection and management. These pillars allow organizations to protect themselves from risks and harness risk insights to attain sustainable development and resilience.

Driving Business Growth

Driving business growth is critical in risk management as it allows organizations to pursue better opportunities. Conventionally, the role of risk management was to protect the company from potential risks. Today, effective risk management can play a vital role in detecting and facilitating growth by balancing risk and reward in decision-making.

The new risk management model is more of an enabler of growth instead of a constraint. It harnesses data and advanced analytics to offer real-time insights, enabling informed and agile decision-making. With risk-return insights assessed at the transaction level, businesses can evaluate the potential results of strategic moves, including expanding into new markets, investing in innovation, and launching new products. Real-time risk insights can be obtained through advanced enterprise risk management software in no time.

Let’s consider an example in the banking sector. Some banks use customer-level transaction data to assess loan portfolio risks and evaluate interconnections across supplier and customer networks. This approach not only makes banks smarter but also enhances the value of their portfolios. By integrating risk analytics into daily operational planning, businesses can achieve their growth ambition with a strong understanding of possible risks.

From a growth perspective, effective risk management focuses on agile and cross-functional collaboration. Businesses promote in-depth understanding, cooperation, and adaptability by organizing risk management and business teams into flexible, integrated units. This setup allows for well-informed and rapid decision-making that aligns risk management with business growth priorities.

Guiding Strategic Direction

Risk management enhances a company’s strategic direction via integrated financial planning and scenario analyses. By closely connecting financial operations with risks, the company can test for various stress scenarios and gain insights that help in capital planning, resource allocation, and liquidity management.

Effective risk management facilitates leadership in charting a course for the future, particularly in a volatile landscape. Through predictive analytics, the risk function empowers leaders with the insights required to make strategic decisions that align with the long-term objectives of the organization. By multi-scenario planning, businesses can assess the potential impact of their choices and prepare for a range of future conditions while understanding the implication of each on their goals. This foresight helps leaders make proactive decisions, empowering them with the tools to navigate uncertain terrain.

Safeguarding Business

The primary role of effective risk management is protecting a business against both anticipated and unanticipated risks. The strategy has changed noticeably as the current business landscape is increasingly becoming complex and interconnected. Modern risk management must utilize automation, real-time monitoring, and data analyses to make a responsive model to detect and address emerging risks. The advanced risk management model reinforces business continuity by embedding risk controls into daily processes.

Consider the banking industry, where cybersecurity and fraud risks are significant. Data-driven risk management strategy can play an essential role here. AI-based tracking can analyze millions of transactions daily, flagging suspicious events in real-time. This approach allows banks to respond instantly to risks, mitigating financial and reputational damage. Many companies are integrating early warning systems across their operations to spot and address risks before they materialize. By adopting automated tracking and controls, banks can respond swiftly to fraudulent transactions, mitigate losses, and ensure uninterrupted business operations.

Integrate Risk Management Platform to Ensure Growth and Resilience

Financial organizations need more than conventional risk management process for sustainable growth and resilience. They need an integrated, comprehensive, and effective risk management solution with integrated real-time insights and proactive controls. Predict360 Enterprise Risk Management Software is a powerful solution, enabling organizations to stay ahead of risks and make informed decisions that drive stability and success.

Predict360 ERM software identifies and assesses risks across various business functions. With a single, centralized dashboard, managers and stakeholders gain complete visibility of enterprise risks, ensuring that any new risks are immediately reflected in all metrics and accessible to authorized users. The cloud-based platform ensures that organizations are always up-to-date with potential risks, providing timely alerts and updates to protect against compliance issues.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.