Home/ Blog / 5 Considerations for Banks Implementing AI-Powered Solutions in Compliance Management Process

Regulatory bodies create and supervise the compliance rules that are mandatory for banks and other financial institutions. It is critical for organizations to strictly abide by these regulations. Noncompliance can turn into hefty penalties and fines, even leading to the loss of a bank’s license.

Compliance regulations are subject to periodic alteration, and banks must continuously update their workflows and compliance management processes according to the latest regulations. In the dynamic landscape of the financial sector, the compliance management process stands as a critical pillar, ensuring that banks operate within the legal and ethical frameworks set by regulatory bodies.

However, traditional approaches to compliance management have been increasingly challenged by the complexity and dynamic nature of financial regulations, necessitating a new, AI-powered solution in this domain.

The Challenges of Non-AI-Based Compliance Management

Traditionally, compliance management has been a labor-intensive and manual process for banks. This approach, while straightforward, has several inherent challenges that can hinder a bank’s efficiency and responsiveness to regulatory changes.

The primary concern lies in the sheer volume and complexity of regulatory requirements that banks must navigate through when implementing an effective compliance management process. With regulations constantly evolving, staying compliant becomes a moving target, often leading to significant resource allocation toward understanding and implementing these changes.

Cost and Resource Intensiveness

One of the most significant challenges of non-AI-based compliance management systems is their cost and resource intensiveness. Banks must allocate substantial human and financial resources to ensure they understand and correctly implement the myriad of regulations. The process involves extensive manual reviews, interpretation of legal documents, and continuous training of compliance staff, which results in a time-consuming and expensive compliance management process.

Risk of Human Error and Inefficiency

The reliance on manual processes in compliance management systems also introduces a significant risk of human error. Misinterpretation of regulations, oversight, and inconsistent application of rules across different departments can lead to non-compliance, potentially resulting in hefty fines and legal repercussions.

Inadequate Response to Regulatory Changes

The pace at which regulatory changes occur is another challenge for traditional compliance management systems. Often, the oversight systems are rigid and need to be more agile to adapt to new regulations quickly. A delay in implementation can leave banks vulnerable to risks due to an outdated compliance management process. Banks also find it difficult to leverage new regulatory opportunities promptly when working with manual compliance management systems.

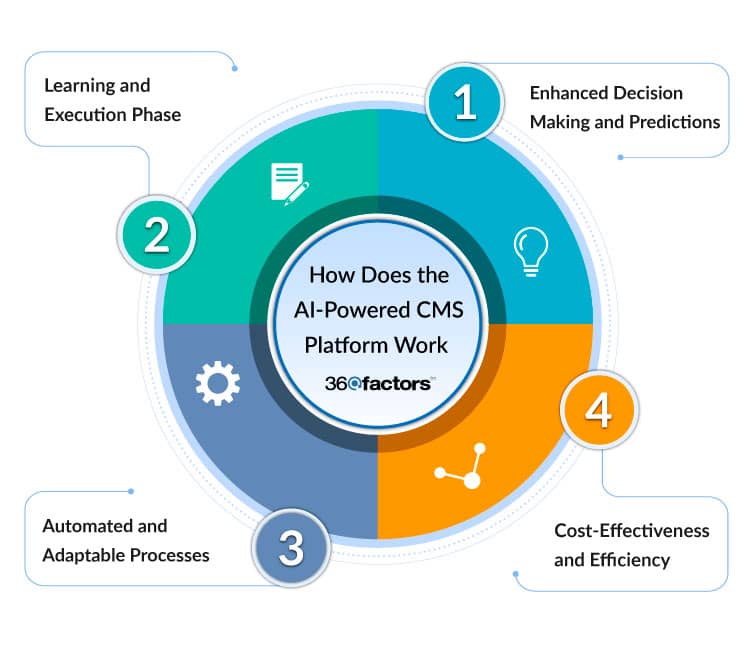

How Does An AI-Powered CMS Platform Work

Integrating AI in compliance management, mainly through cognitive ML compliance management systems, significantly improves how banks manage and follow regulatory requirements. Let’s put some spotlight on how these systems typically function:

Enhanced Decision Making and Predictions

A cognitive compliance system significantly improves decision-making efficiency. It identifies blind spots in compliance checking, which may be missed in manual processes. An AI-powered compliance system performs in-depth comparisons of regulations with policies to make accurate predictions. It facilitates informed decisions by analyzing large quantities of structured and unstructured data, leading to a successful compliance management process.

Learning and Execution Phase

AI-powered systems feature a learning and execution phase that continuously analyzes data. They utilize Machine Learning and Natural Language Processing (NLP) to assess compliance guidelines and instructions, making suggestions in a human-like manner. This ongoing learning process allows the system to evolve and adapt, enhancing its effectiveness over time.

Automated and Adaptable Processes

The cognitive compliance system automates compliance monitoring, reducing the need for constant human intervention. It can interpret text and image data, making the compliance management process dynamic and adaptable to new regulations and guidelines.

Cost-Effectiveness and Efficiency

An AI-powered compliance management solution decreases compliance costs by automating many components of compliance monitoring and reducing the workload. It increases quality, productivity, and proficiency, making the compliance management process more efficient and cost-effective.

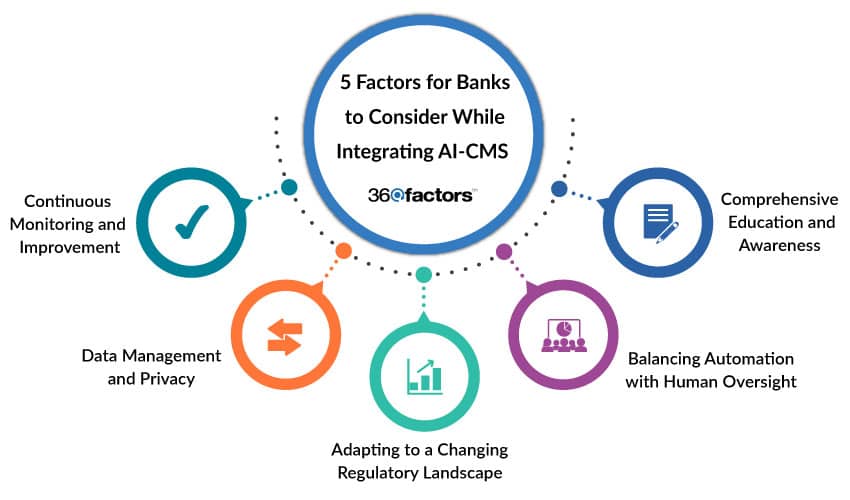

5 Factors for Banks to Consider While Integrating AI-CMS

1- Comprehensive Education and Awareness

The first step in adopting AI-driven compliance management is ensuring comprehensive education and awareness across all levels of the organization. Banks must invest in training programs that familiarize their staff with the new technology, its capabilities, and its daily operational implications. Understanding AI’s role in integrating the compliance management process prepares the workforce for the transition and helps mitigate risks associated with adopting new technology.

2- Balancing Automation with Human Oversight

While AI significantly enhances efficiency and accuracy, it can only partially replace human judgment and expertise. Banks must find the right balance between automation and human intervention. Compliance experts should still review and validate critical decisions to ensure the outcomes align with regulatory expectations and the bank’s risk management framework.

3- Adapting to a Changing Regulatory Landscape

AI systems must be designed to adapt to the ever-changing regulatory landscape. Banks should ensure that their AI compliance management systems are flexible and scalable, capable of adjusting to new regulations and compliance requirements in their respective compliance management process. This adaptability is crucial for maintaining ongoing compliance in a dynamic regulatory environment.

4- Data Management and Privacy

Effective AI implementation in compliance also hinges on robust data management practices. Banks must ensure the integrity and privacy of the data used by AI systems. This involves establishing strict data governance protocols and complying with data protection regulations.

5- Continuous Monitoring and Improvement

Finally, banks should continuously establish mechanisms to monitor and improve their AI-driven compliance systems. Regular audits, feedback loops, and system updates are essential to ensure that the AI solutions remain effective and aligned with the bank’s compliance objectives.

Incorporate an Integrated Compliance Platform to Improve Your Compliance Operations

To enhance the compliance management process, integrating comprehensive, enterprise-wide compliance management solutions is crucial for banks seeking to improve their compliance operations. Predict360, a next-generation compliance management software, is a prime example of how technology can transform compliance management in the banking sector.

Predict360 Compliance Management Software offers an integrated, intuitive approach to compliance management. This AI-powered solution is designed to improve compliance monitoring, insights, and predictions, enabling banks to manage their compliance requirements more effectively and efficiently.

Unified Compliance Platform

Predict360 compliance management software is a single platform for all compliance-related information, data, discussions, and documents, ensuring everything is centralized and easily accessible, which results in an effective compliance management process.

Real-Time Executive Dashboards

The Predict360 compliance management software provides executive dashboards that display real-time compliance intelligence and data. This feature enables proactive compliance management by giving decision-makers a comprehensive view of the compliance status.

Streamlined Workflow Processes

The platform streamlines compliance workflow processes for various activities and users, enhancing efficiency and reducing the likelihood of errors or oversights.

Conclusion

In conclusion, a review of AI-powered solutions in banking compliance management reveals a transformative path. From the beginning, we discussed the limitations of traditional compliance management processes, hurdled by labor-intensive methods and a high propensity for human error. Incorporating AI-Powered Compliance Management Systems, particularly those employing cognitive analysis, marks a pivotal shift towards more efficient, accurate, and adaptable compliance operations. These systems automate and streamline compliance monitoring and enhance decision-making capabilities, leveraging machine learning and Natural Language Processing (NLP) to interpret complex regulations.

The integration of platforms like Predict360, a compliance management system software, further exemplifies this evolution, offering a comprehensive, user-friendly, and cost-effective approach to managing compliance. As banks continue to navigate the ever-changing regulatory environment, adopting such AI-enhanced systems to integrate into their compliance management process emerges as a crucial strategy for maintaining compliance and gaining a competitive edge in the dynamic world of financial services.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.