Home/ Blog / Building a Smarter Ecosystem with AI in Financial Services

The arrival of Artificial Intelligence is not new; it’s making headlines in several sectors, but its transformative capabilities in financial institutions are quite astonishing. The financial industry is known for its dependability on data, and the accuracy of analytical procedures will benefit from AI’s potential. Most discussions were related to technical aspects and noticeable trends around AI in financial services. Hence, it is critical to go through the implications of AI and how it’s revamping the financial ecosystem.

Undoubtedly, AI brings novel and remarkable experiences to modernize how financial enterprises work, compete, and provide the best values to their customers. Let’s discover these unique faculties:

Unique Expertise of AI in Finance

Pattern Identification

AI in finance can analyze enormous datasets to detect complex patterns and trends that seem difficult to human skills. This expertise is beneficial for several financial activities, including fraud detection.

Predictive Analytics

The predictive capabilities of AI enable financial enterprises to predict the probability of future events, such as credit risks or market variations, with greater certainty, allowing them to make proactive risk mitigation decisions.

Improved Decision-Making

Implementing AI in financial services helps generate actionable frameworks and insights, enabling experts to make more informed, proactive, and improved decisions, enhancing overall effectiveness.

Independent Learning

AI systems improve business performance and competitive edge because they can learn and adapt. This enables financial organizations to stay ahead of emerging risks and volatile market aspects.

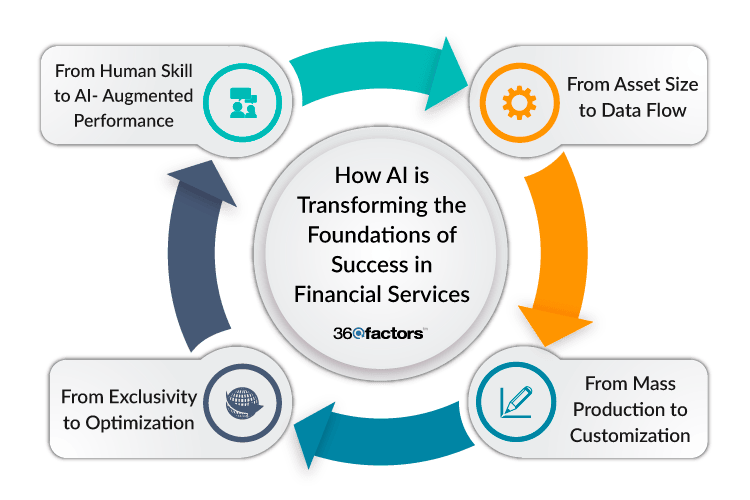

How AI is Transforming the Foundations of Success in Financial Services

Artificial intelligence redefines the basic components of financial industry success, moving from conventional processes to novel paradigms of customization, efficiency, and strategic strength.

From Asset Size to Data Flow

Conventionally, financial enterprises depended on huge financial assets for potency and stability. The adoption of AI in financial services is shifting the focus from sheer asset size to the effective use and flow of data. AI improves the capability of swiftly processing and analyzing enormous amounts of data, allowing organizations to gain real-time information, make the decision process efficient, and respond promptly to market fluctuation.

From Mass Production to Customization

In the past, mass production was considered the best method for standardized products to earn revenue, mainly leading to a one-size-fits-all methodology. With artificial intelligence in finance, banks now have the ability to offer a greater level of personalization. Intelligent AI algorithms analyze customer data to learn about individuals’ financial requirements and preferences, enabling organizations to offer customized products and services.

From Exclusivity to Optimization

Traditionally, existing market expertise built over decades was the main competitive advantage. But now, with the arrival of AI in financial services, enormous datasets can be analyzed within a short time by newcomers, facilitating the creation of more customized and suitable products for the customer. It enhances optimization rather than exclusivity.

From Human Ingenuity to Augmented Performance

Process efficiency once depended heavily on human ingenuity and ability. Artificial intelligence in finance augments human performance by automating routine tasks and providing decision support, allowing skilled professionals to focus on more complex and strategic activities.

Regulatory and Moral Challenges in AI for Financial Services

Integrating AI in financial services brings numerous benefits as well as significant regulatory and ethical challenges. As AI advances, financial institutions, regulators, and policymakers must address these new dilemmas to ensure responsible and fair usage.

Evolving Data Regulations

Global Standards and Cloud Services

Data regulations no longer remain static. Governments introduce newer versions to safeguard the privacy and security of customers as businesses adopt AI in financial services. For example, Europe pursues strict rules for cloud services facilitating financial transactions, restricting certain applications of AI in finance.

Personal Data Protection

Laws like the GDPR in Europe limit how personal data is collected, transmitted, and stored, complicating data partnerships. Businesses must navigate these regulations carefully to keep trust and avoid penalties as consumers gain more control over their data.

Data Sharing Dynamics

European regulations allow financial institutions to share customers’ financial data with third parties upon request, but third parties are not allowed to share non-financial data. This creates an imbalance favoring large tech firms with access to broader data sets that may utilize advanced models for AI in financial services.

Ethical Considerations

Bias and Fairness

AI systems can perpetuate biases in their training data, leading to unfair treatment of certain groups. For example, biased algorithms in credit scoring can discriminate against specific demographics. Institutions must find and mitigate these biases to ensure fairness.

Transparency and Accountability

The complexity of AI in finance algorithms can obscure decision-making processes, posing challenges to accountability. Financial institutions must develop more transparent means to explain AI-driven decisions and ensure they are justifiable, fostering consumer trust and regulatory compliance.

Data Privacy and Security

To successfully implement AI in financial services, businesses require vast sets of training data, making data privacy and security paramount. Financial institutions must implement robust measures to safeguard customer information from breaches and misuse, follow existing regulations, and anticipate emerging threats such as data breaches.

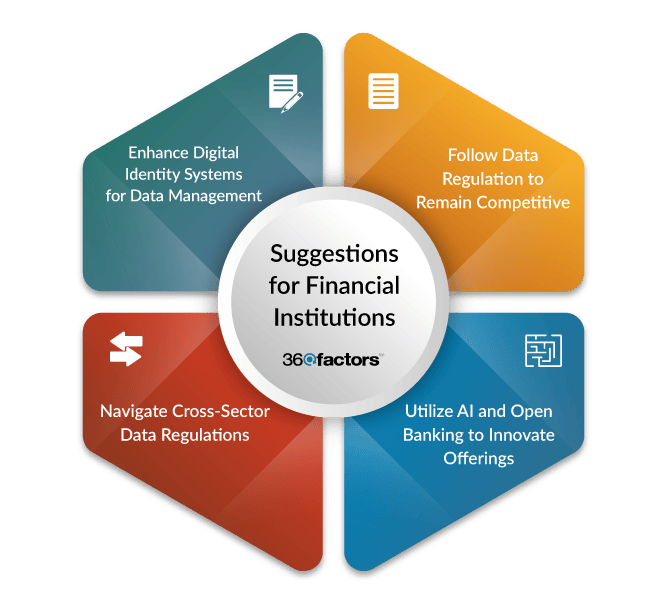

Suggestions for Financial Institutions

Shaping Data Regulation to Remain Competitive

It’s vital for businesses to take part in shaping regulations for AI and data usage to enhance their own competitive edge. Financial enterprises should engage with policymakers to emphasize data regulations that improve innovation while augmenting compliance. By participating in policy discussions and suggesting industry insights for the meaningful adoption of AI in financial services, enterprises can establish balanced rules safeguarding consumer interests while promoting the competitive landscape.

Financial organizations must ensure compliance with existing data regulations in their operating practices. This can be done with regular audits, robust data governance, and transparent data usage policies to establish trust and build a competitive edge.

Leveraging AI and Open Banking for Innovative Offerings

The open banking initiative brings new opportunities for introducing new products and services. By establishing partnerships between tech companies, Banks, and FinTechs, AI in finance can be utilized to offer innovative products and services, including automated saving plans, customized financial advice, and improved fraud identification systems.

Navigating Cross-Sector Data Regulations

Operating across multiple jurisdictions with unique data regulations requires a deep understanding of local laws and robust data management frameworks. Businesses must ensure compliance and minimize regulatory breaches to get the most from the adoption of AI in financial services. It can be done through comprehensive data governance policies covering data quality, security, privacy, usage, and adaptability to changing laws and emerging threats.

Importance of Digital Identity Systems for Data Management

Customers can have immense control over their data, which was difficult if not impossible before. Executing digital identity systems to manage authorizations and consent is essential. By utilizing AI in finance, businesses can improve security by giving protected ways for customers to manage their data permissions, safeguarding against identity fraud and theft. The AI-based identity systems provide effective account management, streamlined customer onboarding, and transaction processing, augmenting the customer experience while improving security.

Conclusion

The arrival of AI in financial services has transformed the foundation of the financial sector, bringing innovation and improving efficiency. AI integration introduces numerous advantages to finance, including efficient operations, improved customer experiences, proactive decision-making, and customization. However, effective risk and compliance management is essential to enjoy the true benefits of artificial intelligence in finance; for that, you should leverage the Predict360 Risk and Compliance Intelligence suite.

The AI-based Predict 360 Risk and Compliance Management Software provides a thorough solution for financial services. It leverages advanced AI capabilities to streamline and automate several processes, enabling them to manage risks more effectively and efficiently. Some of its key features include:

Automation of Repetitive Tasks

Predict360 Risk and Compliance Software automates data collection, analysis, and reporting, freeing human resources for more strategic tasks. This automation enhances operational efficiency and reduces the potential for human error through the integration of AI in financial services.

Streamlined Workflows

This AI-based intelligent suite offers advanced dashboards and manageable workflows, facilitating smooth operations across different departments and functions within financial institutions.

Real-Time Monitoring

Predict360 Risk and Compliance Management Software makes it easier to track regulatory changes, compliance status, and rising risk indicators. Institutions can set up alerts and notifications for potential issues or violations, allowing them to address problems promptly and maintain compliance.

Accurate Risk Assessment

The platform accurately identifies and assesses various types of risks, prioritizing them based on severity and likelihood with the power of AI in finance. This capability facilitates better decision-making and resource allocation, ensuring that financial institutions can proactively manage risks.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.