Maximize the Insight Your Internal Audit Team Delivers

Today’s headlines are full of organizations where risks slip through the cracks, processes break down, and controls collapse. Internal audit teams are under pressure to provide robust and independent assurance and actionable insight like never before. Empowered Systems AutoAudit Internal Auditing Software empowers organizations to:

- Eliminate manual tasks

- Enrich dialog with key stakeholders

- Enhance audit quality

- Deepen engagement with your board audit committee

- Propel business operational excellence

- Detect emerging risks

Features of Empowered Systems AutoAudit

Empowered Systems AutoAudit empowers consistency and transparency of your organization’s audit efforts. Some of the features AutoAudit software include:

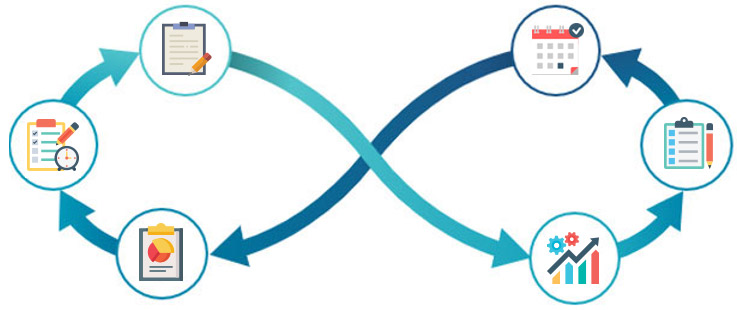

- Identifying risk criteria and scheduling audits for risk assessment

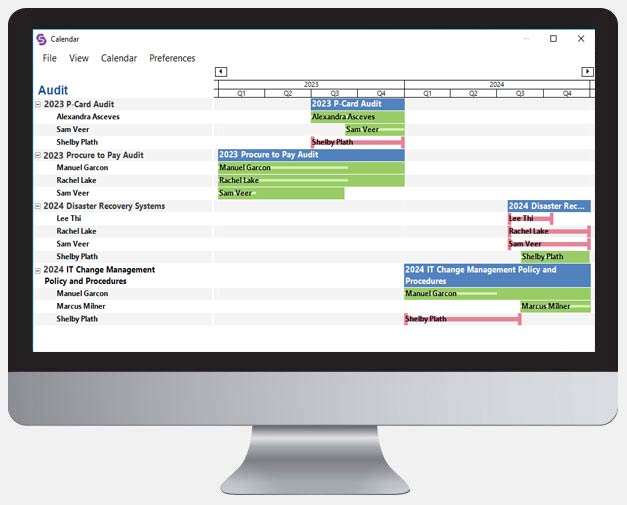

- Streamlining data from legacy solutions to assign and define audit milestones for the team

- Audit execution to highlight gaps and record activities through checklists

- Action plan and issue tracking with tailored emails and notifications

- Real-Time Reporting

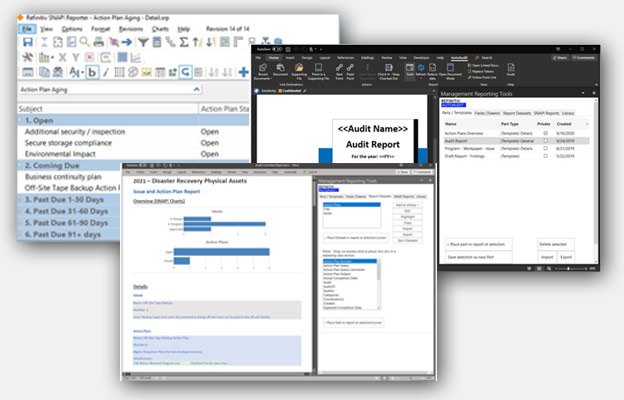

- Auto Audit reporting templates for better transparency between auditors and committee

Empowered Systems AutoAudit Desktop Application

AutoAudit desktop application provides templates and models to make a consistent audit methodology. With the data import and export function, the AutoAudit desktop allows easy data retrieval to adapt to any audit structure and automated processing or risk assessment features.

Advantages:

- Fast implementation of an average of 10-days so you can get your system up and running

- Comes equipped with tailored virtual training to build confidence and ease in learning

- Low-cost solution with complementary upgrades and no hidden fee

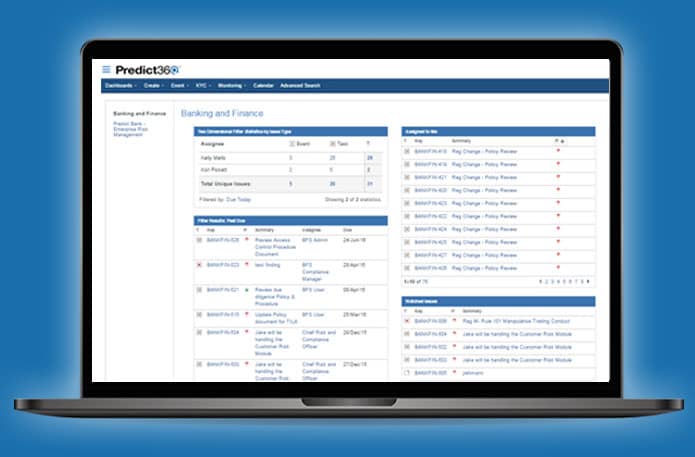

Empowered Systems AutoAudit Cloud Version

The cloud version of Empowered Systems AutoAudit enables users to elevate audit functions to deliver value and engage stakeholders throughout the audit lifecycle. Enrich your business to bring positive changes according to a strategic approach.

Advantages:

- Align your goals with the core compatibility of AutoAudit’s functions and themes

- Adapt a comprehensive cloud solution to enhance team success

- Evolve your audit functions according to industry changes and adaptations

Why Choose AutoAudit Internal Auditing Software?

Hundreds of organizations worldwide use the AutoAudit software solution to improve the efficiency of the internal audit process. It offers enterprises of all sizes a structured approach to scoping and conducting audits. It is a secure audit automation tool that is fast to implement, simple to maintain, and seamlessly integrates with Microsoft Office. A trusted solution for over 20 years — designed by auditors, for auditors. This powerful application automates the audit process, empowering consistency and transparency across the features.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist