Risk Management Solutions to Ensure the Future of Your Business

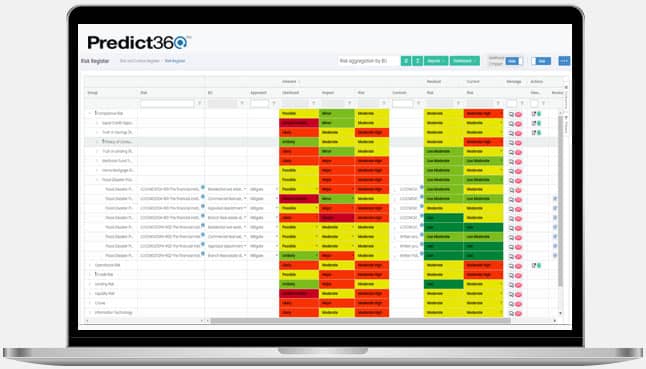

Effective Enterprise Risk management is necessary to ensure your business has a secure and stable future. The Predict360 Enterprise Risk Management Software ensures managers have complete visibility of enterprise risk on a single dashboard. New risks are instantly reflected in all risk metrics and are visible to all authorized stakeholders. Our cloud-based risk management software also ensures that the latest regulatory risks are closely monitored and updated within the system.

- Facilitates the systematic identification and assessment of potential risks across various business functions/processes.

- Helps organizations to proactively recognize and understand both internal and external risks that could impact their objectives.

- Enables organizations to maintain a comprehensive and up-to-date repository of risks, control measures, and mitigation strategies, fostering better decision-making.

- Real-time monitoring and reporting functionality helps management stay informed about the current risk landscape and enables timely interventions when necessary.

- Tableau BI and Power BI visualization integration enable organizations to analyze risk data and scenarios to make informed decisions that align with their overall business objectives.

Risk Management Software Features

Taking a proactive approach enables organizations to increase efficiency, decrease resolution times, collaborate more effectively, and achieve insight into issues and complaints trends.

- Provides a centralized platform for storing and managing risk-related data.

- Importable risk taxonomies (aka risk library) that facilitate creation of a comprehensive and standardized classification system for various types of risks.

- Break down organizational silos that complicate risk management.

- Decentralize compliance to make it an organization-wide function.

- Give executives organization-wide risk visibility through risk management tools.

- Access compliance activities and reports across all functional compliance departments.

- Integration with external data feeds such as FRED and FFEIC to stay up to date with market trends and emerging risks.

- Covers regulations such as Dodd Frank, SOX, BSA/AML, HMDA, CFPB, RESPA, FATCA, FINRA 4210, AISMD, Fair Lending Regulations, and much more.

- Automated interpretation of the legal language to allow quick parsing of new regulations.

- Communicate and collaborate on Risk Appetite with other stakeholders.

Today’s ERM Challenges

Legacy ERM practices are time-consuming and inefficient. The effort required to gather and evaluate inherent and residual risks, or controls, is compounded by decentralized data and manual data entry and analysis. Further, a lack of standardization of risks or control definitions results in the following challenges.

- Every industry faces a unique set of risk mandates and compliance challenges that require close coordination and integration with many related GRC functions, including regulatory and standards compliance, incident management, workplace investigations, internal audit, quality management, and others.

- An organization faces risks on several fronts, including business and regulatory compliance. With frequent regulatory changes, market shifts, and internal restructuring efforts, a strategic risk-based approach can minimize uncertainty.

- Organizations must be able to respond, predict, and mitigate risks with agility in response to ever-changing business conditions as well as manage overall business risks under an umbrella of strategic risk-based culture.

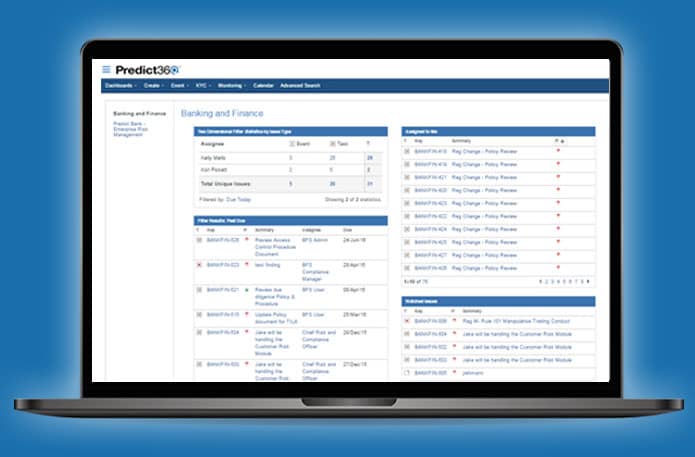

Risk Management Solutions for Your Entire Team

Predict360 ERM is an enterprise-level risk management solution that enables risk and compliance professionals to track, manage, and take action on issues while providing visibility throughout the organization.

It provides risk stakeholders a platform to easily share risk information, offers advanced risk monitoring and automated analytics to risk managers, and enables board members to view detailed reports and executive dashboards.

- Integrated Visibility of Risk Management: Predict360 ERM adds transparency throughout the risk management process, enabling visibility into every facet of the risk management activities throughout the organization.

- Increased End-User Adoption: Predict360 ERM’s User Interface (UI) is highly intuitive, ensuring that all employees can use its risk management activities even if they are not experts in the risk management domain.

- Improved Risk Management Processes: Automation and streamlined workflows ensure that risk management processes are quick and efficient across the enterprise.

- ERM Solutions for Risk Analytics and Reporting: An advanced Business Intelligence engine enables advanced analytics and visualization with customizable report generation to ensure in-depth insights and more.

- Continuous Risk Assessments: Predict360 ERM’s automated monitoring enables continuous risk assessments. This ensures that if a risk suddenly increases in severity level, then the risk management team will be notified.

- Highly Configurable: Predict360 ERM is built as a modular platform and the solution can be customized to fit each organization’s unique needs. Applications can be added or removed as organizations require.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist